As you approach retirement, ensuring that you have a solid financial plan in place is essential for a secure and stress-free transition. Retirement is a time for celebration and relaxation, but without careful preparation, common mistakes can jeopardize your savings and quality of life. In this blog, we’ll walk you through the seven biggest pitfalls to avoid as you approach retirement, empowering you to make informed decisions for a bright future.

1. Not Saving Enough

One of the biggest mistakes people make is not saving enough for retirement. It’s crucial to start saving early and consistently to build a sufficient nest egg. How do you know if you have enough? This is an area where we can provide you clarity on.

2. Ignoring Healthcare Costs

Underestimating healthcare costs in retirement can be a costly mistake. Be sure to factor in potential medical expenses and consider purchasing supplemental insurance or long-term care coverage. As you approach retirement, it’s vital to understand how these expenses might impact your savings and plan accordingly.

Dental expenses are a great example that folks do not think about, can have a big impact. Healthcare costs are a major expense in retirement, with estimates suggesting a 65-year-old couple in 2024 will need about $315,000 to cover medical expenses throughout their lives. Individual estimates are around $165,000 for men and $147,000 for women, largely due to women’s longer life expectancy.

Medicare does not cover all expenses, leaving retirees to handle out-of-pocket costs such as premiums, deductibles, and services like dental or vision care.

With healthcare inflation averaging around 5% annually, planning ahead using Health Savings Accounts (HSAs) or supplemental insurance (e.g., Medigap) is essential to help mitigate these rising costs.

3. Relying Solely on Social Security

While Social Security benefits can provide a valuable source of income in retirement, relying solely on them may not be sufficient. As you approach retirement, ensure you have diversified income sources, such as savings and investments, to maintain your standard of living. For affluent retirees, Social Security typically replaces a lower percentage of pre-retirement income compared to middle- or lower-income households. On average, Social Security replaces about 40% of pre-retirement earnings for the general population. However, for higher earners, this replacement rate drops significantly—often below 20%. This is due to Social Security’s benefit formula, which is designed to provide a higher replacement rate for lower-income individuals to help maintain a basic standard of living. Affluent individuals, who may have higher lifetime earnings, rely less on Social Security as their benefits max out based on a capped income level for taxable Social Security earnings.

4. Taking on Too Much Debt

Carrying high levels of debt into retirement can put a strain on your finances. Pay off as much debt as possible before retiring to reduce financial stress and free up more of your retirement income for living expenses and enjoyment.

5. Failing to Plan for Taxes

Many retirees underestimate the impact of taxes on their retirement income. As you approach retirement, developing a tax-efficient retirement strategy is key to considering factors such as withdrawal timing, Roth conversions, and tax diversification. Tax drag on your portfolio is a real thing that could impact your ability to grow your assets long term.

6. Not Having a Withdrawal Strategy

Without a clear plan for how to withdraw from your retirement accounts, you risk running out of money too soon or depleting your savings unnecessarily. Develop a withdrawal strategy that takes into account

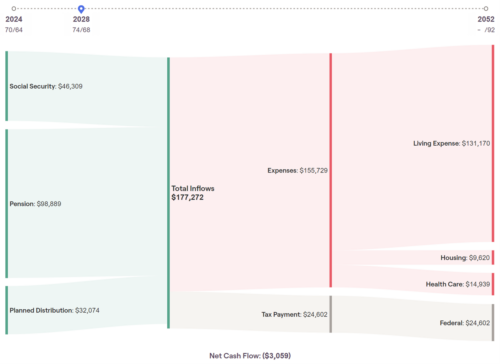

factors such as tax implications, market conditions, and longevity risk. This step is critical to having confidence about how to replace your income during retirement. A good example of this is delaying Social Security benefits and drawing from the portfolio to help with longevity risk. You will have increased benefits from Social Security in the future and by taking distributions from an IRA during low-income years you will be able to pay less tax on those dollars versus waiting until RMD age. Also monitoring if withdrawal rates are too high and unsustainable. We do not want to run the risk of running out of money and so sometimes our value is talking through this to adjust high withdrawal rates. These are two of many examples when it comes to figuring out a withdrawal strategy. We have the ability to provide a visualizer for what retirement income can look like. See below an example in projecting future cash flows and withdrawals from portfolio.

7. Overlooking Inflation and Longevity

Failing to account for inflation and the possibility of a longer-than-expected lifespan can erode your purchasing power and exhaust your savings prematurely. Adjust your retirement plan to account for inflation and consider strategies to mitigate longevity risk, such as annuities or delaying Social Security benefits.

By avoiding these common mistakes and taking proactive steps to plan for retirement, you can enhance your financial security and enjoy a more comfortable and fulfilling retirement. The best way to make sure that you do not make these mistakes is to build a financial plan with a financial advisor. Give our office a call today to have confidence as you enter into this new chapter in life!

Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapital.com.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial.