After what we have seen so far this year, the last week of July was one of the busiest as it relates to releases and reporting on a daily basis. We are in the middle of Q2 earnings season, and contrary to what many expected, overall earnings reports have been encouraging (more on this later). After continued high inflation readings over the past year, watching the recent Fed announcement was important to see if the committee would stay the course of raising interest rates at 0.75%, or deviate with a higher rate increase. Much of what has driven these decisions is in fact inflation, which continues to hold at a stubbornly high rate. Lastly, Q2 Gross Domestic Product data was also released. There were mixed thoughts with many economists expecting a positive GDP figure, while other indicators were showing another negative quarter of growth. When the report came in, the economists were not on the winning side, and we saw our second negative GDP figure for 2022.

The market had a very strong week to end July, with a considerable number of companies reporting earnings. As of the end of last week, approximately 60% of the S&P companies have reported results, and despite an environment filled with headwinds, the results reported a 6% increase from a year ago. These strong earnings have resulted in about 72% of companies beating their earnings targets. There are still a number of companies to report from this past quarter, but overall markets experienced a much needed reprieve from the first 6 months of the year.

Many of you have probably watched the news or read an article regarding the GDP initial results for Q2. The recent Q2 GDP reading came in at -0.9%, which followed the contraction in GDP from Q1. One rule of thumb that many have been taught or read about is that two consecutive quarters of negative GDP are a recession. With inflation at 40 year highs along with the market volatility we have seen so far this year, it might very well feel like we are in a recession. As discussed in recent webinars, consumer sentiment is at very low levels. Because most Americans are feeling pressure from inflation, have geopolitical concerns, and are experiencing the volatility of the market and rising rates, we could very well be entering a “sentiment driven recession.”

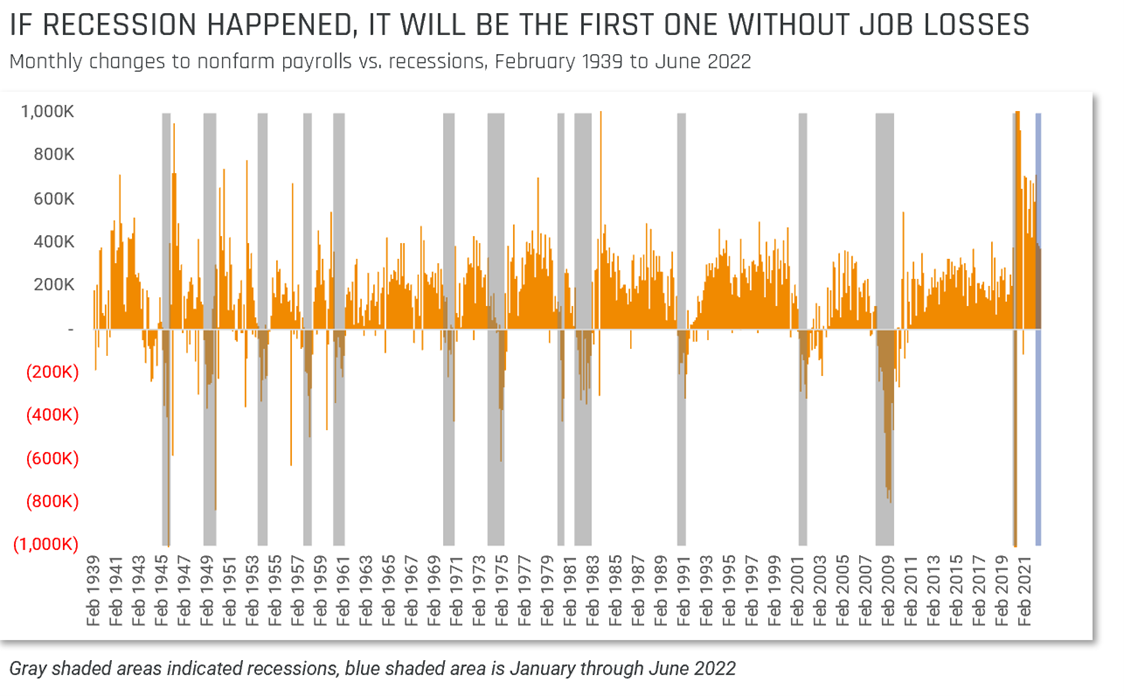

While there has been an overwhelming amount of negative news (let’s be honest, the news is usually negative), there are still some positive data points that leave many wondering what to think. Unemployment figures are still holding up at a relatively low rate with many job openings still available. Some larger companies are beginning to announce cutbacks, but overall jobs data is still strong.

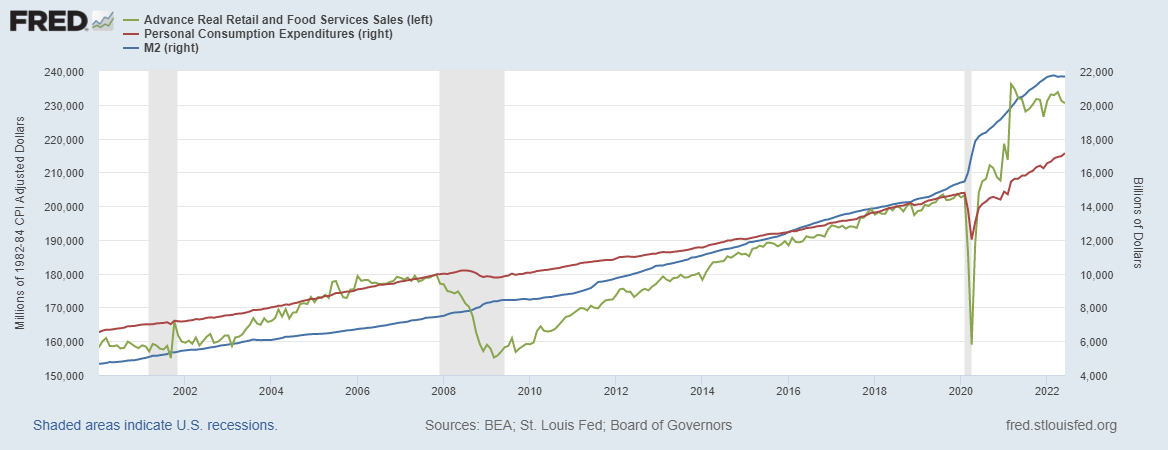

As you can see in the chart, this would be the first recession in over 80 years where there have not been significant job losses. Consumers are also still out spending, as reflected by the Personal Consumption Expenditures and Advance Real Retail and Food Service Sales in the second chart below. Another important aspect of the health of the American economy is the amount of the money supply in circulation, or M2 (reflected in the blue line of the second chart). This includes cash, cash equivalents, savings, or anything else that is easily convertible for spending. While this did balloon to higher levels with the stimulus received in the past 2 years, the money supply is still healthy with an almost record amount of cash in the banking system. This will likely trend downward as we progress forward with higher inflation, but it is still very strong.

