Statistics tell us the only 1 in 6 retirees have a retirement income plan. On average, many Americans approach retirement without a clear understanding of their financial readiness. This uncertainty often leads to a lack of confidence that their savings will last throughout retirement.

Our job as advisors is to help build a plan to provide both confidence and peace of mind as you enter this next chapter of your life.

Retirement Income Plan

The key to doing this is building an income plan that will take care of your needs today as well as your future needs – potentially decades in the future. At a bare minimum, we need to consider things like your lifestyle spending and the financial and family goals that you have for this stage of your life. Once you have a clear idea of what this looks like, we can then evaluate your existing assets to determine if you have what it takes to have a successful retirement. Then, we will begin building out your retirement income plan.

The beautiful thing about a retirement income plan with BentOak Capital is that it is designed to be dynamic, acknowledging that life is unpredictable, and your needs may evolve over time. No matter the change of plans, our strategies are built to adapt. This flexibility ensures that your retirement income plan remains aligned with your goals, providing peace of mind and the confidence that you can navigate through various phases of life with a strategy that supports your financial well-being.

Data gathering is a key step to helping us develop your income plan. During the data gathering process, you’ll want to do your best to provide us with the most accurate information regarding your financial situation. The more data that we have the better plan we can put together. For example, we will typically ask for tax returns, investment statements, retirement accounts, estimated monthly expenses, life insurance policy information, social security statements, etc. These are important bits of information that will be needed to make progress on your income plan.

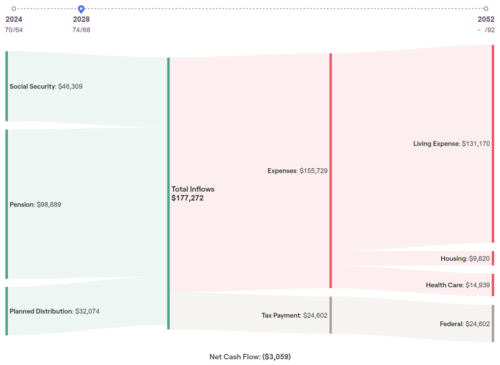

Once we have gathered the necessary information, we can begin building out your plan and start a projection of your cashflows during retirement. One really informative thing that we provide is a visual of what this plan could look like. See below:

This is an example of an income plan that is generated with Social Security income, pension income, and planned distributions from the portfolio. This visual also does a great job of matching up the income and expenses that are being projected.

We also have the ability to project out the income and expenses to determine if we can expect the income to pay for expenses now and in the future. Considering both the short-run as well as the long-run it is critical to determining whether or not you have the ability to retire with confidence.

This again emphasizes these important of the details within the data that you provide.

If you are interested in building out your retirement income plan, give us a call today and speak with one of our retirement income experts!

Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapital.com.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial.