As the presidential election on November 5 approaches, the financial landscape is filled with questions about how this election impacts financial plans. Recent polls indicate a competitive race between former President Donald Trump and Vice President Kamala Harris. Both candidates are actively campaigning in key swing states, which has raised concerns among investors about the potential impact of the election results on their portfolios.

For many, understanding how the election impacts financial plans is key to making informed decisions about long-term strategy. Given the significant political divisions in recent years, emotions surrounding this election are understandably heightened. In this context, it is essential for investors to remain focused on their long-term financial strategies and not allow political developments to disrupt their plans.

Tax Policy is Uncertain, Especially Relating to Estate Planning

As citizens, voters, and taxpayers, the result of this election could have important implications for our everyday lives. However, when it comes to investment portfolios, political preferences should not dictate decisions. Historically, it is the markets and economic conditions that influence election outcomes, rather than the reverse. Therefore, it’s crucial to participate in the election process without allowing political sentiments to affect financial strategies.

One of the most complex issues related to the election is tax policy. The Tax Cuts and Jobs Act (TCJA) is set to expire at the end of 2025, which introduces uncertainty regarding individual and corporate tax rates and creates a potential “tax cliff.” The candidates have differing views on corporate taxes, individual rates, capital gains, tax credits, and more.

Although it’s tempting to react immediately, it’s important to take a balanced view of how the election impacts financial plans. While taxes undoubtedly affect households and businesses, their impact on the overall economy and stock market is not always straightforward. Taxes are just one of many factors influencing economic growth and investment returns, and various deductions, credits, and strategies can mitigate the effective tax rate.

Currently, tax rates are relatively low by historical standards, regardless of whether the top marginal tax rate is 37% or 39.6%. Given the increasing federal debt, investors should prepare for the likelihood of tax rates rising in the future, whether that occurs after this election or not. Planning for this potential change, ideally with the guidance of a trusted advisor, is becoming increasingly important.

