As we enter the final quarter of the year, financial markets and the economy have surprised many investors. Instead of entering a recession, the economy has experienced steady, albeit slower, growth, and inflation rates have decreased toward the Federal Reserve’s target. This shift has led to a cycle of monetary easing, driving the S&P 500 and Dow Jones Industrial Average to new all-time highs and improving bond returns. The performance of the first three quarters serves as a reminder that focusing on long-term trends is often more beneficial than fixating on past events.

1. The Market Achieves Many New All-time Highs During Bull Markets

Of course, there are still many risks in the months ahead. The path of Federal Reserve policy remains uncertain, and investors are currently debating the magnitude of the next rate cut. The presidential election is competitive, with wide-ranging implications for tax policy, regulation, trade, and more. Additionally, geopolitical conflicts are escalating, which could affect global stability, supply chains, and oil prices. Market volatility is always a possibility, especially given the elevated levels of valuations and earnings expectations.

However, it’s important to recognize that facing risks is an inherent part of investing and planning for the future. The way investors respond to these risks ultimately determines their financial success. Instead of trying to time the market to avoid risks, it is generally more effective to maintain a well-constructed portfolio capable of withstanding various market conditions. Below, we discuss five key factors driving the market and their implications for investors in the coming months.

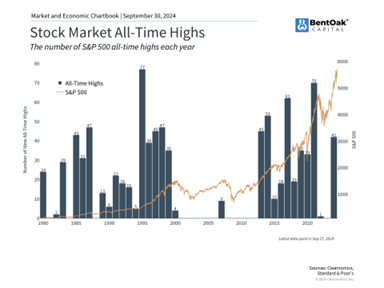

First, the market has reached multiple new all-time highs this year, including during the most recent quarter. While this performance is promising, it can also make some investors anxious, leading to concerns about a potential pullback.

Historically, during bull markets, stock indices often hit new all-time highs, as illustrated in the accompanying chart. This is largely expected and results from sustained earnings, economic growth, and improving investor sentiment. New highs are not reliable indicators of impending market declines, as the underlying trends in the market and economy are far more important. Attempting to time the market based solely on index levels often proves counterproductive.

Market fluctuations are an unavoidable aspect of investing, and declines will occur at some point. However, predicting the timing of these declines is challenging. Historically, markets have experienced both higher highs and higher lows. For instance, the pullbacks in April and August of this year serve as reminders that the market can recover more quickly than many investors anticipate. While past performance does not guarantee future results, it is often wiser to remain invested rather than attempting to time market entries and exits.

2. The Market Has Performed Well Under Both Political Parties

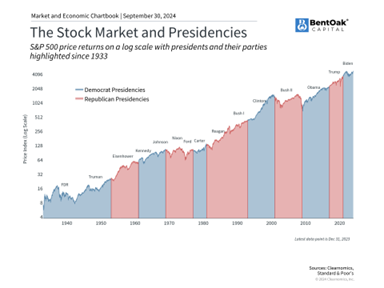

Many investors are concerned about how the upcoming presidential election might impact the economy. According to polling data from the Pew Research Center, 80% of registered voters consider the economy a very important factor in their voting decisions. As the election race heats up, it’s essential to remember that while elections matter for the country, we should avoid making investment decisions solely based on political events.

Historically, the stock market has demonstrated long-term growth under both major political parties, as illustrated in the accompanying chart. Market performance does not typically collapse when a particular party is in power because the fundamental drivers of market success—such as economic cycles, earnings, and valuations—are far more significant than who occupies the White House.

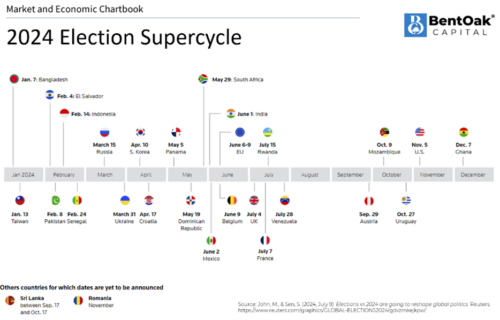

In addition to the upcoming domestic election, this year has been labeled an “election supercycle” year. Approximately 70 countries around the world are holding elections this year, affecting about two-thirds of the global population. Many countries are facing similar concerns to those we see in the U.S., including inflation, energy issues, high debt levels, immigration, and defense/security matters. Despite these challenges and the resulting changes in policy and government composition, global markets have generally remained stable throughout the year.

