If you have strong political leanings, even the thought of the party you support losing a presidential election might be demoralizing. In that moment, you might be feeling frustrated, anxious, or even angry—you may even feel those emotions and tightness in your chest reading this. Hear me when I say this: it’s okay. These emotions are real and valid. We’re not here to lecture you or tell you that you’re wrong to feel that way. That said, let’s talk about why making rash investment decisions based on these feelings or the hypothetical outcomes of an administration you don’t support, such as “what do I do if Trump wins the election?” or “what do I do if Harris wins the election?”, could affect your long-term wealth.

The Emotional Rollercoaster

When the candidate you support loses, it’s natural to feel a mix of disappointment, fear, and uncertainty. This is more than just politics—it’s about values, beliefs, and the vision you have for you and your family’s future. It’s okay to feel disheartened. We understand that these moments can be deeply personal and emotional. You might start thinking that the economy will tank or that your investments are doomed. If you’re grappling with the question of “what do I do if Trump wins the election?” or “what do I do if Harris wins the election?”, remember that it’s crucial to focus on the long term. However, it’s crucial to remember that investing is a long-term game. Emotional reactions, while human, shouldn’t drive your investment strategy.

Understanding the Emotional Side

Behavioral finance tells us that our emotions significantly impact our financial decisions, often to our detriment. This phenomenon is known as “emotional investing,” where decisions are driven by fear, anxiety, or overconfidence. Studies have shown that emotional investors often sell in a panic during downturns or buy excessively during booms, resulting in poor long-term returns.

Here’s a fact: U.S. and global markets have weathered countless political changes and uncertainties—World Wars I & II, the Cuban Missile Crisis, the Kennedy Assassination, U.S. Civil Rights unrest, the Vietnam War, Watergate, the Oil Embargo, the 1980s recession, the Technology and Y2K crisis, 9/11, the War in Iraq, the Housing Crisis, and Global Pandemics. Each time, markets have not only recovered but gone on to reach new highs again and again. Overreacting to a political shift can cause you to make inappropriate short-term decisions that could negatively affect your long-term plan. Your emotions might be telling you to flee, but history and data suggest otherwise. Take a look at Capital Group’s chart that goes back to the Great Depression all the way through 2023 if you’d like to see for yourself.

The Facts: Politics and Market Performance

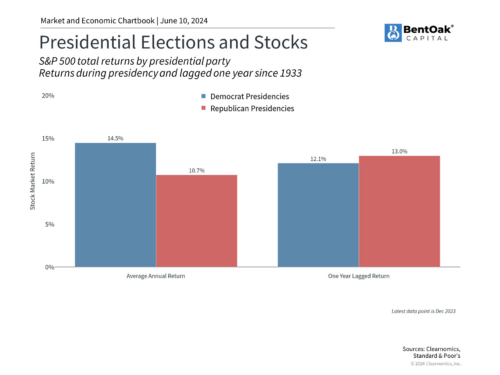

Historical data shows that the stock market doesn’t care who’s in the White House nearly as much as you might think. Sure, policies can influence specific sectors, but the overall market has a way of marching forward regardless of the political landscape. I’m sure just as you read that, you thought, “But wait, this time is different!”—and you might be right. But one thing we like to say is that while history may not repeat itself, it often rhymes. According to a Clearnomics study, the average annual return of the S&P 500 going back to 1933 was 14.5% during Democratic administrations and 10.7% during Republican ones. Over the past century, the market has consistently grown, despite numerous changes in political leadership. The average annual return of the S&P 500 since its inception in 1926 is about 10%. This growth is driven by innovation, productivity, and the economic fundamentals of the country, not by short-term political events.

Keeping Your Eye on the Prize

Long-term investors don’t get bogged down by political noise. They understand that their goals—whether it’s retirement, buying a home, or funding a legacy for their kids and grandkids—require a steady, disciplined approach. So, if you’re wondering, “what do I do if Trump wins the election?” or “what do I do if Harris wins the election?” remember that panicking over an election and making knee-jerk changes to your portfolio can derail these goals.

At BentOak Capital, we’re here as your lookout. We’re the ones who sift through the noise, analyze the data, and keep your investments aligned with your long-term objectives. May we kindly remind you to focus on what truly matters: your family, your dreams, and your future.

A Call for Perspective

If you find yourself spiraling now, during, or after the election cycle, take a step back and breathe. Remember that a single political event is often nothing more than a blip in the grand scheme of your financial journey. Lean on us for guidance and support. We understand the emotional turbulence and are here to provide a steady hand.

Ultimately, what matters most is not who sits in the Oval Office but what’s happening in your life and the lives of those you care about. Your family, your passions, your future. Let us handle the intricacies of the market while you focus on what truly matters.

Remember, BentOak Capital is here to support you through every twist and turn. We’re committed to guiding you with empathy, understanding, and a solid grounding in facts and logic. Together, we’ll navigate the uncertainties and keep your financial future on track.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

This information is not intended to be a substitute for individualized tax advice. We suggest that you discuss your specific tax situation with a qualified tax advisor.

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services.

Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapital.com.

Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial.