In recent months, the buzz surrounding NVIDIA has been palpable. The company’s remarkable growth and its pivotal role in the tech industry have captured the attention of many investors. This scenario isn’t new; we’ve seen similar frenzies around Tesla, Apple, Amazon, Facebook, and many other giants. As a Registered Investment Advisor, we occasionally encounter clients who are eager to jump on the bandwagon of the latest market sensation. However, this fear of missing out (FOMO) on chasing investment trends can often lead to misguided investment decisions.

The Pitfalls of Chasing Investment Trends

Investing based on the latest market trends or buzz can be likened to chasing shadows. It’s an unpredictable and often frustrating endeavor that can divert you from your long-term financial goals. The allure of quick gains from hot stocks is powerful, but it’s crucial to understand the risks involved.

Volatility: Stocks that are in the limelight tend to exhibit high volatility. While the potential for high returns exists, the risk of significant losses is equally substantial. For instance, a company like NVIDIA may see its stock price soar rapidly, but it can also experience sharp declines just as quickly.

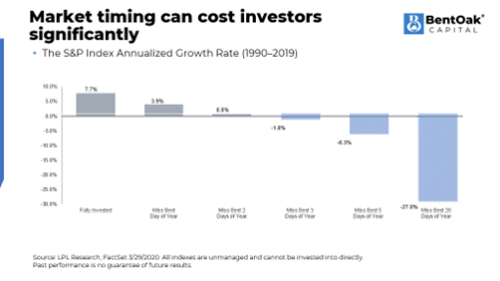

Market Timing: Successfully timing the market is a near-impossible feat, even for seasoned investors. Attempting to buy into a stock as it’s on an upswing and sell before a decline requires an uncanny level of luck, which is not a sustainable investment strategy.

Diversification Risk: Concentrating your portfolio on a few high-flying stocks increases your exposure to sector-specific risks. This lack of diversification can lead to substantial losses if those particular stocks or sectors experience downturns.

The Power of Market Cap-Weighted Indices

Instead of chasing individual stocks, consider the advantages of investing in market cap-weighted indices. These indices, such as the S&P 500, are designed to capture the performance of the market’s largest companies based on their market capitalization. Here’s why this approach is beneficial:

Built-In Rebalancing: Market cap-weighted indices automatically adjust their composition based on the performance of their constituent stocks. As a company like NVIDIA grows and its market capitalization increases, its weight in the index grows as well. This means that your exposure to rising stars increases organically, without the need for active trading.

Diversification: By investing in a broad index, you spread your risk across a wide range of companies and sectors. This diversification reduces the impact of any single stock’s poor performance on your overall portfolio.

Long-Term Growth: Historically, market cap-weighted indices have provided steady, long-term growth. By capturing the overall market’s performance, these indices have the potential to deliver consistent returns over time, outpacing the returns of many actively managed funds. Research has shown that a significant percentage of actively managed funds underperform their benchmarks over time.

Let the Market Work for You

The beauty of market cap-weighted indices lies in their simplicity and effectiveness. By allowing the market to dictate the value of individual companies, you benefit from the collective wisdom of countless investors and analysts. Here’s how this plays out in practice:

Growth Capture: When a company like NVIDIA experiences significant growth, its increasing market cap means it takes up a larger portion of the index. Your investment in the index thus becomes more heavily weighted towards successful companies without the need for active management.

Reduced Transaction Costs & Tax Expenses: Frequent buying and selling to chase the latest trends can incur transaction costs and potential capital gains taxes (depending on account type), thereby eroding your returns. Indices minimize these costs by maintaining a relatively stable composition, with changes occurring gradually over time.

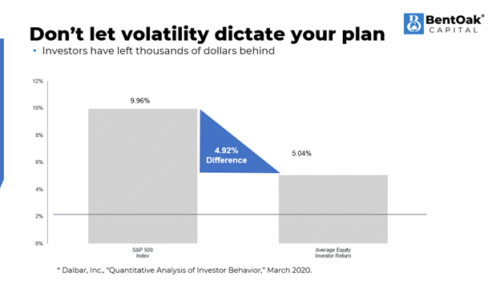

Behavioral Advantages: Investing in indices helps mitigate emotional decision-making. The urge to buy high and sell low, driven by FOMO or panic, is reduced when you commit to a passive investment strategy.

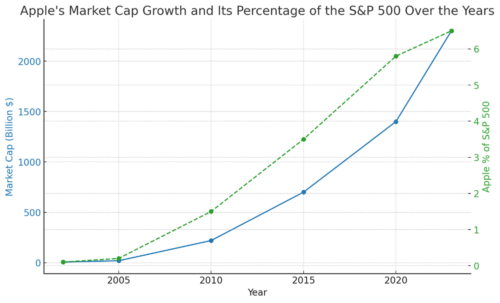

Example: Apple’s Journey in the S&P 500

Apple provides a perfect illustration of how market cap-weighted indices capture growth over time. In the early 2000s, Apple was a much smaller component of the S&P 500, as its market capitalization was relatively modest compared to other companies in the index. For instance, in 2002, Apple’s market cap was around $7 billion, making it a minor player in the index.

Sources:

Apple Market Cap Data: Yahoo Finance, Bloomberg

Apple Percentage of S&P 500: S&P Dow Jones Indices

Fast forward to today, and Apple’s market cap has soared to over $2 trillion, making it one of the largest components of the S&P 500. This dramatic increase in market cap means that Apple now holds a significantly larger weight in the index. Investors who have held positions in the S&P 500 index have benefited from Apple’s growth without needing to actively trade its stock. As Apple’s value grew, so did its representation in the index – from less than 0.5% in 2002 to over 6% today, providing a natural boost to investors’ portfolios.

Conclusion: Stick to a Proven Strategy

At BentOak Capital, our philosophy is rooted in providing personalized, long-term guidance that aligns with our clients’ financial goals. We advocate for a disciplined approach to investing, one that leverages the inherent strengths of market cap-weighted indices. By avoiding the pitfalls of chasing investment trends and embracing the benefits of indices, you may have a better chance to achieve steady, sustainable growth.

Remember, investing is a marathon, not a sprint. Resist the temptation to follow the latest hype and instead, trust in a strategy that lets the market’s natural dynamics work in your favor. Through thoughtful, well-diversified investments, you can navigate the complexities of the market and build a robust financial future.

Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapital.com.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The S&P 500 is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. Indexes are unmanaged and cannot be invested in directly.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Stock investing includes risks, including fluctuating prices and loss of principal.

No investment strategy assures a profit or protects against loss.

Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial.