LOCAL COMMUNITY MEMBERS WITH NATIONAL REPUTATIONS

Our local firm has been offering wealth management services since 1994, spanning decades and generations. Throughout that time, we have helped many Lockheed Martin employees & retirees pursue their financial goals. We have worked with managers, directors, and C-Suite level executives and are familiar with the various investment vehicles, retirement options, and employee benefits available at Lockheed Martin. Both then and now, relationships have been at the core of what we do. Working directly with you and your family, we help orchestrate a successful retirement income strategy by coordinating pensions, salaried-savings plans, and/or employer stock in conjunction with additional resources you may have to establish a baseline retirement expectation.

Relationships have always been at the core of what we do. At our wealth management firm, you will never be “just a number,” and your advisor will never be “just a suit.” We’re local community members, but we’re also nationally recognized professionals.

Through conversations, we work to understand your needs, goals, and objectives, and then craft an individualized financial through a collaborative team approach. This comprehensive discovery and planning process enables us to then provide customized recommendations across the interrelated topics reflected below.

Investment Management

Investment Management

Total portfolio analysis (aggregation – including outside investments)

Risk tolerance assessment & portfolio stress test

401k / Retirement plan investment analysis

Net an realized appreciation analysis

Concentrated stock strategies

Stock options planning

Retirement Planning

Retirement Planning

Determining goals and objectives

Retirement needs analysis

Social Security and pension planning

Investment income planning and design

Annuity income strategies

Tax Planning

Tax Planning

Income tax Planning

Charitable trust and foundation planning

Tax-efficient investing

Tax-loss harvesting

Tax-deferred annuities

Estate Planning

Estate Planning

Estate planning document review

Third-party corporate trustee services

Trust and partnership planning

Estate and gift tax planning

Multigenerational planning

Insurance Planning and Risk Management

Insurance Planning and Risk Management

Life insurance needs analysis

Disability Insurance needs analysis

Long-term care needs analysis

Buy / Sell insurance planning

Asset care strategies

Cash Flow and Debt Management

Cash Flow and Debt Management

Net worth statements

Cash flow statements

Budgeting

Debt repayment / consolidation strategy

Creative lending strategies

7 Key Considerations for a Fulfilling and Confident Future

If you are someone who values careful planning, thorough analysis, and attention to detail, BentOak Capital can assist. This Lockheed Martin eBook is tailored specifically for individuals like you who appreciate the importance of delving into the finer points to create a solid foundation for the future to help meet your needs, goals, and objectives.

BentOak Capital financial planners and investment advisors work as a team. That means you reap the benefits of collective experience and specialties. Excellent wealth management requires a comprehensive approach. We examine every angle, accounting for every opportunity and challenge so you can make the most of your wealth – whatever that means to you.

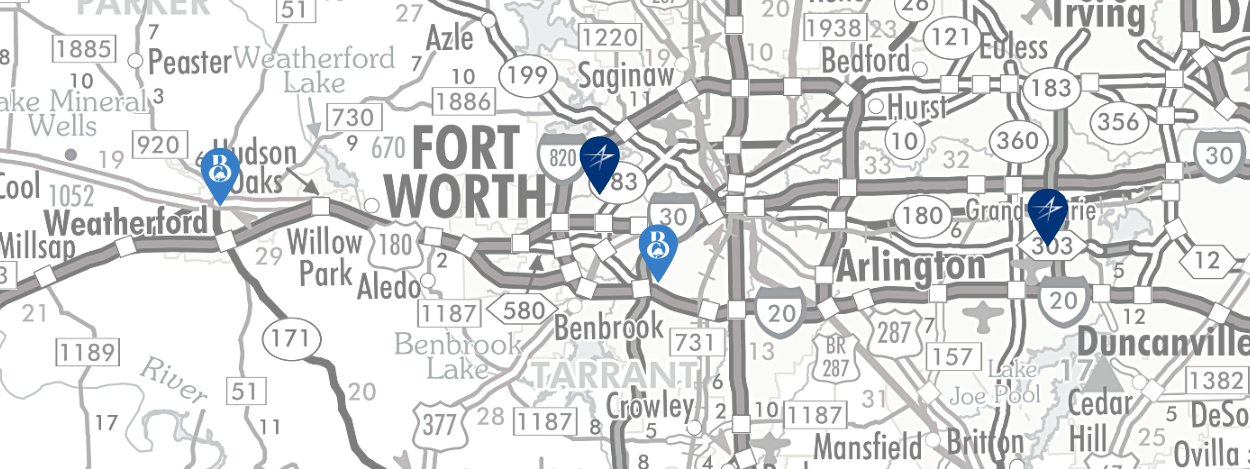

If you would like to learn more, please submit the information below, or call us at 817-550-6750 to coordinate a 15 minute introductory call. After that we will be happy to coordinate a meeting at one of our two convenient local locations in Weatherford and Fort Worth, and are available on Friday’s for convenience with Lockheed’s 4/10 schedule.

BentOak Capital Insights for Lockheed Martin Employees

Get In Touch With Us

Have a question? Want to talk?

"*" indicates required fields