Traditional financial planning and estate planning have long been the pillars of efficiently passing a financial legacy from generation to the next. But there are some things financial and estate planning are not designed to do. This blog post discusses the third pillar, and how BentOak Capital is trying to help make the process of passing your legacy more effective and impactful.

——————

What is the most important thing you could pass on to your heirs?

If we were to ask you to write that down, what would it be? What’s the most important thing you would want to pass to your heirs if you were not here tomorrow?

Many people we talk to about this will give answers like “faith” or “love.” They will talk about work ethic, close family ties, honesty and integrity, or friendship.

What most people will not mention is money or possessions.

Here is something else to think about. How are you using your money to perpetuate those things you said were most important to you? How are your will, trust, and other estate planning documents reinforcing those values?

Let’s define two terms very quickly.

Financial planning is the process of saving, investing, and planning for the future of your money.

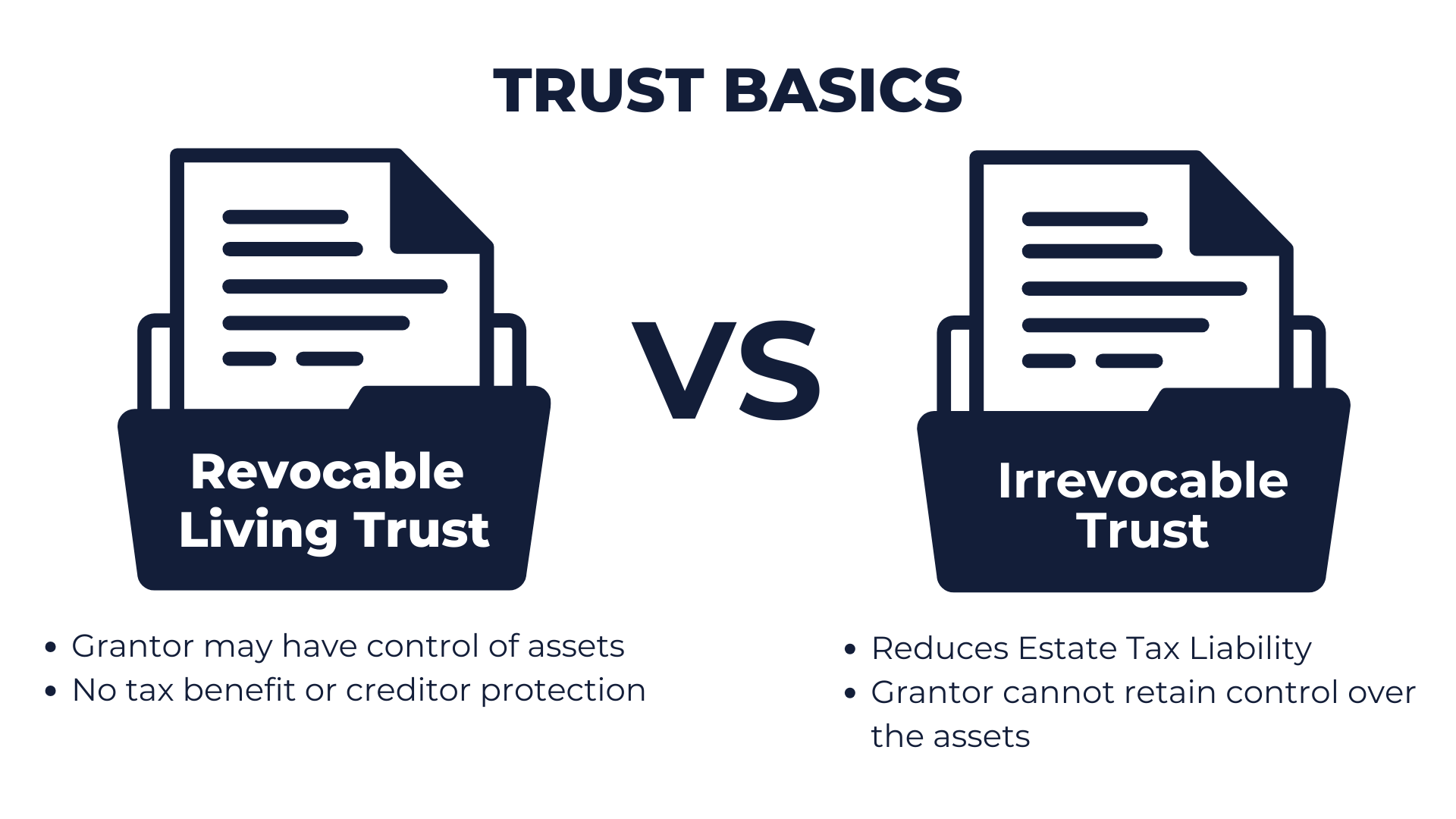

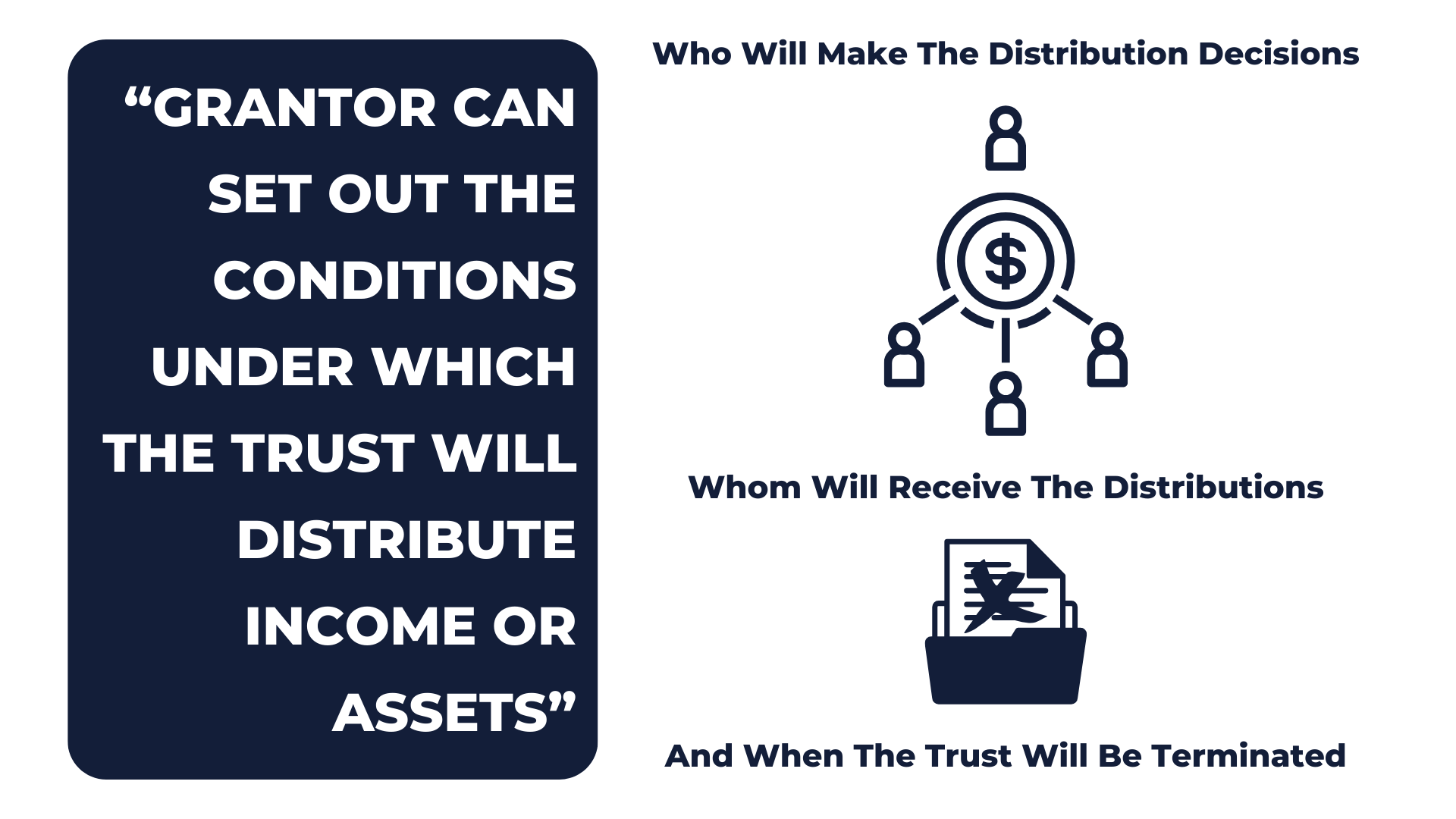

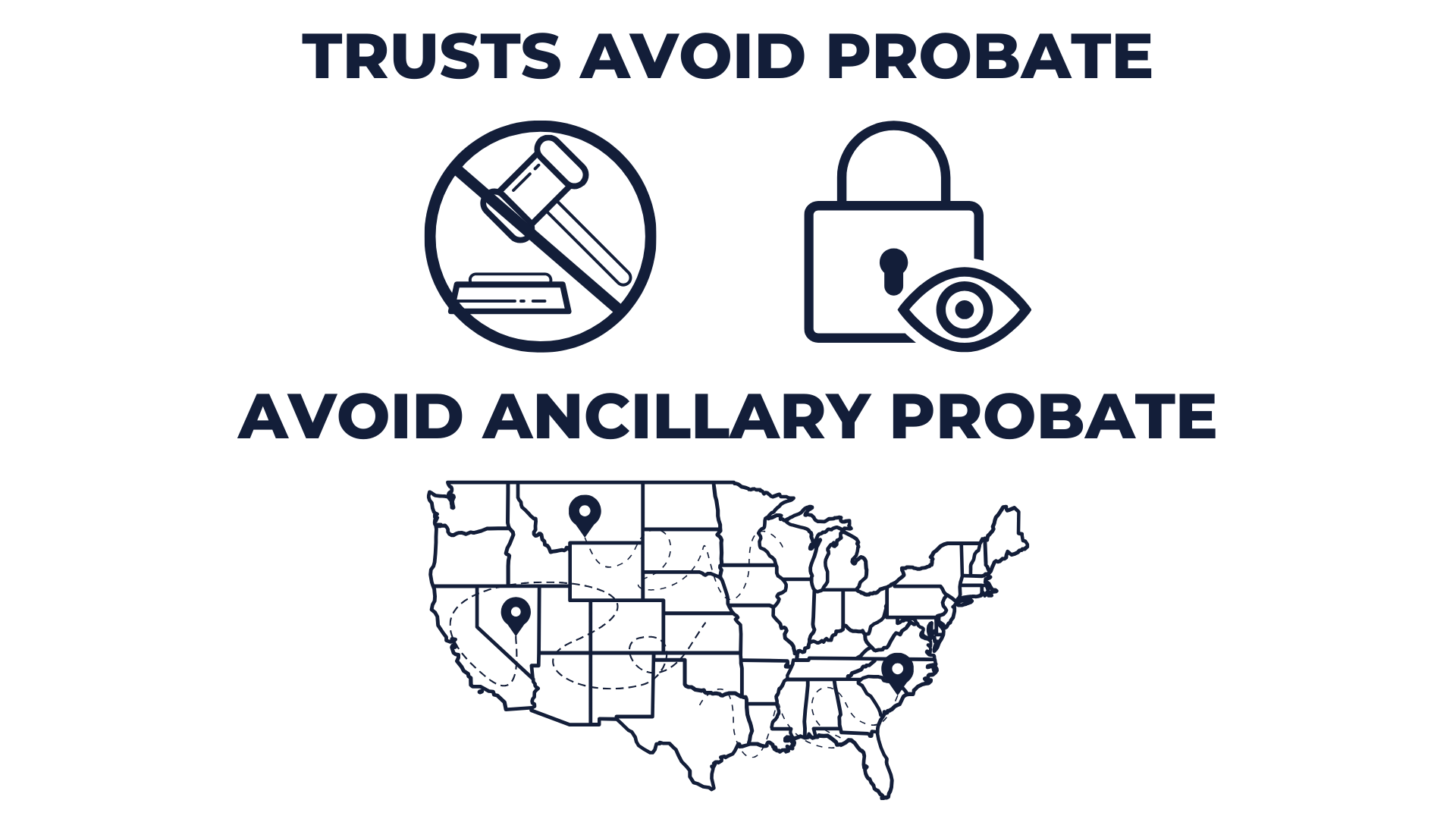

Estate planning is the process of preparing your money for your heirs.

Both financial and estate planning are extremely, vitally important; you will never hear us say otherwise. But the question we led off with, about what’s most important to pass on, is not and cannot be answered with traditional financial planning and estate planning practices.

We want to introduce you to something new:

Heritage planning: the process of preparing your heirs to receive their inheritance.

Decades of research and intentional practice, both professional and within families, show that if you have a financial, estate, and heritage plan in place, your family is far more likely to be successful at keeping the family together (unified, cohesive, whole) for multiple generations after you are gone.

You may have noticed in our definition of heritage planning that we said “inheritance”, not money. Traditional financial planning and estate planning techniques have limited themselves to the balance sheet and cash flow of a family’s life while heritage planning is the intentional passing of both your values and your valuables. The inheritance you leave for heirs can encompass your family stories, life lessons, community relationships, hopes and dreams. And also, money and assets.

Why might it be important to prepare heirs in advance to receive their inheritance?

First, families typically want to reinforce positive family traits, such as time spent together, emotional ties, an aligned purpose, and the willingness to work through problems.

Second, families typically want to reduce negative family traits, such as breakdowns in generational communication, family units drifting apart, or outright implosion of family unity.

When it comes right down to it, most people want to make sure that their wealth helps, and not hurts, their heirs.

Throughout history, regardless of culture or time period, there have been those who have successfully maintained their unity as well as keeping the wealth within the family for multiple generations. This is not common; in fact, it’s relatively rare. But studying those success stories shows that there are some common factors among the families that get it right over the long run. The four most important characteristics are:

- The most successful multi-generational families are intentional about developing, encouraging, and passing on the values, history, and character of the generations that come before, tying together the emotional inheritance with the monetary.

- Human beings have a massive desire to be heard and to be understood. Successful families foster open and effective communication between family members and between generations.

- In a successful family, all family members must have permission to assert themselves and to feel that they will be safe when doing so. All family members need to feel that what they can contribute will truly make a difference to the greater family.

- Successful families have a well-defined common purpose – a forward-looking statement that articulates “this is who we are” and “this is what we do because of who we are”.

In short, the families that are most likely to successfully maintain their family unity and their family wealth are the ones that intentionally create a culture of communication and trust wrapped around a common family purpose.

Imagine it’s 50 or 70 years from now. Imagine that even though you are not physically present, you nonetheless have the ability to watch a gathering of your family. What would you like to see happening?

Who is there? What are they experiencing? What smells are there? How does it feel? What are they doing?

What is important to you about that vision of the future? Really stop and think about that. Stop reading, look away from the screen, and consider.

What would it mean to you if that future were to become a reality? Again, take a moment to consider that question. If you are so moved, write down your answer.

Now describe what your family gatherings are like today, as you perceive them. Who is there? What are they experiencing? What smells are there? How does it feel? What are they doing?

Can you describe any gaps between that vision of the future of your family, and how you think about your family today?

If there are any gaps, what value would you place on filling those? What would it mean to you if you could look back and have had an active role in bridging those gaps?

Which gap would you want to work on first?

One gap might include thinking about the questions we asked at the beginning: how are you using your money to perpetuate the things you say are most valuable to you? How do your estate planning documents reinforce those values?

This is heritage planning at BentOak Capital.

Our desire is to be better than anyone at listening and understanding, deeply, what matters most to you.

Many people have not thought about the correlation between money and values and inheritance and a shared family purpose and why knowing the family history can be so valuable. Our goal is to help you uncover your “gaps”, to define them in plain English, to see the value to you of filling those gaps. For some families, we can work with you to create a completely customized intentional process that is driven by your family towards your desired outcomes. For other families, our goal is to provide resources and encouragement that will empower you and your family to take an active role in bridging your gaps.

Our purpose is to intentionally seek out ways to make a positive impact on the future of the families we work with.

Heritage planning works best by interweaving itself with a proactive financial plan and a thoughtful, future-oriented estate plan. This is what BentOak Capital strives to do for you. We want to be a team that advocates for you and for your family, so that you can focus on what matters most.

Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapital.com.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial.