Planning for your and your family’s financial future is a large part of what we do at BentOak Capital. Estate planning being a big piece of the puzzle, it’s apparent that you should have estate documents. For those of you that have taken the significant step of drafting your estate documents, we commend you. Bravo! But your journey doesn’t stop here; consistent updates are key. You might be wondering, “How frequently should I revisit my estate documents?” We’re here to offer you well-defined, actionable guidance on this critical issue.

Why Look Over Your Estate Documents?

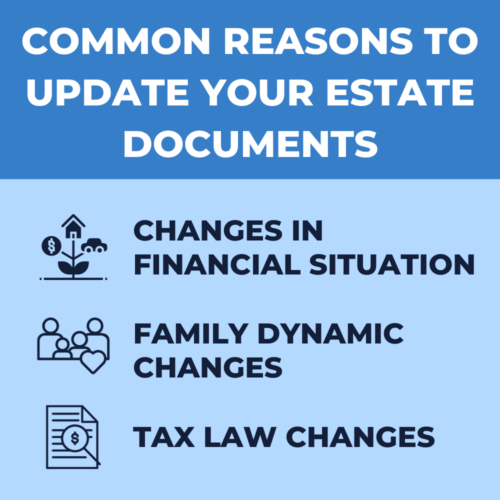

First, let’s understand why it’s crucial to keep these papers current. Estate documents not only dictate the distribution of your assets but also can outline your wishes in case of incapacity. A few of the more common reasons to update your estate documents are:

- Changes in Financial Situation: Your assets today most likely are not the same they were five or ten years ago and what they will be five or ten years from now.

- Family Dynamics: Births, marriages, divorces, and even the loss of loved ones can all significantly impact your estate plans. All these events have the potential to change your beneficiary needs.

- Tax Laws: Legal changes can affect the tax implications of your assets. As tax laws change every few years, it is wise to visit with your estate attorney to be sure you’re taking advantage of new benefits.

Suggested Timeline to Revisit Your Estate Documents

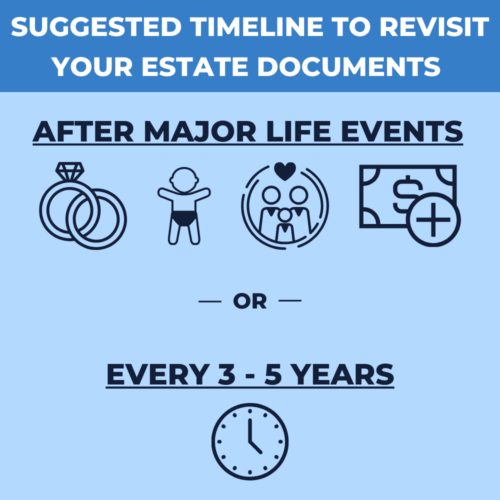

Don’t forget to revisit your estate plan after major life events. Whether it’s a marriage, divorce, the birth of a child, or a substantial inheritance, these pivotal moments require your immediate attention to ensure your estate documents are aligned with your current circumstances.

A solid rule of thumb is to review your estate documents every three to five years. This schedule allows you to make the essential changes that align with shifts in your financial landscape and personal life.

Why so often?

In the ever-changing landscape of life, your financial and family situations are bound to evolve. Just ponder for a moment—has your life remained the same as it was five years ago? Have you changed jobs or perhaps relocated to another state?

Even seemingly minor changes, like purchasing a new vehicle or boat, could cause updates to important financial documents.

Regularly updating your estate documents is not just a matter of legal formality—it’s an essential aspect of sound financial planning. Regularly updating your estate documents ensures that your legacy remains intact, offering peace of mind for you and your loved ones.

If you have any questions or need guidance on how to proceed, feel free to reach out to our expert team at BentOak Capital for personalized attention.

Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapital.com.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial.