Ah, retirement. The golden years, where you’re supposed to sit back and relax on a beach without a care in the world, right? But wait, what’s this? The Income-Related Monthly Adjustment Amount (IRMAA)!? Okay, so it’s not THAT exciting and maybe sounds more like a snooze-fest, but don’t snooze on it – this sneaky little thing can nibble at your retirement savings if you’re not careful. But fear not, we are here to break it down for you and give some insight into it.

What, or who, is IRMAA?

IRMAA, pronounced “er-ma,” is not your Great Aunt that overstays her welcome during the holidays, but it can be just as much of a pain in the you know what if you don’t pay close attention to it. It stands for “Income-Related Monthly Adjustment Amount.” In simple terms, it’s an extra fee tacked onto your Medicare Part B and Part D premiums if you have a higher income in retirement. Think of it as the “Rich Tax” for retirees – the more you earn, the more you pay (a good news/bad news type situation).

High Net Worth Retirees, This One’s for You

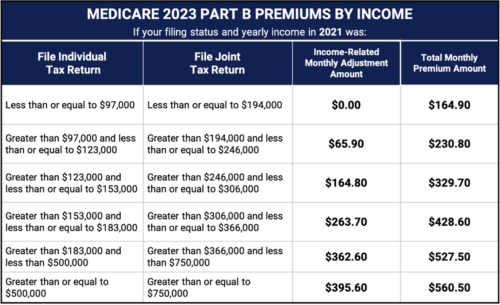

So, how does this pesky IRMAA sneak into your retirement? Well, for many high-income retirees, it really can be like that Great Aunt that just shows up on your doorstep without a phone call. IRMAA comes knocking when your modified adjusted gross income (MAGI) crosses certain thresholds. Based on 2023 Tax Tables, if you’re single and your Modified Adjusted Gross Income (MAGI) was over $97,000 or a couple with a MAGI over $194,000 in 2021, be prepared to pay more. And the more you make, the higher the IRMAA. Note that the IRMAA tax tables are based off income from two years prior.

For example, let’s say you’re a couple pulling in a combined MAGI of $230,000. You’ll end up paying not only your regular Medicare premium but also an extra IRMAA charge on top. It’s like ordering extra queso at Uncle Julio’s – it’s going to cost a little extra unfortunately, but you’re also happy you have more queso at the same time.

The One-Time Get-Out-of-Jail-Free Card

IRMAA isn’t always a lifelong sentence. If you had a one-time event that significantly reduced your income, you might be able to escape the clutches of this extra fee. Think of it as the “Oops, I messed up” waiver.

For instance, let’s say you were still receiving a high income in your early retirement years working part time or doing some consulting but decided to hang up your work boots at 70. Suddenly, your income drops dramatically. In this scenario, you can apply for a waiver based on the “life-changing event” provision. This could save you from paying IRMAA for the rest of your retirement.

Roth Conversions and IRMAA

Performing a Roth conversion can have repercussions on IRMAA, which takes effect after enrolling in Medicare. The amount you convert in the present year becomes part of your taxable income, consequently boosting your MAGI. This increase may potentially push you into a higher income tax bracket, triggering additional IRMAA surcharges.

Again, it’s crucial to note that IRMAA is determined based on your MAGI from two years earlier. To illustrate, the IRMAA premiums for 2023 rely on your 2021 MAGI. Hence, if you execute a Roth conversion this year (2023), it won’t impact your IRMAA until two years down the road (2025).

Let’s take a look at a practical example, consider Geoff, who recently retired at the age of 64 and receives a $25,000 pension. He is not yet eligible for Medicare because he hasn’t turned 65. He expects his income to significantly increase by over $100,000 when he begins taking Required Minimum Distributions (RMDs) at age 75. In anticipation of this, he opts to complete an $85,000 Roth conversion in 2023. In 2025, when he is 66 and has enrolled in Medicare, he receives a notice indicating that his Medicare Part B and D premiums are higher than the standard rates due to his high income in 2023 (two years earlier). As a result, he is now required to pay an additional $66 per month for Medicare Part B and $12 per month for Medicare Part D. This doesn’t necessarily negate the benefits of the Roth conversion, but it is an important consideration. Timing is often the key to everything in life and avoiding IRMAA is no different. If you plan your Roth conversions strategically, you can minimize the impact on your MAGI.

If you’re retiring prior to your pensions, Social Security, and other income sources starting, it’s possible your taxable income will be lower in your early retirement years. This is a scenario where it could make sense for your financial situation to start those Roth conversions. By the time you hit 70, your MAGI will have leveled off, and you’ll avoid the higher IRMAA costs. Always consult with your CPA and financial advisor to determine if this is an appropriate strategy for you.

Handle IRMAA with Ease

In the grand scheme of retirement planning, IRMAA is just another quirky tax code to navigate and keep tabs on while you plan for retirement. It’s just another puzzle piece that fits into the larger picture of your financial plan. Remember, IRMAA isn’t the end of the world, but it’s worth understanding and strategizing around. It’s like the occasional rain on your beach vacation – a little inconvenient, but with the right plan, you can still enjoy the sun when it shines.

So, keep your IRMAA radar on, plan your moves wisely, and those golden years will shine even brighter. If you’d like to discuss the potential impact of IRMAA on your financial plan, give us a call today!

Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapital.com.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.