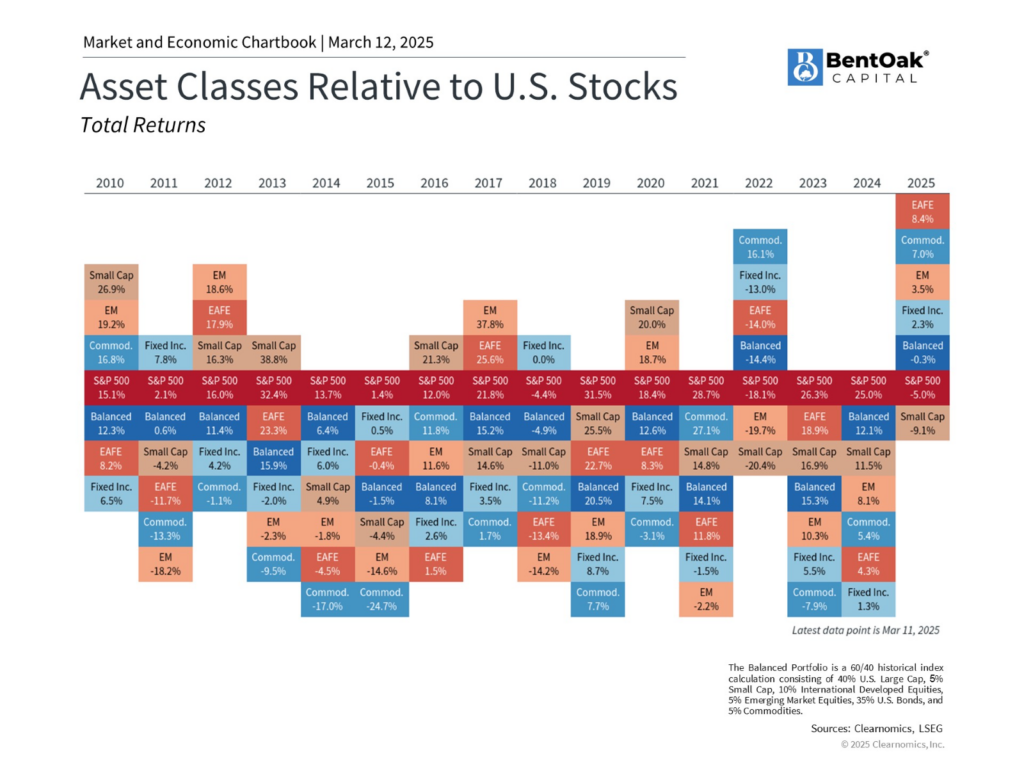

For much of the past few years, investment diversification strategies have felt broken. The S&P 500 was the undisputed leader when markets were up, and when they were down – like in 2022 – other asset classes didn’t behave as expected. Bonds, traditionally a safe haven, failed to provide meaningful downside protection, leaving investors questioning whether the standard principles of asset allocation still applied.

I wrote about this phenomenon in a 2022 blog post, “3 Reasons It Feels a Little Different This Time.” In it, I discussed why recent market cycles had felt unusual, largely due to an unprecedented combination of high inflation, aggressive rate hikes, and an overconcentration of returns in a handful of mega-cap tech stocks.

But as we navigate the most recent market pullback, something has changed. Investment diversification strategies appear to be working again.

