How Artificial Intelligence, Tech, and Productivity Impact Portfolios

BLOGS|5 Jul 2023

Tech stocks have benefited from falling interest rates and enthusiasm for AI

The two decades since the internet bubble have witnessed numerous hype cycles over new technologies. In just the past few years, these have included the metaverse, virtual reality, blockchain technology, self-driving cars, space exploration, and many more. Each of these has been accompanied by narratives on how they will transform society. The computer scientist Roy Amara famously said that people tend to overestimate the impact of technology in the short run and underestimate the effect in the long run. Although many new technologies do eventually play an important role in business and everyday life, investors can often get ahead of themselves in the meantime.

When it comes to AI, this is partly because the term naturally ignites the imagination. However, even if the promises are vast, today's generative AI and large language models are the culmination of statistical and computer science techniques that can be accurately described with the more sober-sounding term "applied statistics," without understating their importance. Just as with any other new development, investors should strive to maintain levelheaded views on how new technologies can benefit companies and individuals.

For example, while products such as OpenAI's ChatGPT, Google's Bard, and others have only recently burst onto the scene, the methods underlying these tools have been decades in the making. The latest cutting-edge AI models, known as transformers, were described by Google researchers in 2017. Previous state-of-the-art techniques, which have names such as RNNs and LSTMs, were invented in the 1980s and 1990s. The exponential growth in computing power, especially the wide availability of graphics processing units (GPUs), and perhaps more importantly an abundance of natural language data (i.e., the internet), is what have allowed the field to leap from academic research to practical application.

From an economic perspective, the promise of any new technology is a boost to productivity. Whether it's new machines, software, or just a better way of doing things, technology is what allows us to accomplish more with less. After all, the simplest way to think about the economy is that growth occurs when there are more workers (labor), more machines (capital), or improved technology (e.g., better trained workers and/or better machines). Productivity, or the ability for the same number of workers to produce more, is what improves quality of life generation after generation.

The two decades since the internet bubble have witnessed numerous hype cycles over new technologies. In just the past few years, these have included the metaverse, virtual reality, blockchain technology, self-driving cars, space exploration, and many more. Each of these has been accompanied by narratives on how they will transform society. The computer scientist Roy Amara famously said that people tend to overestimate the impact of technology in the short run and underestimate the effect in the long run. Although many new technologies do eventually play an important role in business and everyday life, investors can often get ahead of themselves in the meantime.

When it comes to AI, this is partly because the term naturally ignites the imagination. However, even if the promises are vast, today's generative AI and large language models are the culmination of statistical and computer science techniques that can be accurately described with the more sober-sounding term "applied statistics," without understating their importance. Just as with any other new development, investors should strive to maintain levelheaded views on how new technologies can benefit companies and individuals.

For example, while products such as OpenAI's ChatGPT, Google's Bard, and others have only recently burst onto the scene, the methods underlying these tools have been decades in the making. The latest cutting-edge AI models, known as transformers, were described by Google researchers in 2017. Previous state-of-the-art techniques, which have names such as RNNs and LSTMs, were invented in the 1980s and 1990s. The exponential growth in computing power, especially the wide availability of graphics processing units (GPUs), and perhaps more importantly an abundance of natural language data (i.e., the internet), is what have allowed the field to leap from academic research to practical application.

From an economic perspective, the promise of any new technology is a boost to productivity. Whether it's new machines, software, or just a better way of doing things, technology is what allows us to accomplish more with less. After all, the simplest way to think about the economy is that growth occurs when there are more workers (labor), more machines (capital), or improved technology (e.g., better trained workers and/or better machines). Productivity, or the ability for the same number of workers to produce more, is what improves quality of life generation after generation.

Productivity is the key to sustainable economic growth

New technologies often lead to societal questions around "creative destruction," a term coined by the economist Joseph Schumpeter. This is especially true when they disrupt established methods, ideas, and businesses, creating a source of resistance as jobs are lost and existing skills become outdated. At the same time, technological progress has created countless new industries, benefiting workers with the proper skills and training, as well as the consumers of these new products and services. Whether this progress is positive or negative is a classic debate that is revived each time a seemingly transformational technology disrupts the status quo.

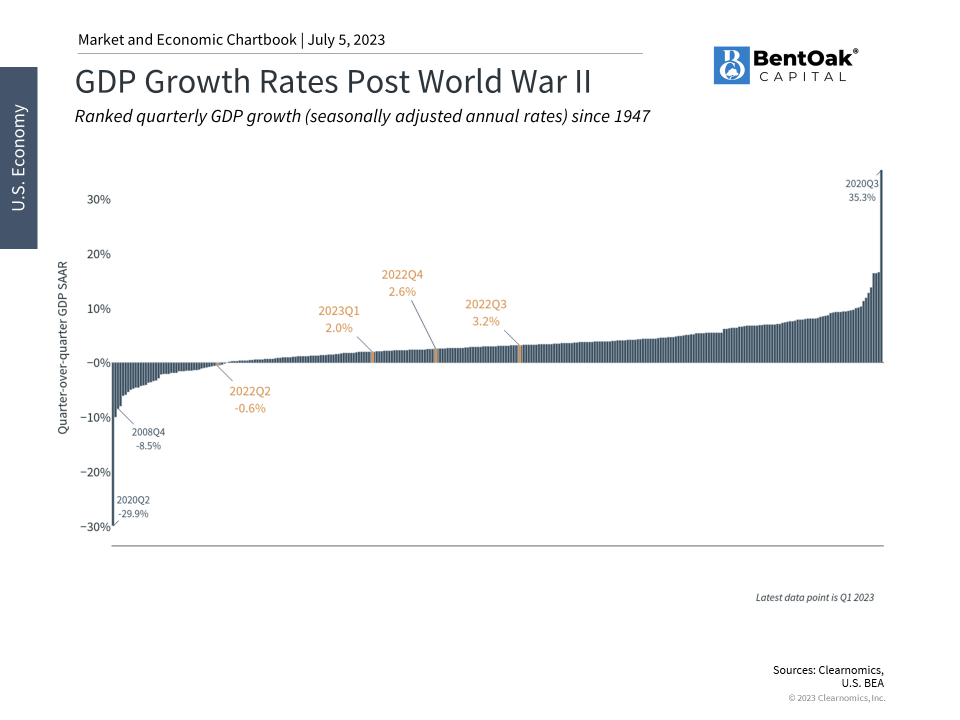

Regardless of one's views on AI and technology, it's undeniable that productivity growth has slowed in recent decades. The average year-over-year productivity growth rate since 1948 is 2.1%, but only 1.5% over the last few years. Prior to the pandemic, one of the biggest macroeconomic concerns cited by many economists was known as "secular stagnation," or the idea that the economy would grow at a tepid pace due to poor demographic trends, aging infrastructure, and slowing productivity. This isn't just a concern in the U.S. - many parts of the world, including Japan and throughout Europe, have aging populations and poor productivity.

While the differences in growth rates may seem small, they have big implications when compounded over years and decades. If the economy grows at a steady 3% annual rate, it can double in size every 23 years. In contrast, a growth rate of 2% requires 35 years while 1% growth takes nearly 70 years. Clearly, small differences in growth can have huge differences on economic outcomes. So, regardless of whether the hype around AI pans out, technologies that can boost long run productivity are important for maintaining the quality-of-life improvements that we have grown to expect over the past century.

New technologies often lead to societal questions around "creative destruction," a term coined by the economist Joseph Schumpeter. This is especially true when they disrupt established methods, ideas, and businesses, creating a source of resistance as jobs are lost and existing skills become outdated. At the same time, technological progress has created countless new industries, benefiting workers with the proper skills and training, as well as the consumers of these new products and services. Whether this progress is positive or negative is a classic debate that is revived each time a seemingly transformational technology disrupts the status quo.

Regardless of one's views on AI and technology, it's undeniable that productivity growth has slowed in recent decades. The average year-over-year productivity growth rate since 1948 is 2.1%, but only 1.5% over the last few years. Prior to the pandemic, one of the biggest macroeconomic concerns cited by many economists was known as "secular stagnation," or the idea that the economy would grow at a tepid pace due to poor demographic trends, aging infrastructure, and slowing productivity. This isn't just a concern in the U.S. - many parts of the world, including Japan and throughout Europe, have aging populations and poor productivity.

While the differences in growth rates may seem small, they have big implications when compounded over years and decades. If the economy grows at a steady 3% annual rate, it can double in size every 23 years. In contrast, a growth rate of 2% requires 35 years while 1% growth takes nearly 70 years. Clearly, small differences in growth can have huge differences on economic outcomes. So, regardless of whether the hype around AI pans out, technologies that can boost long run productivity are important for maintaining the quality-of-life improvements that we have grown to expect over the past century.

Market returns have been concentrated in tech-related sectors this year

From a market perspective, enthusiasm for AI has boosted tech-related sectors and benefited diversified investors. While the S&P 500 has gained 12% this year, the information technology and communication services sectors have climbed 35% and 33%, respectively. Macroeconomic factors such as a possible Fed pause, improving inflation, and steady economic growth have boosted these sectors as well. These returns have more than offset the poor performances of sectors such as energy and financials, and have overshadowed problems in the banking and commercial real estate industries.