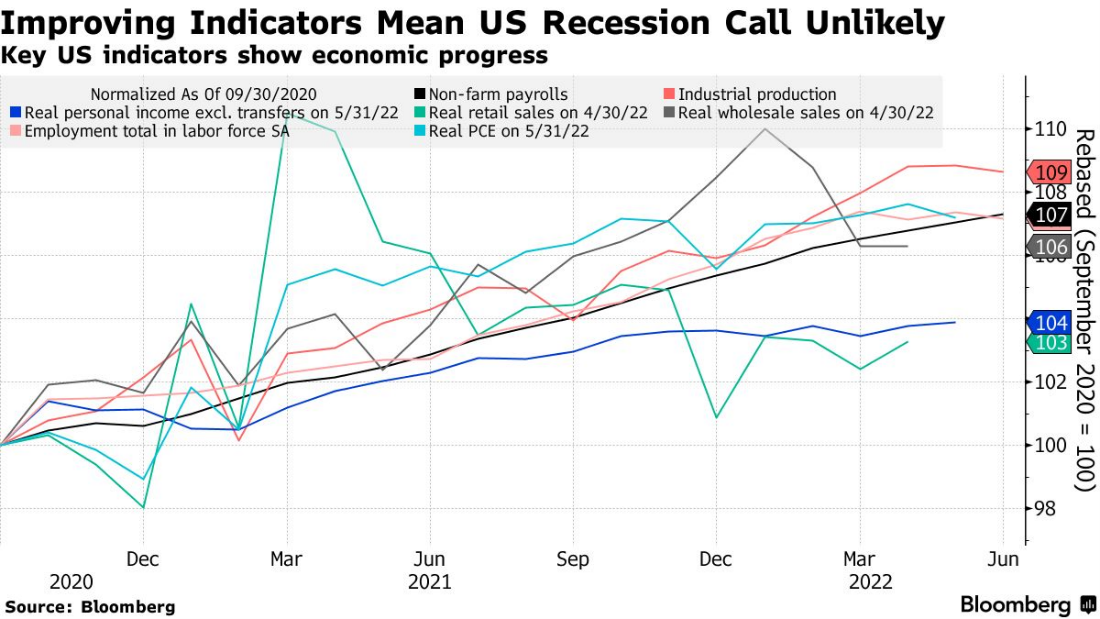

We bring up these still positive readings because a group of economists with the National Bureau of Economic Research (NBER) are the ones to officially make the call on whether or not we are in an official recession. The definition of a recession by the NBER is a “significant decline in economic activity spread across the economy, lasting more than a few months”. The NBER looks at more than just GDP to deem the economy in a recession, and factors in the various indicators reflected in the chart below as well.

As you can see from the various indicators, many are still trending in the right direction. Given the timing of the data coming in, future revisions to the up or downside, and uncertainty for what might be ahead, it is unlikely that the NBER will announce that we entered a recession in the first half of this year. This is not to discount the pressure that many Americans are feeling at this time, but to cut to the facts of what many in the news and media are discussing – are we in a recession or not? We believe investors shouldn’t stew too much on the traditionally accepted definition of a recession versus the official declaration of a recession. At the end of the day, we are coming off an overheated period of growth in 2021 impacted by stimulus and post-pandemic pent up demand. With those two economic contributors largely in the rear-view mirror as the Federal Reserve tightens monetary policy, it is not unexpected that the economy would soften.

One important concept to understand during this type of economic and market environment is that the two are separate from one another. Of course, the markets and economy tend to trend in the same general direction, but not always – and certainly not at the same pace. Economic data and indicators are mostly lagging or coincident indicators – meaning they are created from past or real-time data. The financial markets on the other hand are forward-looking, as investors price assets based on the future expectation of growth. The stock market tends to bottom months before the economy does as investors begin to look forward to better times ahead. We are by no means calling a bottom since we do not have a crystal ball, but we want to reiterate that the current news on the economy will not always perfectly align with action in the stock market. As we saw at the end of July, investors are very keyed in on earnings. You may have noticed in past blogs and webinars that the long-term impact of earnings is something we talk about often, and we feel like this is what all long-term investors should be focused on rather than short-term news: the long-term profitability of companies.

Early last month we wrote a blog post titled “3 Things to Remember During a Stock Market Correction.” While this piece was geared more to the markets (all of which are true today), the three main points can also be applied to the economy. Many pundits, “experts,” and friends/family, will all have opinions that will come at you from every direction. The best advice we can provide is to not have a reaction to all of the noise that is coming from every angle.

Regardless of the market or economic environment, we are here to meet with you, answer your questions, and either make adjustments to (or create) a comprehensive plan for the future. If you have a friend, family member or colleague that you feel would benefit from a conversation with us, please have them contact us or provide our information to them. Remember to be on the lookout for future posts, webinars, and videos as we continue forward through the year.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.