The 2022 Breakdown: When Invesment Diversification Strategies Failed

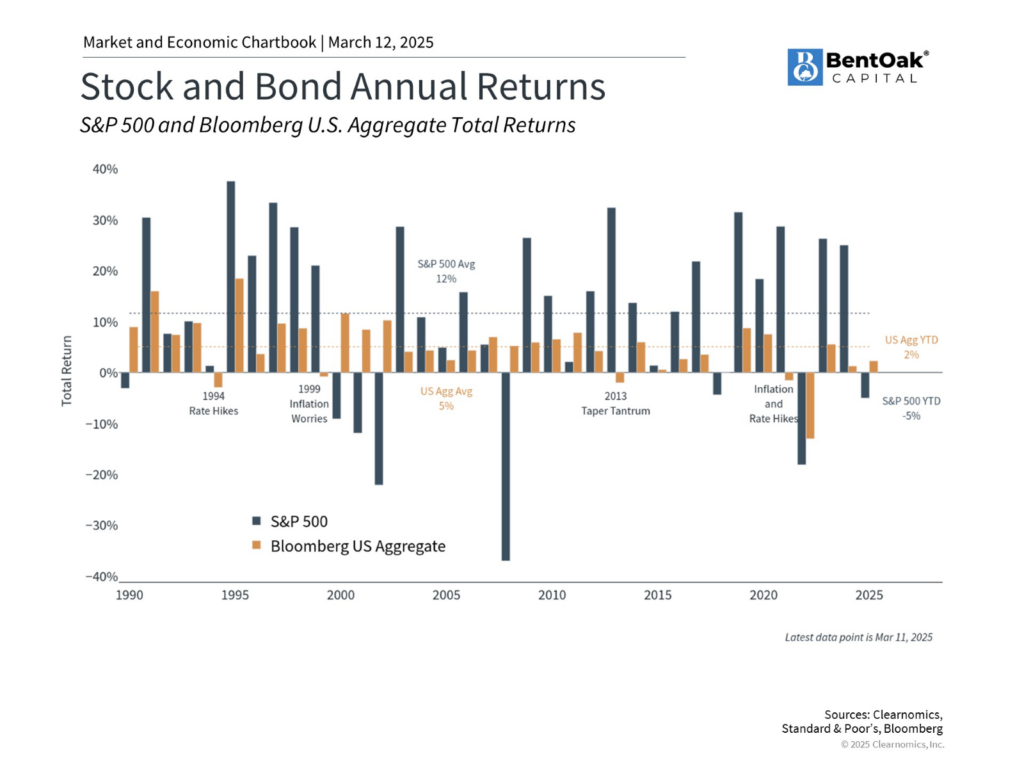

Traditionally, bonds have served as a buffer against stock market downturns, providing stability when equities falter. But in 2022, this inverse relationship broke down. According to verified data from reputable financial sources, the S&P 500 experienced a decline of approximately 18.04%, marking its most challenging year since 2008. Similarly, while the Bloomberg U.S. Aggregate Bond Index, a key benchmark for investment-grade fixed income, saw a decrease of around 13.0%. Investors holding balanced portfolios suffered across the board, as both major asset classes moved in tandem to the downside instead of offsetting each other.

This rare scenario left investors questioning the effectiveness of investment diversification strategies in mitigating risk. Even international equities, which typically provide diversification benefits, struggled amid a globally synchronized downturn. It was a year when nothing seemed to work.

The Return of Investment Diversification Strategies in 2025

Fast forward to today, and the investment landscape looks much more like what we would expect from a well-diversified portfolio. The most recent market pullback in 2025 has provided evidence that diversification is doing what it’s supposed to do.

1. The S&P 500 Has Entered Correction Territory – But Not All Asset Classes Are Down

As of early March 2025, the S&P 500 has officially touched correction territory, falling more than 10% from its recent peak. This decline has been driven by a combination of renewed trade tensions, rising geopolitical uncertainty, and shifting Federal Reserve policy expectations.

However, unlike in 2022, this time, other asset classes are doing their job. International equities have held up much better, with the MSCI EAFE Index declining far less than the S&P 500, and emerging markets showing resilience. This shift highlights why global diversification matters.

2. Fixed Income Is Acting as a True Hedge Again

One of the biggest failures of 2022 was that bonds didn’t provide protection when stocks fell. That’s no longer the case. In the 2025 pullback, the Bloomberg U.S. Aggregate Bond Index has remained stable, providing a cushion against equity losses. With the Fed shifting its stance and rates expected to stabilize, bonds are finally functioning as a counterweight to stock market volatility.

3. The 60/40 Portfolio Is Holding Up Better Than the Market

For years, critics claimed the traditional 60/40 stock-bond portfolio was dead. But more recent performance shows that this allocation is working again. Unlike in 2022, when both stocks and bonds fell together, this time around, bonds are holding up, helping to soften the blow of equity declines.

A Short-Term Trend, But a Powerful Reminder

It’s important to acknowledge that markets move in cycles, and this is just a short-term period – things can change. Investment diversification strategies won’t work perfectly in every environment, and no strategy guarantees a smooth ride. However, the most recent market pullback in 2025 has shown that a well-diversified portfolio can help manage risk and improve resilience – providing real value to investors.

- Investors who stuck with international equities are seeing relative strength.

- Those who maintained balanced portfolios with bonds are benefiting from stability and income.

- Sector concentration within the S&P 500 is broadening, rather than being driven by a handful of names.

While we can’t predict the future, what we do know is that chasing past performance and abandoning investment diversification strategies at the wrong time has historically led to poor investment outcomes. The past few months have provided a timely reminder that patience and discipline still pay off.

At BentOak Capital, we continue to believe in long-term investing principles – principles that have worked across market cycles, even when they go through periods of underperformance. If you’re feeling uncertain about how your portfolio is positioned, let’s talk.

IMPORTANT DISCLOSURE INFORMATION: Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request at www.bentoakcapital.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your accounts; and, (3) a description of each comparative benchmark/index is available upon request. Please Note: Limitations: Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any designation, certification, or license should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if BentOak is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation criteria/methodology, to the extent applicable). Unless expressly indicated to the contrary, BentOak did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of BentOak by any of its clients. ANY QUESTIONS: BentOak’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.