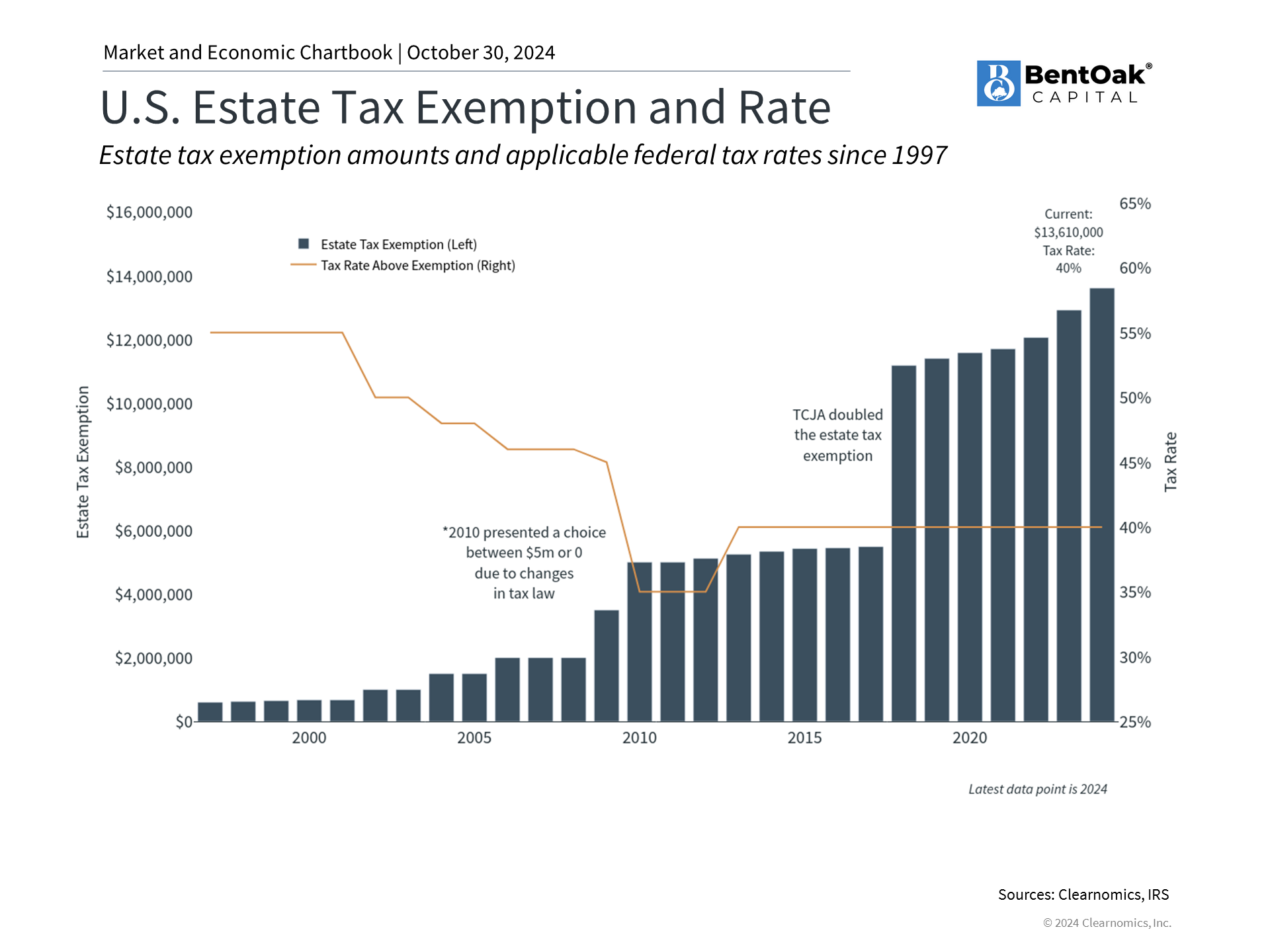

One area where taxes remain particularly low is estate taxes, which apply to the transfer of assets to heirs after death. The Tax Cuts and Jobs Act (TCJA) doubled the estate tax exemption amount, which has been adjusted for inflation to reach $13.6 million for 2024. Without further legislative action, this exemption is expected to revert to its pre-TCJA level—approximately $6.8 million per individual by 2026, adjusted for inflation.

Although estate taxes generate only a small portion of government revenue and affect a limited number of individuals, they have become a contentious political issue. The future of estate taxes will largely depend on the outcome of this election, including the results of Congressional races. For many affluent households, these developments could significantly impact their tax and estate planning strategies.

Global Trade and Tariffs Will Depend on the Election

The candidates also have differing views on potential trade policies, particularly regarding tariffs. While the trend of deglobalization and the reshoring of manufacturing—bringing production closer to the U.S.—is likely to continue, the specific use of tariffs to enhance U.S. competitiveness and generate revenue may hinge on the election outcome. During his administration, President Trump implemented several tariffs, many of which were maintained by the Biden administration.

Historically, tariffs were a significant component of trade policy and a major source of revenue for the U.S. government. However, in recent decades, their role has diminished. The establishment of organizations and trade agreements, such as the WTO, NAFTA, and the USMCA, has helped reduce trade barriers among key partners. Despite this, tariffs are still used periodically to protect domestic industries and intellectual property, including sectors like steel, electronics, semiconductors, and agriculture.

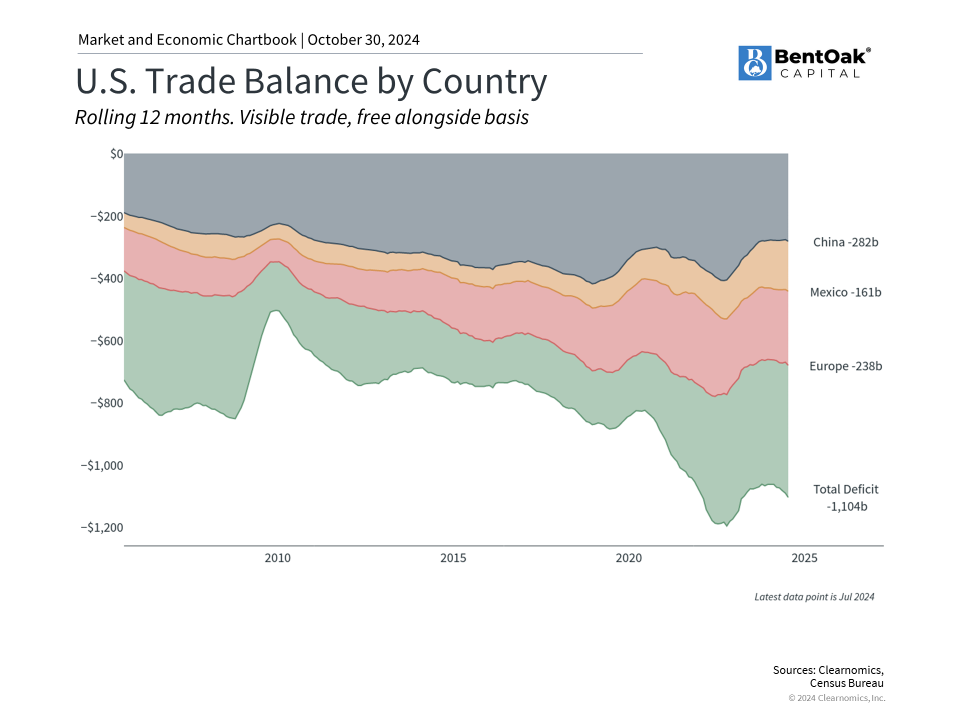

For investors concerned about the possibility of a trade war, it’s important to remember that similar fears in 2018 and 2019 did not result in the worst-case scenarios that many anticipated. During that period, the economy remained robust, with unemployment near historic lows and inflation effectively nonexistent, even late in the business cycle. Ongoing negotiations between key trading partners also alleviated some concerns. As illustrated in the accompanying chart, the U.S. has consistently maintained a trade deficit with many countries across various trade regimes.

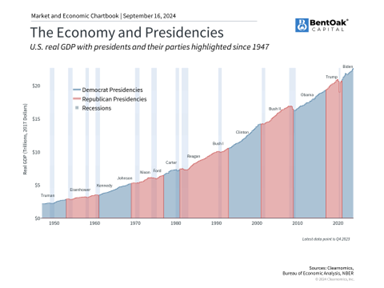

The Economy Has Grown Under Both Major Parties

Historically, the economy has shown growth under both major political parties, and bull markets have occurred regardless of who is in the White House. While it might seem counterintuitive, politics typically has a limited impact on the economy and financial markets. More significant factors include the business cycle and broad trends, such as advancements in artificial intelligence and technology, declining inflation, and a robust job market.

Despite the perceived significance of this election, policy changes tend to be gradual due to the checks and balances inherent in our political system. Candidates’ campaign promises often differ from what they can realistically implement.

Regarding taxes, neither candidate is suggesting a return to the high tax rates of the pre-Reagan era, when the top marginal rate reached as much as 94%. Similarly, while tariffs may increase, they are unlikely to rise to the levels seen during the Great Depression nearly a century ago. Keeping these facts in mind is crucial when planning for the next four years.

Keeping Perspective on How This Election Impacts Financial Plans

The upcoming election impacts financial plans in ways that may be subtle yet significant over time. While it’s natural to consider potential policy changes, investors should remember that the economy has grown under both major parties. By keeping a steady perspective, investors can focus on broader, long-term trends rather than immediate political shifts.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

IMPORTANT DISCLOSURE INFORMATION: Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request at www.bentoakcapital.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your accounts; and, (3) a description of each comparative benchmark/index is available upon request. Please Note: Limitations: Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any designation, certification, or license should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if BentOak is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation criteria/methodology, to the extent applicable). Unless expressly indicated to the contrary, BentOak did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of BentOak by any of its clients. ANY QUESTIONS: BentOak’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.