That said, policies can influence taxes, trade, industrial policy, and regulatory frameworks. However, these policy changes usually unfold gradually, and their timing and impact are often overestimated. What politicians promise during campaigns can differ significantly from what is actually implemented. Therefore, investors should concentrate on long-term economic and market trends rather than daily polling data. If you have any questions about the election and its potential outcomes and you financial plan, please don’t hesitate to reach out to your advisor.

3. The Fed is Expected to Cut Rates Further

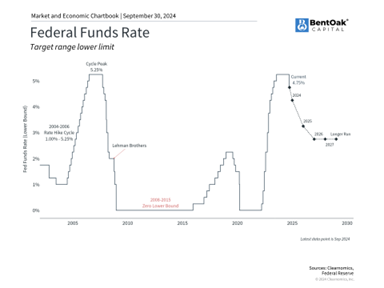

Third, the rate of inflation is showing signs of moderation, with the latest data indicating that the PCE price index— the Federal Reserve’s preferred measure of inflation—rose only 2.2% compared to a year earlier, approaching the Fed’s target rate of 2%. At the same time, the labor market is showing signs of slowing, with the unemployment rate at 4.2%, which remains low by historical standards.

These economic conditions have paved the way for the Fed’s first 50 basis point interest rate cut in September, with additional cuts anticipated throughout the year and into 2025. The market had been expecting various cuts all year and reacted positively following the announcement.

Analyzing historical rate cuts can be complex, as the reasons behind the Fed’s decisions are often more significant than the timing or magnitude of the cuts. The Fed typically lowers rates during economic or financial crises, such as in 2008 or 2020, when prolonged struggles for the economy and markets are expected.

In contrast, the current scenario aims for balance, or what is often referred to as a “soft landing,” similar to the Fed’s actions in the mid-1990s. After rapid rate hikes in 1994, the Fed initiated cuts in 1995 once inflation concerns eased, setting the stage for a prolonged economic expansion and bull market. While this is just one example, it’s crucial to draw accurate historical parallels when considering Fed policy.

4. The Fixed Income Landscape is Shifting

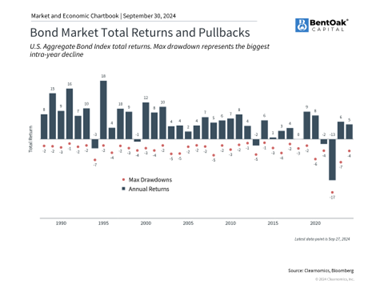

Recent Federal Reserve rate cuts have led to lower interest rates across various maturities and a “disinversion” of the yield curve, often referred to as a “bull steepener,” which can be beneficial for bonds. This shift represents a reversal from the bear market in bonds experienced in 2022, when rates were rising.

Bond prices typically move inversely to interest rates. As market rates fall, existing bonds with higher interest rates become more valuable. Consequently, current bondholders not only enjoy higher-than-average yields but may also see price appreciation if rates continue to decline.

For the economy, lower interest rates reduce borrowing costs for both corporations and individuals, which can stimulate economic growth and investment. This improved economic environment often leads to better corporate earnings and fundamentals. Therefore, despite the challenges bonds have faced in recent years, it remains crucial to maintain a balanced approach across different asset classes.

5. Geopolitical Conflicts are Worrisome But Do Not Directly Impact Markets

Finally, tensions have escalated in the Middle East due to the intensifying conflict between Israel and Hezbollah, adding to existing global geopolitical strains, such as the ongoing war between Russia and Ukraine. While these events have significant real-world implications, their effects on the economy and stock market can be less predictable, and any impact on investors’ portfolios is usually temporary. As illustrated in the accompanying chart, prolonged market downturns often align with major events, such as the dot-com crash or the rate hikes in 2022.

One way that regional conflicts can influence the broader economy is through oil prices. The recent escalation in the Middle East has led to a slight increase in oil prices, but this rise is modest compared to previous crises. Additionally, the United States’ status as the world’s largest oil and gas producer may offer some protection from global disruptions.

Despite these geopolitical uncertainties, the stock market has only seen two pullbacks of 5% or more this year, highlighting the importance of maintaining investment strategies and focusing on broader market trends rather than reacting to headlines.

In summary, with the Federal Reserve lowering interest rates, an election approaching, and markets nearing all-time highs, it’s crucial to prioritize long-term financial goals over short-term events.

IMPORTANT DISCLOSURE INFORMATION

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies.

Bond yields are subject to change. Certain call or special redemption features may exist which could impact yield promoted will be successful.

The fast price swings in commodities will result in significant volatility in an investor’s holdings. Commodities include increased risks, such as political, economic, and currency instability, and may not be suitable for all investors.

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services.

Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapital.com.

Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.