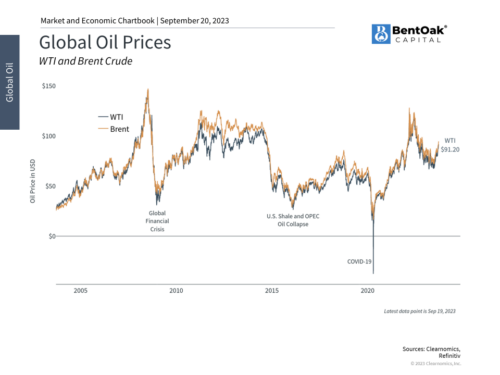

In our recent mid-year outlook, we discussed a key driver of global markets and inflation over the past two years has been the price of oil. As an important commodity that fuels the economy, investors watch the oil market closely. While oil has fallen considerably from its peak in 2022, it has also rebounded over the last few months. Since mid-June, West Texas Intermediate (WTI) crude prices have risen over ~22%, from around $70 per barrel to above $86. What do long-term investors need to know about energy prices as the inflation story evolves and the market rally continues?

Oil prices have begun to rise after falling steadily for a year

Oil is still a critical input into economic activity with the International Energy Agency estimating that global demand will rise to 102 million barrels per day this year. Demand plummeted during the pandemic and the price of oil even briefly turned negative, but this reversed quickly as economic growth surged when lockdown restrictions were lifted. Oil prices then spiked in February last year when Russia invaded Ukraine, raising concerns over the supply of energy for Europe and the rest of the world. Fortunately, oil prices began easing soon thereafter, falling from nearly $128 at the peak.

Oil is still a critical input into economic activity with the International Energy Agency estimating that global demand will rise to 102 million barrels per day this year. Demand plummeted during the pandemic and the price of oil even briefly turned negative, but this reversed quickly as economic growth surged when lockdown restrictions were lifted. Oil prices then spiked in February last year when Russia invaded Ukraine, raising concerns over the supply of energy for Europe and the rest of the world. Fortunately, oil prices began easing soon thereafter, falling from nearly $128 at the peak.

Oil matters to markets and investors for many reasons. Not only does the price of oil interact with broad markets and the U.S. dollar, but it is also an important driver of inflation. Rising energy prices are a direct burden on consumers and businesses who spend more on gasoline and other fuels, putting upward pressure on headline inflation. This also indirectly raises prices on all goods and services as production and transportation costs rise, potentially impacting core inflation. Thus, higher oil prices effectively function as a tax which can slow economic growth and impact corporate profitability.

For these reasons, the recent increase in oil prices could hinder improvements in inflation and act as a drag on the broader economy. Why have oil prices risen in recent months?

First, the U.S. economy has been much steadier than expected. Weakness in oil prices earlier this year partly reflected fears around an imminent recession. The fact that a recession has not materialized, while the odds of a so-called “soft landing” by the Fed have increased, has helped to propel oil prices higher.

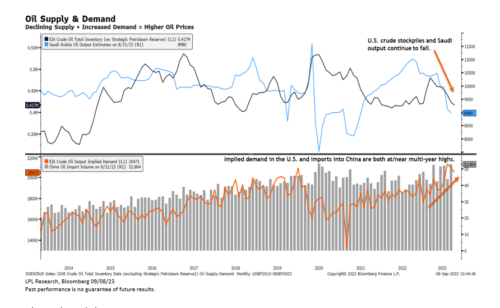

Second, Saudi Arabia and Russia recently announced that production cuts of 1.3 million barrels per day would be extended until December. This amounts to 1.3% of global production – not an insignificant sum – and adds to previous cuts. The two countries are among the largest in OPEC+ and have led other cuts in order to prop up oil prices, as well as in response to slower GDP growth and weakness in China. Some economists estimate that this could result in a global deficit of more than 1.5 million barrels per day in the fourth quarter.

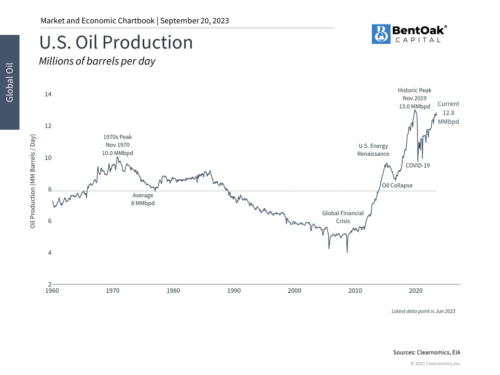

U.S. oil production is returning to pre-pandemic levels

It’s important to maintain perspective around these cuts. The relevance of OPEC as a price-setting cartel has declined over the past decade, partly because cuts by each country are voluntary and difficult to enforce, and because the U.S. has become the top producer of oil in the world. U.S. oil production, as shown in the chart below, is nearly back to its pre-pandemic level of 13 million barrels per day. While there are many nuances in terms of the types of oil produced and consumed in the U.S., Europe, and elsewhere, the fact that the U.S. has been a “swing producer” has shifted the dynamics of the energy markets considerably.

