With major stock market indices hovering around all-time highs, some investors continue to worry about the state of the economy. While trends around inflation and jobs have been positive, putting the Fed in a position to cut rates later this year, there are still many concerns in areas such as real estate. This is because real estate is not just another asset class but a large sector of the economy that impacts consumer net worth, inflation, financial stability and more. What do long-term investors need to know about stresses in the real estate market?

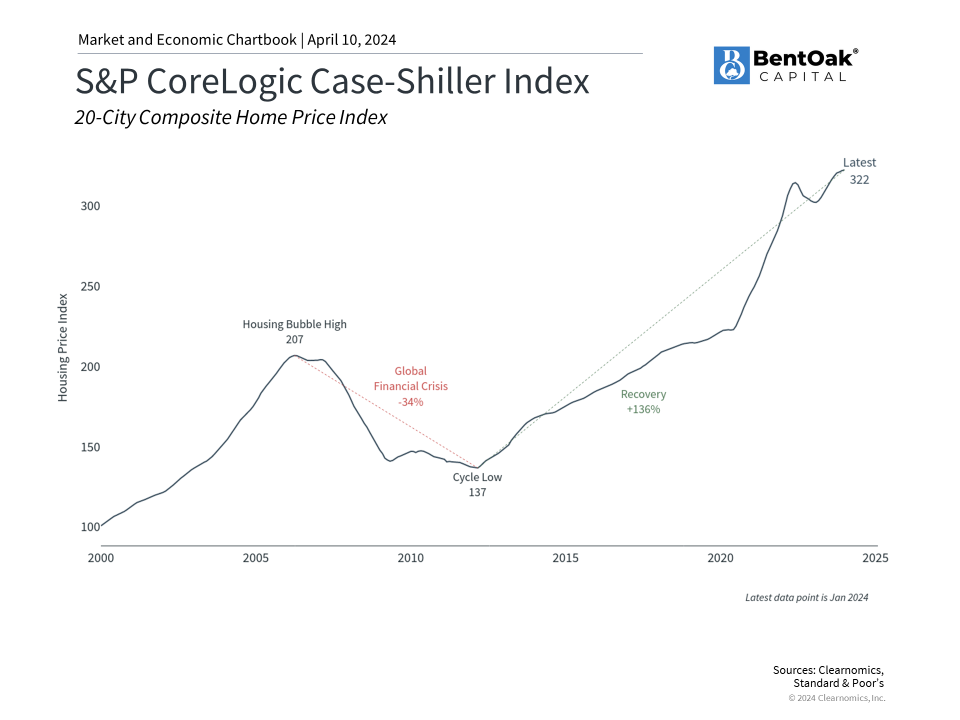

Housing Prices Are at Record Levels

Perhaps more than any other sector, real estate has borne the brunt of higher interest rates over the past few years. Recent developments in both residential and commercial real estate have only added to uncertainty in these markets. In residential real estate, the recent National Association of Realtors (NAR) settlement upends decades of established pricing for agents. Specifically, plaintiffs argued that the typical 5 or 6% commission that is split between the buyer’s and seller’s agents is anti-competitive. While the effects of the NAR settlement will take time to materialize, it potentially opens the door for new business models and more competitive fees.

At the risk of oversimplifying, economic theory suggests that in any industry, monopoly pricing restricts activity. At a more competitive price, there is likely to be more demand which in this case would be for agents’ services by real estate buyers and sellers. At the margin, this would then translate into more transactions since the overall costs would be lower. In economics parlance, the net result is that some “producer surplus” shifts to consumers, and there is less of a “deadweight loss.” In a textbook world, a more competitive market for real estate agent services is good for consumers and society since more mutually beneficial transactions occur, although the industry would also need to evolve.

This is happening at a time when home prices are back to record levels, as shown in the chart above. However, the number of transactions has remained low due to the level of interest rates and supply. Housing starts have stabilized and are beginning to creep up, and there has been a rebound in existing home sales as well. Given where prices are and the level of underlying demand, many economists hope that more flexible commissions could help to boost the housing market in the years to come.

This affects monetary policy as well. The fact that “shelter” costs make up over a third of the Consumer Price Index basket is one reason the pace of inflation improvements has slowed. While economists and the Fed have expected price pressures in rent and mortgage payments to ease, this has not yet materialized. At his most recent press conference, Fed Chair Jay Powell addressed this issue by saying “there’s a little bit of uncertainty about when [shelter price improvements] will happen but there’s real confidence that they will show up eventually over time.”

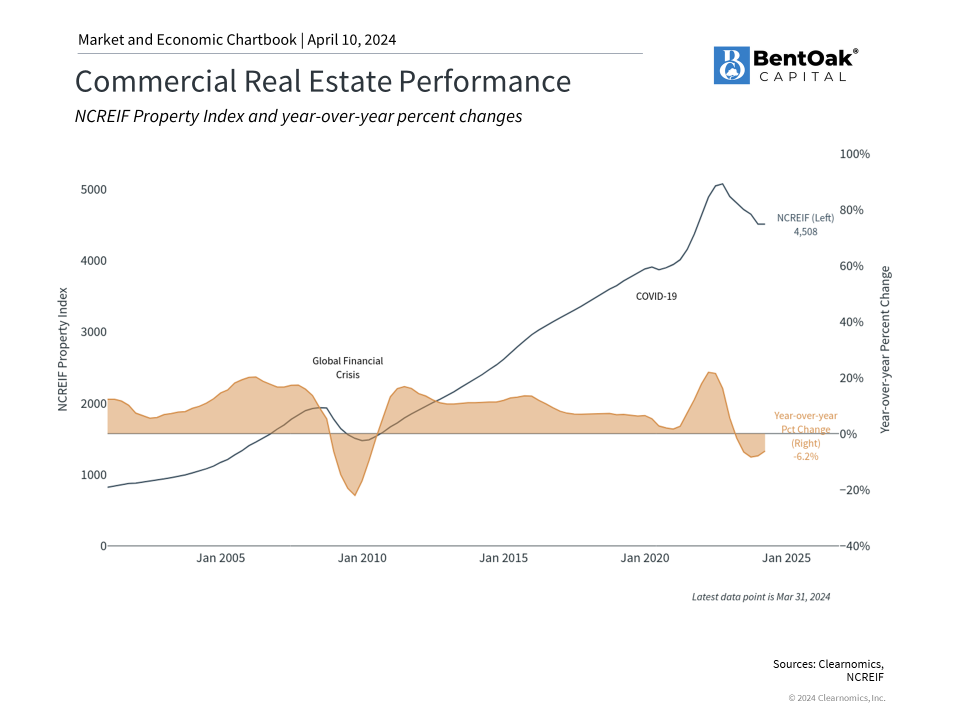

Commercial Real Estate Prices Are Beginning to Stabilize

In commercial real estate, recent events such the rescue of New York Community Bank (NYCB) by private investors have also raised market concerns. While the banking sector has stabilized since last year, commercial real estate has continued to struggle especially in the office and multifamily segments. Unfortunately, these areas constitute a significant portion of NYCB’s loan portfolio, much of which was acquired from Signature Bank. That acquisition also pushed NYCB’s assets above $100 billion which makes it subject to higher capital and liquidity requirements.

Thus, the issues facing NYCB can be characterized as a continuation of the problems that Signature Bank faced due to higher interest rates and a slowing economy, rather than a broader, new systemic issue. This means that it’s possible for these issues to be bank-specific rather than reflect problems across the entire financial system. One consequence of Fed rate hikes across history is the impact on banks, including the various savings and loan crises that occurred in the 1980s and 1990s. Ideally, these pressures begin to ease as the Fed loosens monetary policy in the coming months.

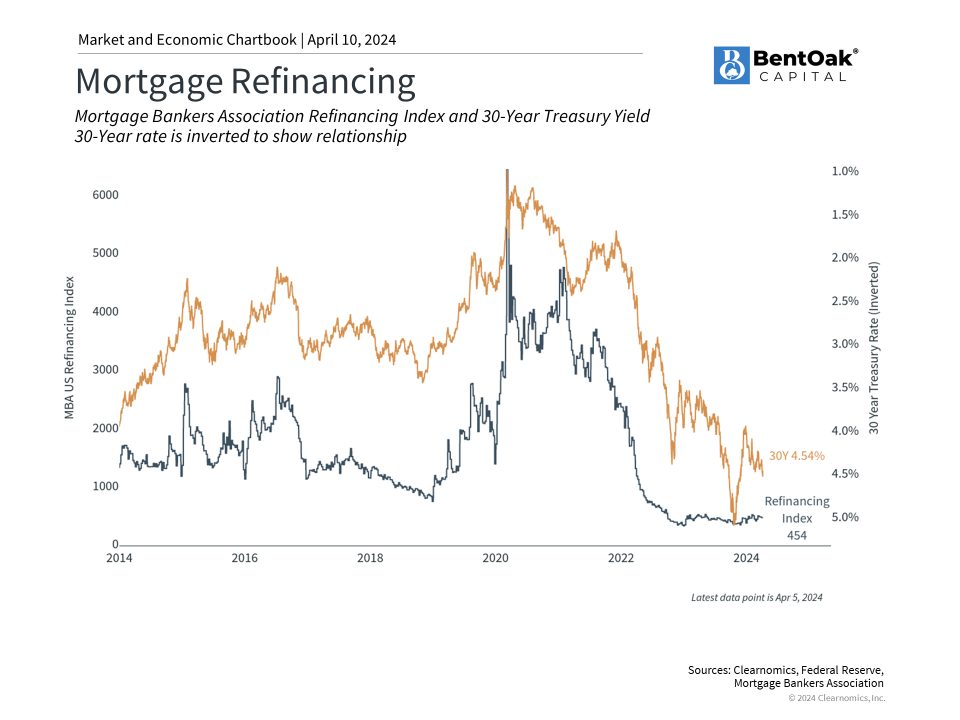

Refinancing Activity Has Stalled Due to High Interest Rates

Thus, there are many factors impacting all areas of the real estate market including high interest rates, the settlement on commissions, ongoing issues with CRE loans, and more. While interest rates are only one of these factors, transaction volumes should improve and financial pressures should ease as rates begin to moderate. Since the conditions that created this environment over the past few years could begin to change quickly, investors should continue to focus on the longer-term economic and market trends rather than on the rearview mirror.

The bottom line? While there are many issues across both residential and commercial real estate, there are positive developments as well that could boost activity, especially as the Fed begins to cut rates. Investors should continue focusing on long-term trends and staying diversified.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

IMPORTANT DISCLOSURE INFORMATION: Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request at www.bentoakcapital.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your accounts; and, (3) a description of each comparative benchmark/index is available upon request. Please Note: Limitations: Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any designation, certification, or license should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if BentOak is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation criteria/methodology, to the extent applicable). Unless expressly indicated to the contrary, BentOak did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of BentOak by any of its clients. ANY QUESTIONS: BentOak’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.