Make a move today that your future self will thank you for.

If you’re a retiree or approaching retirement, you’ve likely seen markets pull back before. And you’ve probably learned that when volatility spikes, the urge to sit still or make a rash move gets loud.

But some of the best long-term decisions happen when things feel uncertain. And one of the smartest, most overlooked strategies available right now is a Roth conversion.

What’s a Roth Conversion and Why It Matters

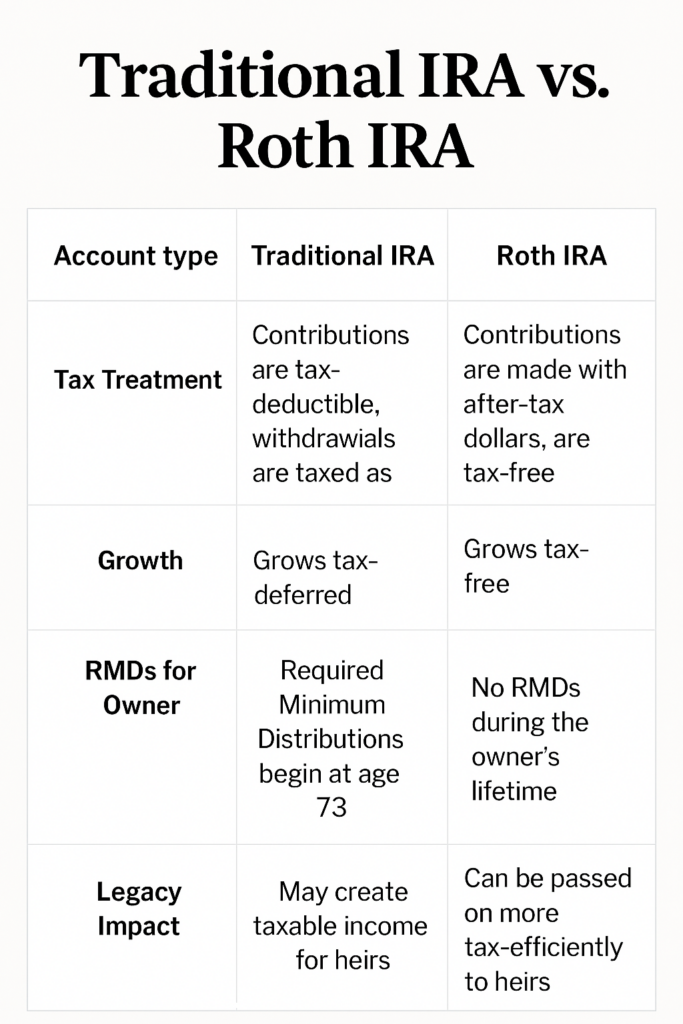

A traditional IRA is tax-deferred, meaning you don’t pay taxes while the money grows. You pay when you take it out. A Roth IRA works in reverse. You pay taxes up front, but everything after that grows and can be withdrawn tax-free in retirement.

A Roth conversion moves money from a traditional IRA into a Roth. Yes, you’ll owe income tax on the amount you convert. But from that point forward, the growth and withdrawals are potentially tax-free for life, subject to IRS rules and individual circumstances. However, it’s important to consider that market conditions can affect the actual growth of investments

This also matters because of Required Minimum Distributions (RMDs). Starting at age 73, the IRS requires you to withdraw from traditional IRAs, whether you need the money or not. Roth IRAs don’t have RMDs during your lifetime, which gives you more control over your future income and tax bracket. And because of this, they’re also a powerful legacy planning tool, offering tax-free assets that can be passed to heirs more efficiently.

Volatility Can Be a Window of Opportunity

When markets drop, it’s easy to get defensive. But that’s often when opportunity quietly shows up.

A down market means the value of your investments is temporarily lower. You can convert more shares for the same tax hit. If those shares rebound inside a Roth, that entire recovery is yours, tax-free.

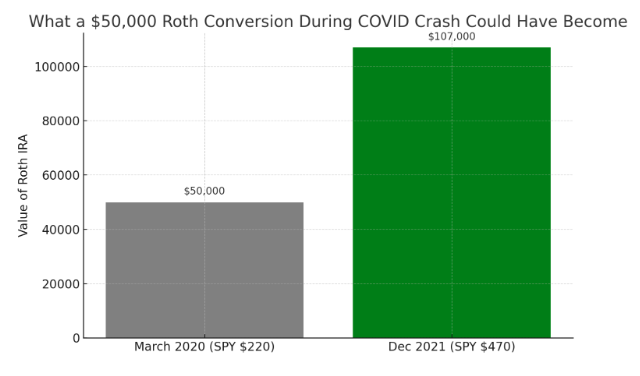

Let’s make that real. In March 2020, the S&P 500 dropped more than 30 percent. SPY, the ETF that tracks it, fell to around $220 per share. If you had hypothetically converted $50,000 of SPY at that moment, you would have received about 227 shares. By the end of 2021, SPY rebounded to over $470. Those same shares could have been worth nearly $107,000, with every penny of growth potentially shielded from future taxes inside the Roth. Please note, this is a hypothetical example and past performance is not indicative of future results.

You would’ve paid tax on the $50,000 conversion, not the $57,000 of growth. That’s what it means to turn volatility into long-term advantage.

Why This Works Best in Retirement’s “Low-Income Window”

Many retirees face a 5 to 7 year stretch between retirement and when Social Security, pension income, or RMDs begin. This window can be a golden opportunity. Lower income means more room to convert assets at lower tax brackets.

It’s not about market timing. It’s about aligning your tax strategy with your income reality and using temporary volatility to your advantage. With current tax rates scheduled to increase in 2026, this window may be narrowing.

This Isn’t Reactive. It’s Intentional.

When uncertainty is high, the question “Should I be doing something?” is common. But not every action has to be loud or reactive. Some of the best decisions in retirement planning are quiet and strategic.

A Roth conversion isn’t a bet. It’s a shift. From taxable to tax-free. From forced distributions to financial flexibility. From potential tax burdens to long-term clarity.

Closing Thought

Roth conversions aren’t flashy, but they’re one of the most powerful long-term tools available to retirees. Especially when markets are unsettled and income is temporarily low, this kind of planning can quietly shift your financial future in the right direction.

It’s not about trying to guess the bottom. It’s about using the moment well.

If that window applies to you, it’s worth exploring.

IMPORTANT DISCLOSURE INFORMATION: Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request at www.bentoakcapital.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your accounts; and, (3) a description of each comparative benchmark/index is available upon request. Please Note: Limitations: Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any designation, certification, or license should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if BentOak is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation criteria/methodology, to the extent applicable). Unless expressly indicated to the contrary, BentOak did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of BentOak by any of its clients. ANY QUESTIONS: BentOak’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.