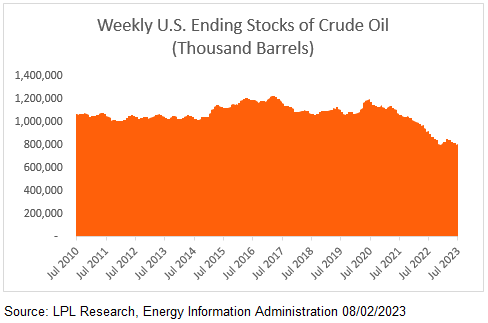

Another tailwind for oil prices is declining oil inventories. For instance, the Strategic Petroleum Reserve (SPR), a large emergency supply of oil in the U.S., is at its lowest level since the mid 1980s. This is primarily because oil was drawn from the SPR to offset high prices last year when gasoline was averaging more than $5 per gallon nationwide. The federal government would need to purchase 376 million barrels of oil to restore the SPR to its 2010 peak level. While there is no set timeline for doing so, this deficit naturally places upward pressure on oil prices.

Another tailwind for oil prices is declining oil inventories. For instance, the Strategic Petroleum Reserve (SPR), a large emergency supply of oil in the U.S., is at its lowest level since the mid 1980s. This is primarily because oil was drawn from the SPR to offset high prices last year when gasoline was averaging more than $5 per gallon nationwide. The federal government would need to purchase 376 million barrels of oil to restore the SPR to its 2010 peak level. While there is no set timeline for doing so, this deficit naturally places upward pressure on oil prices.

In addition to this, the Energy Information Administration (EIA) reported commercial crude inventories in the U.S. dropped by over six million barrels at the beginning of September, marking a fourth straight weekly drop that has left inventories at their lowest level since December (dark blue line in the chart below). On the demand side of the equation, China continues to import more oil (see grey bar chart below). In August, they imported 52.8 million tons of crude oil, or 12.5 million barrels per day, marking a 21% increase compared to July. In the U.S., implied oil demand reached multi-year highs (orange line below) in July before pulling back modestly last month.

The energy sector has been volatile over the past year

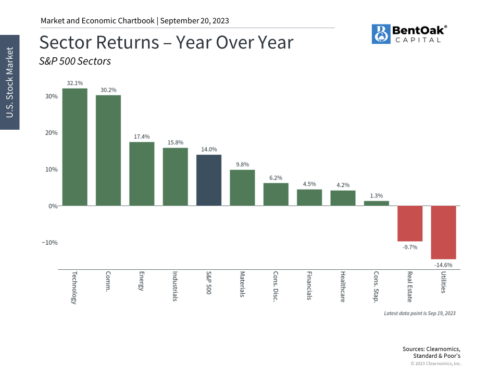

When it comes to the stock market, these dynamics have driven significant volatility for the energy sector of the S&P 500. The sector has risen 17.2% over the past year but this includes a decline of 18.8% from November 2022 to March 2023 followed by full recovery. On a year-over-year basis, its return is third only to the information technology and communication services sectors which have led markets this year. Last year, it was the top performing group.

This is another reminder to investors that it is exceedingly hard to predict which parts of the market might outperform in any given year, and chasing what’s already performed well can backfire as well. Changes in leadership between energy, tech, consumer sectors, and others have been commonplace as the world stabilizes, the inflation story unfolds, and investors look to the next market cycle. As always, the best course of action is simple: long-term investors should maintain balanced allocations across a variety of sectors and asset classes. Doing so in a way that is tailored to financial goals is still the best approach for increasing the odds of investment success.

The bottom line? Oil prices have risen in recent months due to a steadier than expected economy and production cuts. While this may act as a headwind that we will continue to closely monitor, the economy remains relatively healthy and there are other signs that inflation is improving. Investors should stay balanced in the months ahead.

IMPORTANT DISCLOSURE INFORMATION

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services.

Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapital.com.

Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial.

Copyright (c) 2023 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.