Many high net worth individuals will come to the point where they ask themselves the question, “Do I need a trust?” Estate laws can be confusing, and getting advice from an unqualified source can make that decision all but impossible. To some, trusts are a stigmatized embodiment of a silver spoon. To others, the concept of a trust is so complicated that the thought of looking into establishing one is insurmountable. To simplify the matter, we will discuss some trust basics including the main reasons one might establish a trust.

Trust Basics

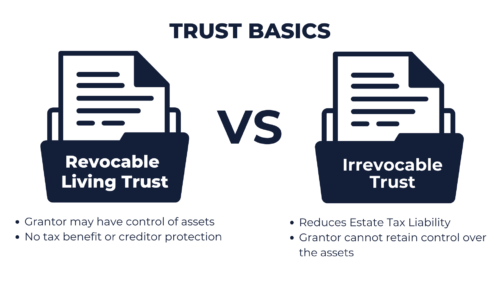

Trusts need not make your eyes cross. We will keep this simple. There are two main types of trusts to consider: revocable living trusts, and irrevocable trusts.

A revocable living trust is established during the grantor’s life for the purpose of controlling the distribution of the assets within the trust both during and after the grantor’s life or for avoiding probate. These are the most common types of trust. The grantor, the person creating the trust and making the gift, may make gifts during their life or at their death through their will to the revocable trust. During their life they may serve as trustee to the trust, or they can appoint someone else to serve as trustee. They also name the trust beneficiaries to which the assets will pass.

A revocable living trust is established during the grantor’s life for the purpose of controlling the distribution of the assets within the trust both during and after the grantor’s life or for avoiding probate. These are the most common types of trust. The grantor, the person creating the trust and making the gift, may make gifts during their life or at their death through their will to the revocable trust. During their life they may serve as trustee to the trust, or they can appoint someone else to serve as trustee. They also name the trust beneficiaries to which the assets will pass.

An irrevocable trust is established to remove assets from one’s estate with the main purpose of reducing estate tax liability. With the increase of the Unified Estate Tax Exemption from the Tax Cuts and Jobs Act of 2017, these types of trusts have become less common because fewer people are faced with a possible estate tax liability. In simple terms, one can reduce the size of their estate during their life by irrevocably gifting assets to the trust, hence the name. The downside of the irrevocable trust is that the grantor cannot retain any control over the assets in the trust. Instead, they appoint a trustee that controls the assets.

Controlling the Distribution of Assets

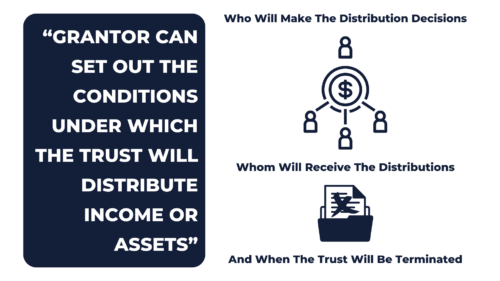

Many who have worked hard to build their wealth want to maintain some control over those assets both during their life and after. A grantor can set out the conditions under which the trust will distribute income or assets, who will make the distribution decisions, to whom those assets will be distributed, and when the trust will terminate.

When establishing a trust, the grantor sets out the terms under which the trust can, or must, distribute income or principle and under which conditions the trust will be terminated. Additionally, the grantor names income beneficiaries who will receive the income while the trust is in place, and remainder beneficiaries who will receive the assets after the trust is terminated. Lastly, the grantor names primary and secondary trustees who will serve to distribute the assets according to the terms of the trust.

The grantor of a revocable trust can directly control the assets both during and after their life. During the grantor’s life, he can name himself as trustee and an income beneficiary while he is alive. In fact, most do just that. To maintain control after his life, he will name remainder beneficiaries and secondary trustees. The naming of secondary trustees also serves the purpose of eliminating the need of financial powers of attorney for the assets owned by the trust.

Irrevocable trusts can also provide some sense of control for a grantor, even though legally they must give up actual control of their assets. A grantor of an irrevocable trust is still able to name income and remainder beneficiaries of the trust but cannot serve as trustee and cannot name herself as a beneficiary. Simply put, the grantor gifts assets out of her estate to the trust and gives up all control to the trustee to make income and corpus distributions according to the trust terms that she established when she created the trust. That is where the control stops.

Avoiding Probate

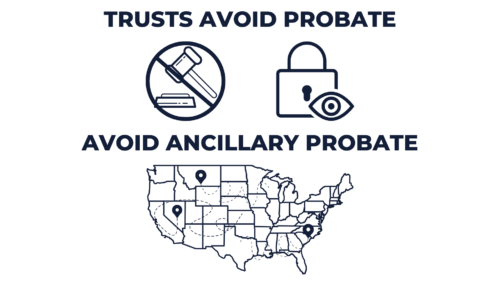

Another benefit of a trust is that it allows the assets within the trust to avoid probate. Probate is the legal process in which a deceased person’s property is distributed. Probate is also a public process. Many would prefer to avoid this process all together, largely due to reasons of privacy and simplicity. Gifting to a trust removes those specific assets from the probate process, keeping them out of the public eye. Please note that any assets within a revocable trust are still included in one’s taxable estate.

Another form of probate that many like to avoid is ancillary probate. This is the probating of one’s estate in a state in which the deceased owned assets but did not reside as their primary residence. One common example of this is someone living in one state and owning a vacation property in another state. In that case, the deceased person’s estate would have to go through probate in both states unless the vacation property was owned within a trust. If the property was owned within a trust, the vacation home would not be subject to probate and the executor of the deceased person’s estate would not have to travel to another state for a separate probate process.

Whether you own property in another state, want to avoid probate in the state in which you reside, wants to maintain control of your property during or after your life, or want to avoid estate taxes then a trust could be the estate planning tool for the job. Now you should be more equipped to decide whether or not a trust is right for you.

If you would like to discuss whether a trust makes sense for your family’s situation, please contact BentOak Capital. We can discuss the pros and cons of trusts, relating them to your needs. Importantly, we have a strong list of very good estate planning attorneys we can recommend to you.

Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapital.com.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial.