To paraphrase Ernest Hemingway, shifts in the stock market often occur “gradually, then suddenly.” Over the past month, the market has rotated from large cap technology stocks to small caps and other sectors. Following the latest jobs report, however, global stocks experienced a sharp pullback due to concerns over the timing of Fed rate cuts, a weakening labor market (more below on the latest jobs report), and disappointing tech earnings. Financial markets are on edge as investors adjust to a changing economic landscape.

Specifically, the Nasdaq is now in correction territory, defined as a 10% decline from recent highs. The S&P 500 has pulled back 5.7% from its high three weeks earlier, while the Dow has been steadier with a decline of 3.5%. The VIX, often described as the market’s “fear gauge,” has surged to its highest level since early 2023. The 10-year Treasury yield has now fallen below 3.8%, a sharp decline from 4.7% only three months ago (a positive for fixed income price performance).

Ironically, current macroeconomic conditions – inflation returning to 2%, low but rising unemployment, falling interest rates, and double-digit stock market gains – are exactly what investors had hoped for at the start of the year. Now more than ever, investors need perspective to navigate markets and stay on track to achieve their financial goals. How should investors view recent stock market swings as they position for the coming months?

Investors Need Perspective in Volatile Markets

Investors focused on recent performance alone would no doubt wonder if the cycle is over. While recent market events are still playing out, it’s important to remember that not only are stock market swings normal, but they can also be healthy if they are the result of investors adjusting to new economic facts. This is especially true if valuations improve as prices adjust, and corporate earnings continue to grow.

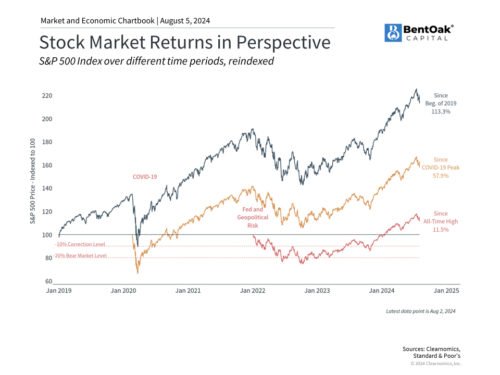

For many investors, the volatility since 2020 may already seem like a distant memory after the steady recovery of the past year and a half. As the accompanying chart shows, the S&P 500 has gained 113% over the past five years, including the pandemic collapse and the 2022 bear market. While market pullbacks are never pleasant, viewing the market on these timescales does help to put the current decline in perspective.

It’s no secret that technology-related stocks, particularly those related to artificial intelligence, have contributed greatly to these market returns. The Magnificent Seven, a group of stocks including Nvidia that benefits from recent trends, is still up a whopping 162% since the beginning of 2023, and has gained 362% since early 2020.

The rotation and now pullback in these stocks is the result of investor concerns over the magnitude of the rally, large tech company earnings, and recent news on product rollout delays. Whether AI and large language models can live up to their lofty promises has yet to be seen, and it’s not surprising that investors are growing antsy at seeing a return on the billions invested by large companies in these technologies.

So far, market fundamentals still appear to be strong regardless of how stocks move in the short run. Profit forecasts are still positive, with S&P 500 earnings expected to grow 13% over the next 12 months. More than half of S&P 500 sectors are expected to grow earnings by double digits, and all 11 sectors are forecasted to experience positive growth. In the long run, earnings are what drive stock market returns, and thus the health of the economy matters more than short-term stock and sector-specific trading activity.

Concerns are Growing that the Fed has Made a Policy Mistake

This is why concerns around the Fed have spooked the market in recent days. The Fed has now kept rates unchanged for over a year as it seeks “greater confidence” that inflation is returning to its 2% target. However, its focus on inflation is now resulting in a weakening labor market, which some fear could spiral toward a “hard landing.”

It’s important to remember how fickle market expectations have been. The year began with investors believing the Fed would need to cut rates several times due to an imminent recession. Expectations then shifted after a few hotter-than-expected inflation reports, with investors believing the Fed would not cut at all this year. Today, markets expect the Fed to cut in September and possibly at each subsequent meeting. These swings show how difficult it is to get monetary policy right, even as backseat drivers.

These dynamics have shifted the Fed’s focus to the labor market, with the Fed acknowledging that it is “attentive to the risks to both sides of its dual mandate.” The latest jobs report showed that the economy added 114,000 new jobs in July, lower than the consensus estimate of 175,000. Unemployment, which was expected to remain at 4.1%, rose to 4.3%. While this is still relatively low compared to history, it is the highest rate of unemployment we’ve seen since the pandemic (and mid-2017 before that) but the data is skewed. In this recent report, there were ~461,000 individuals that were not able to work due to weather (e.g. Hurricane Beryl), which is 10x higher than the July monthly average. In addition to this, there were approximately 1.1 million nonfarm employees that had to work part-time instead of full-time.

Regardless, both sides of the Fed’s mandate – maximum employment and stable prices – now point strongly to a September rate cut. Investors are now worried that the Fed has waited too long to cut rates.

Where does the Fed stand today? Very few argue that the Fed has made the wrong moves per se – just that they have not timed them well. While many may wish the Fed had cut rates at its last meeting, it is likely they will do so soon.

Investing is About Both Returns and Managing Risk

Investing is never a sure thing. The stock market comes with many risks that can be managed with proper portfolio construction and a long time horizon. History shows that despite the ups and downs of the market, staying invested is still the best way to grow wealth and achieve financial goals over the course of decades.

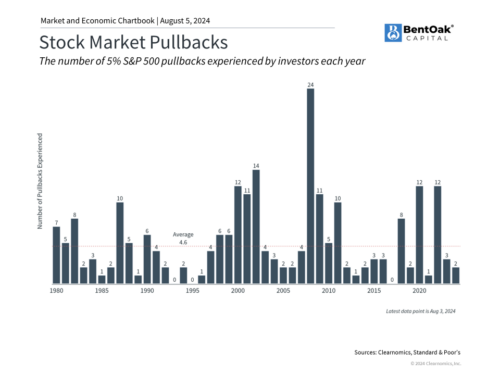

Stocks never move up in a straight line, so how we react to market volatility is perhaps more important than the volatility itself. The S&P 500 has now experienced its second 5% or worse pullback this year. As the accompanying chart shows, this is below the average of 4 to 5 pullbacks experienced in the average year, and the dozens during bear markets.

Additionally, current market concerns driven by tech stocks, the Fed, and the labor market all have their silver linings. The economy is still quite healthy, corporate earnings are still growing, and if interest rates do sustainably fall, many other parts of the market (including fixed income exposure) could benefit. As in past episodes of volatility, seeing past the current market moves and headlines is needed to benefit from the long-term trend.

The bottom line? Recent economic data have sparked concerns that the Fed should have cut rates sooner. Tech stocks have declined as investors worry about valuations and earnings, but overall fundamentals in the market are relatively healthy. Maintaining a diversified portfolio of stocks and bonds helps during these volatile periods. Over the next several months it will be important for investors to stay level-headed and not overreact in the coming months as more “headlines” come out. Maintaining a long-term focus on your portfolio, supported by a comprehensive financial plan, has shown to be one of the best courses of action to attain your goals.

IMPORTANT DISCLOSURE INFORMATION

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services.

Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapital.com.

Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.