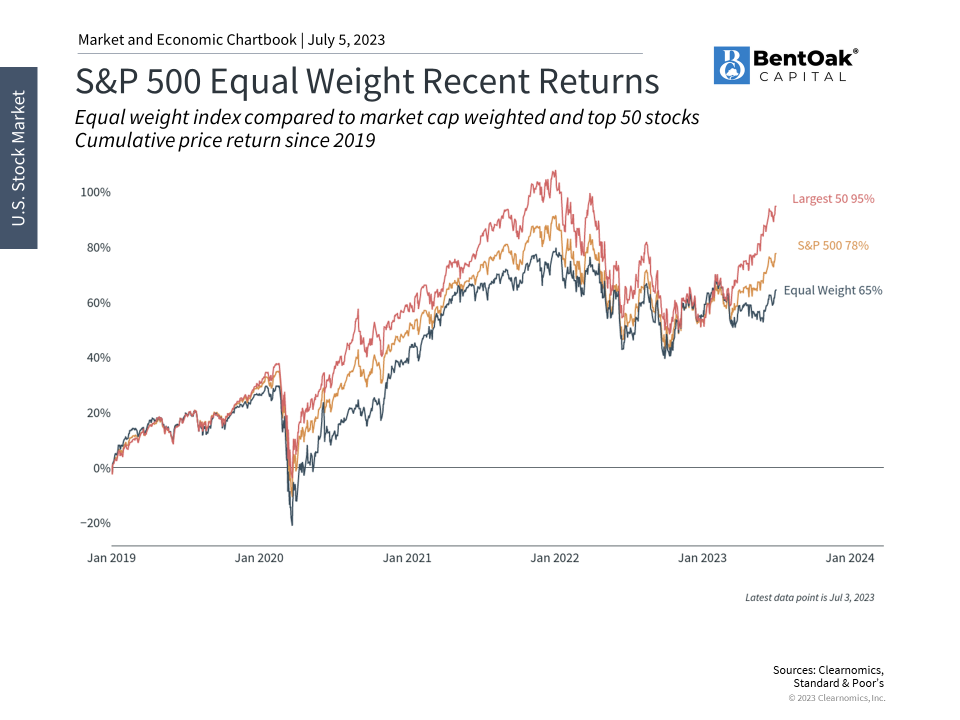

One concern with this dynamic is that a small number of stocks have generated most of the returns this year. This is often referred to as narrow market leadership or limited market breadth. Indeed, the largest 50 stocks in the S&P 500 have generated an outsized proportion of the returns this year, far outpacing a broader equal-weighted index. Unfortunately, this has been the trend over the past decade as mega caps have played an ever-growing role in market performance. This is due to economies of scale related to large technology companies which have pushed many market caps to the trillion-dollar level and beyond.

While there is a debate around whether this is good or bad for markets, the reality is that this is not something investors can control. What they can control is whether they are diversified across all of these sectors. Those that have appropriate portfolio exposures have benefited from these trends, just as they benefited from strong energy returns last year, while also staying prudent as valuations rise to higher and higher levels. These dynamics are further evidence that it is difficult to predict what will outperform in any given year, and thus it remains important to be properly diversified.

The bottom line? Investors should maintain a level head around new technologies such as artificial intelligence. Greater productivity growth and strong sector returns are a reason for investors to stay diversified and focused on the long run.

From a market perspective, enthusiasm for AI has boosted tech-related sectors and benefited diversified investors. While the S&P 500 has gained 12% this year, the information technology and communication services sectors have climbed 35% and 33%, respectively. Macroeconomic factors such as a possible Fed pause, improving inflation, and steady economic growth have boosted these sectors as well. These returns have more than offset the poor performances of sectors such as energy and financials, and have overshadowed problems in the banking and commercial real estate industries.

One concern with this dynamic is that a small number of stocks have generated most of the returns this year. This is often referred to as narrow market leadership or limited market breadth. Indeed, the largest 50 stocks in the S&P 500 have generated an outsized proportion of the returns this year, far outpacing a broader equal-weighted index. Unfortunately, this has been the trend over the past decade as mega caps have played an ever-growing role in market performance. This is due to economies of scale related to large technology companies which have pushed many market caps to the trillion-dollar level and beyond.

While there is a debate around whether this is good or bad for markets, the reality is that this is not something investors can control. What they can control is whether they are diversified across all of these sectors. Those that have appropriate portfolio exposures have benefited from these trends, just as they benefited from strong energy returns last year, while also staying prudent as valuations rise to higher and higher levels. These dynamics are further evidence that it is difficult to predict what will outperform in any given year, and thus it remains important to be properly diversified.

The bottom line? Investors should maintain a level head around new technologies such as artificial intelligence. Greater productivity growth and strong sector returns are a reason for investors to stay diversified and focused on the long run.

IMPORTANT DISCLOSURE INFORMATION Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapstg.wpengine.com. Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial. Copyright (c) 2023 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapital.com. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial.