There are many opinions available as to what individuals should do if they want to invest cash they have on hand into the market. This could be from a liquidity event (sale of business, distribution from a illiquid investment, etc.), a bonus, a lump sum pension payout, or an inheritance to name a few. There is no “silver bullet” answer to this question, but if you’re ready to invest now, rather than wait for a “better” time to invest, it comes down to two options to put the funds to work

1) invest the entire “lump sum” of money now

2) dollar cost average into the market to spread your investing risk over time

The second option does have some appeal, and many people take it. The problem is, no one has a crystal ball to know when the “better time” will start. If you are working with a long-term investment plan in place, the other two choices offer a better deal.

A lump sum investment is exactly what it sounds like: taking the full amount all at once and investing it. The alternative to this is dollar cost averaging. This method takes the full amount and invests portions over time (e.g. 3 months, 6 months, 9 months). A common way many people “dollar cost average” without even thinking about it is contributing to their retirement savings via their paycheck. In this example there is a set amount or percentage of their income that is contributed from each paycheck into a previously set investment allocation.

| Pros | Cons | |

| Lump Sum | Historically this has generated slightly higher returns over the long run (see below). | An investor could regret their decision if they experience market losses very soon after investing |

| Dollar Cost Average | This can help remove the emotion of investing. It can also reduce the risk of attempting to time purchases. | Dollar cost averaging requires patience and a willingness to commit to the plan. Historically it also tends to underperform relative to going all-in at once. |

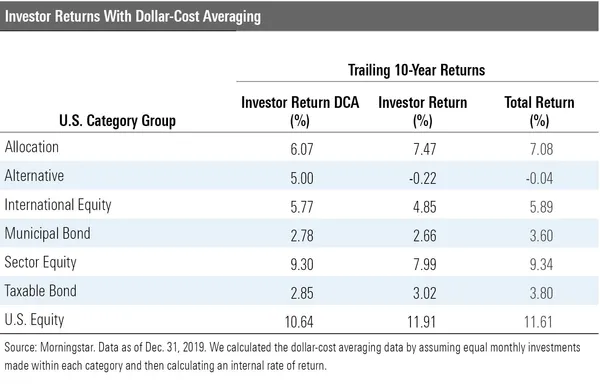

As mentioned above, lump sum investments, particularly in stocks, tend to provide a slightly higher return when compared to dollar cost averaging.

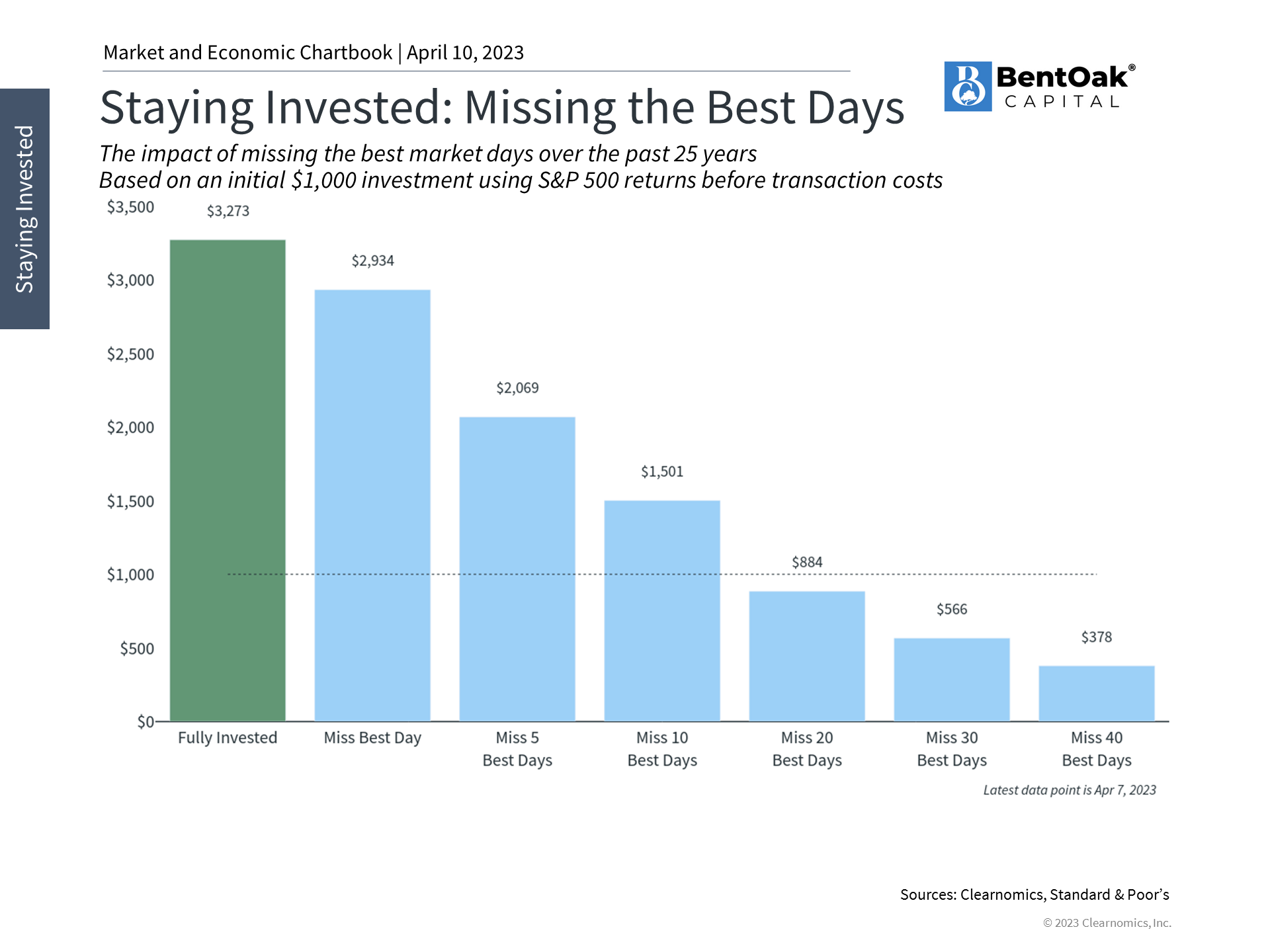

Historical data shows that the market does rise over the long run, and investors must be aware that there will be volatility along the way. That being said, the key to reaching long-term goals is making the decision and commitment to invest (whether that be dollar cost averaging or a lump sum). As you can see below, there is a significant opportunity cost in missing some of the best days in the market. Returns can be incrementally reduced as one waits on the sidelines or attempts to time the market.

Additional factors do come into play when considering which decision to make with cash that you would like to invest. As a planning first firm, we recommend having a comprehensive plan in place so that you will be better informed about what you can do if a situation similar to this presents itself. Through these conversations, we also work with clients to help them understand the pros and cons, along with their risk ability and risk willingness. One’s risk ability is determined by reviewing how market volatility is likely to affect their plan and overall portfolio. Risk willingness is the individual being open to taking a calculated level of risk with their investments. Through the planning process, our advisors work to understand the goals, needs, and objectives, and then work to identify an appropriate risk tolerance for each individual. Determining risk tolerance is crucial, as it takes into consideration both the ability and willingness to take risk.

We are here to provide the very best advice to our clients, work to remove the inherent emotion, and want them to have trust and comfort in the plan that we design and review on an ongoing basis. If you are presented with this situation, or know someone that might be, please feel free to contact us.

IMPORTANT DISCLOSURE INFORMATION: Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request at www.bentoakcapital.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your accounts; and, (3) a description of each comparative benchmark/index is available upon request. Please Note: Limitations: Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any designation, certification, or license should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if BentOak is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation criteria/methodology, to the extent applicable). Unless expressly indicated to the contrary, BentOak did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of BentOak by any of its clients. ANY QUESTIONS: BentOak’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.