As election season approaches, it’s common for investors to feel anxious about navigating markets during election years, market volatility, and the potential impact of political changes. Many consider becoming more conservative or moving to cash to avoid perceived risks, but this reaction can often stem from a misunderstanding of how markets work. While elections can influence the market over the short-term, the primary drivers of market performance remain largely unchanged. Let’s explore the historical evidence for maintaining your investment strategy during election years and understand the actual engine of markets—corporate profits.

The Direct Impact of Politics on Markets: Taxes and Regulations

Elections can directly affect markets through changes in taxes and regulations. When a new administration takes office, there may be shifts in tax policies that impact corporate profits and investor returns. Similarly, changes in regulations can affect specific industries, either by increasing operational costs or creating new opportunities. Keep in mind that these changes often occur over extended periods of time and markets adjust accordingly. Additionally, coming out of a high inflation and high interest rate period, we believe it is highly unlikely for either political party to be successful in drastically reforming tax or regulatory policy if it causes harm to consumers and investors.

Example: The Tax Cuts and Jobs Act of 2017 significantly reduced corporate tax rates, leading to an increase in corporate profits and a subsequent rise in stock prices. Conversely, increased regulatory scrutiny on sectors like technology or healthcare can lead to short-term market adjustments as companies adapt to new rules.

The Indirect Impact: Consumer Confidence

Elections can also indirectly affect markets through consumer confidence. Political uncertainty can lead to fluctuations in consumer and business sentiment, which in turn can influence spending and investment decisions. However, this impact is typically short-lived and tends to stabilize once election results are clear and new policies are implemented.

It’s important to remember that most companies are politically agnostic. Their primary focus is on generating profits and delivering value to shareholders, regardless of who is in office. Companies are adept at adapting to new policies and regulations, formulating strategies to thrive under different political landscapes.

Example: Consider a major corporation facing new labor regulations under a new administration. Instead of being hindered, the company might streamline operations and invest in technology to maintain profitability. The rules themselves do not pose a threat; rather, it is about understanding and navigating them effectively.

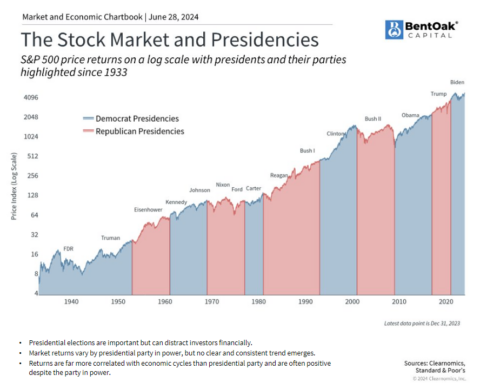

The Historical Evidence: Staying the Course

Historical data shows that reacting to elections by moving to cash can be detrimental to long-term investment goals. Markets are resilient and have weathered many political changes, consistently trending upward over time. Here are a few key points to consider:

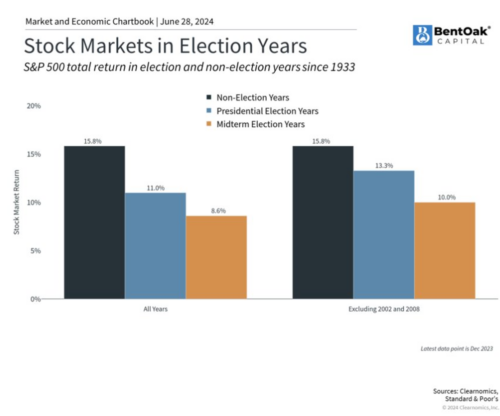

1. Market Performance in Election Years

Historically, markets have performed positively in most election years. According to data from the S&P 500, the average return during presidential election years since 1928 is approximately 11.3%. This suggests that markets tend to rise regardless of the political outcome.

2. The Cost of Market Timing

Attempting to time the market based on political events can lead to missed opportunities. For instance, if an investor had moved to cash before the 2016 election, fearing market volatility, they would have missed the significant post-election rally that followed. Furthermore, studies have proven that market timing – for any reason – has resulted in significantly lower returns for investors had they just remained invested.

3. Corporate Profits: The True Market Engine

The primary long-term driver of market performance is corporate profits. Regardless of political changes, companies continue to innovate, grow, and generate earnings. Over the long term, it is these profits that propel stock prices higher. Political events may cause short-term volatility, but the underlying strength of businesses determines the market’s direction. These multibillion-dollar companies were founded and continue to be managed by executive leaders that are well aware of the fact that politics will change over time. They are not looking to be profitable every 4 or 8 years, they have learned how to navigate all political and economic climates to position their companies and investors for success.

Navigating Markets During Election Years: Focus on Long-Term Goals

While it’s natural to feel uncertain during election years, it’s crucial to remember that markets are driven by corporate profits, not politics. As a long-term investor, you are investing in earnings and growth, not Republicans and Democrats. Short-term reactions to political events can lead to missed opportunities and hinder your long-term investment success. By staying the course and focusing on your long-term goals, you can be confident navigating markets during election years.

Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapital.com.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The S&P 500 is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial.