As the S&P 500 kisses bear market territory (down 20%), you can expect no shortage of bold predictions, “told ya so” declarations and doomsday outlooks. The secret to managing through a bear market is to focus on the long-term and control your emotions, and we have found that one of the best ways to do that is to not let counterproductive and speculative information take up space in your head. Below are three things to consider during a selloff.

1. Pundits and talking heads have a historically bad track record

It’s 2022 so surely we aren’t all just waking up to the fact that the news media doesn’t always have our best interest at heart. Long gone are the days of straightforward, no spin news media, which has mostly been replaced by opinions and “hot takes.” As a layman investor, financial fact or spin might be even more difficult to sort out when you have little firsthand experience with the subject matter. With typical news stories, you likely process the information and then agree or disagree based on your own experiences and beliefs. But unfortunately, when it comes to the economy and stock market, for many people it’s tempting to just trust “the experts” on the television since these are topics you may know little about.

There are two very important things you should understand about the financial news media:

- They exist to make a profit. Networks need viewers to generate revenue, and they are very aware of the fact that saying something like “there’s a lot of short-term volatility, but long-term investors should not be concerned” will not drive viewership. They need you glued to the television set, and the best way to get you there is to scare the daylights out of you. Do not fall prey to their game.

- The information is extremely shortsighted. When you tune in to the financial news, you are getting a front-row seat to second by second, minute by minute market action and commentary. This 100% contradicts sound long-term investment behavior. We have never met anyone with a 30-second, 1-day, or 6-week time horizon, so most of this information is just noise.

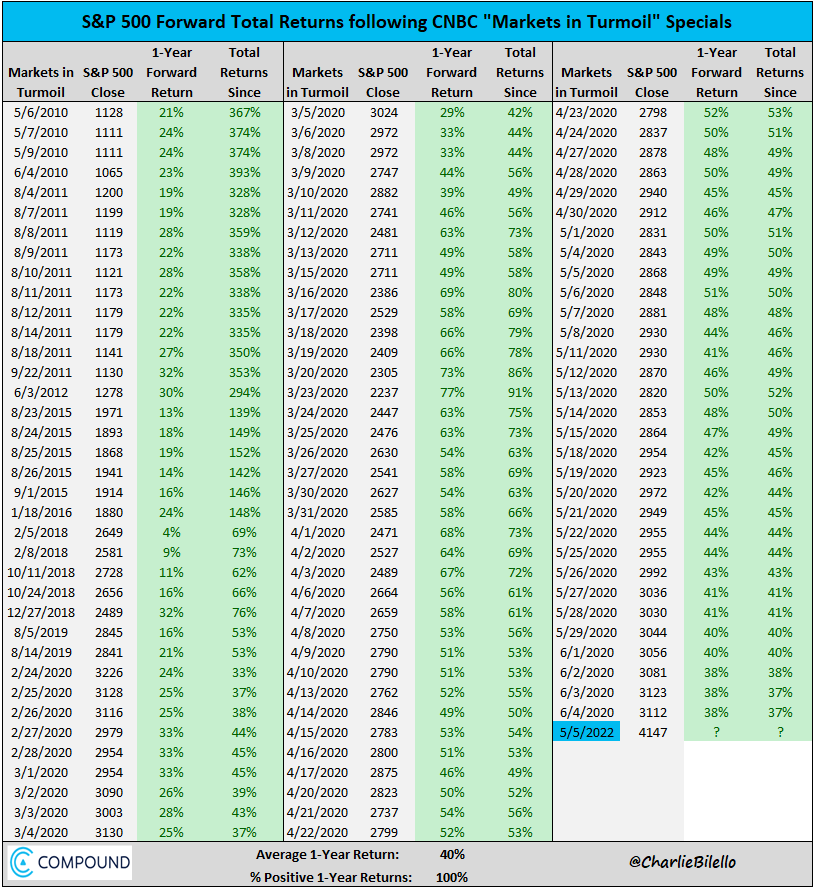

There’s probably no better historic example of market shortsightedness and ill-timed doom and gloom news stories than CNBC’s “Markets in Turmoil” special that runs when markets have big down days. Credit to Charlie Bilello, CEO of Compound Capital, for compiling this data.

What this chart is showing is that every single time over the last decade-plus that CNBC paraded doomsday market commentators onto their set to talk about just how bad it is and predict just how worse it will get during this special, the market was up 100% of the time after 12 months. Does that mean it will be the case again? No one knows what the future holds, but the moral of the story is that neither does the financial media.

2. The so-called “experts” have as cloudy a crystal ball as you do

So if the experts on the news don’t always get it right, what about economists and market strategists? These folks are highly educated and esteemed, after all. There’s no doubt that many economists and financial experts take a calculated and academically rigorous approach to their outlooks and forecasts. But therein lies the problem – that is all they are: forecasts. Just as you do not know what the future holds, neither do economists.

In our office, we often joke that “economists exist to make weathermen look good.” That might be a little harsh, but what makes things even more difficult for an economist versus a meteorologist is human behavior. Barometric pressure is easier to measure than how consumers, investors, and central banks will behave. Think of all the times you’ve dressed for warm weather but those elusive Texas seasons met you with a chilly, windy day and vice-versa. The same can be said for economic forecasts – they often don’t come to fruition.

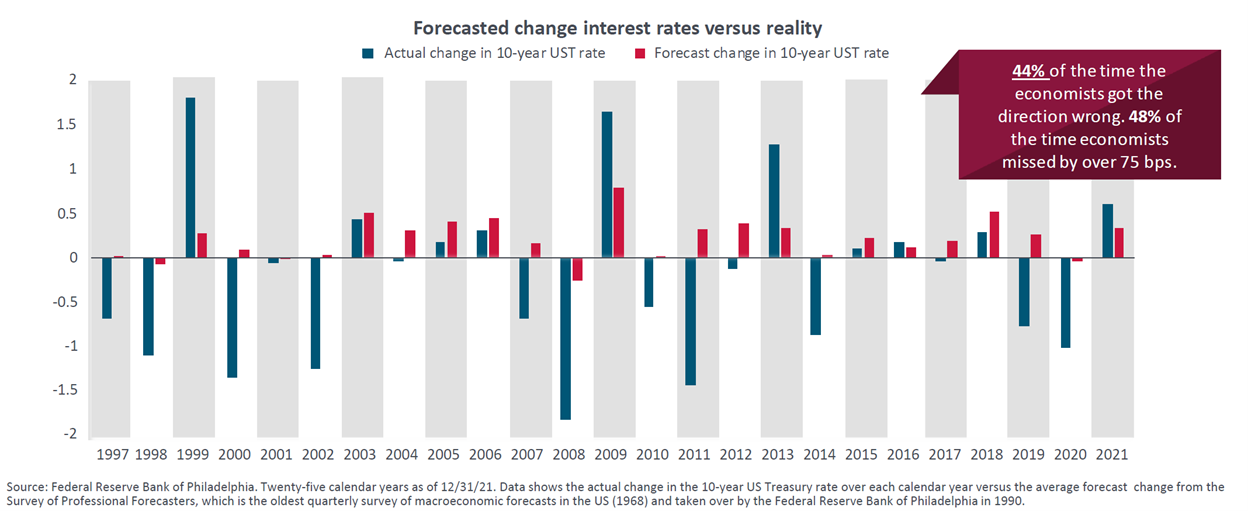

Lately, there has been a lot of talk about interest rates since inflation is at the forefront of investors’ minds. So, what can we learn from economists on this topic? The short version is: flip a coin, and you may have similar odds of being right.

The blue bars in this chart represent the actual change in interest rates in any given year versus what economists predicted in red. Approximately 44% of the time they got the direction wrong – meaning they weren’t even accurate on rates moving up or down – and half the time they missed by over 0.75%.

The Federal Reserve has been fairly transparent about where rates are headed given current conditions, which is likely why both stock and bond markets have reacted so strongly. The stock market is known as a leading indicator and has historically worked as a forward pricing mechanism. Much of what economists are forecasting now has likely already been digested and the odds are actively being priced in by markets. Of course, we can get surprises – both up and down, but don’t let forecasts scare you. Professional forecasters are not clairvoyant when it comes to the markets and economy. Their information might prove helpful in certain long-term applications, but again these are typically short-term forecasts: i.e. where rates could be in 6 months, where the S&P 500 might close the year, etc. Your investment time frame is longer than that, which leads us to our next point about market timing.

3. Your brother-in-law doesn’t hold the secret to timing the market

Investing legend and Vanguard founder John Bogle said of timing the market, “After 50 years in this business, I do not know of anybody who has done it successfully and consistently. I don’t even know of anybody who knows anybody who has done it successfully and consistently.”

So while every well-meaning professional in our industry has accepted the fact that market timing is virtually impossible to implement successfully, that doesn’t mean that people won’t claim they do it effectively. Sure, there are probably some folks that “got out” earlier this year. The problem is, they won’t tell you about the other 75 times they got out of the market and had to buy back in higher and how much their long-term returns lag because of it. It’s a lot like that person you know that goes to the casino often and only tells you about their winnings – we all know there is more to the story.

If you encounter this person in your life, it might not actually be your brother-in-law (although anecdotally they seem to be the most common culprit). It could be the person you chat with at the water cooler, or the nice lady from church, or your dentist. And right now it might even be the opportunist on the radio talking up their silver bullet investment strategy. It might be tempting to think market timing is a strategy you should pursue, but we assure you, it is not.

The only feeling worse than being invested as the market corrects (falls) is selling out after it has corrected and then sitting in cash as you watch it rebound. That short-term feeling of relief is often soon overshadowed by anxiety of getting back in. Locking in losses with the belief that you can get back in later when “things are better” is a trick your mind is playing on you. When things feel better and more stable, the market will undoubtedly be higher because the train doesn’t stop at your doorstep to let you back on, it just keeps on rolling!

That does not mean you shouldn’t rebalance and tweak your portfolio as conditions and long-term outlooks evolve. At BentOak Capital, we are advocates of managing risk through a quantitative, rules-based process and we do that for our clients. But we also believe that the core portfolio should be diversified, strategic, and long-term. Repositioning and rebalancing should be done while looking out 12+ months, not to capture or avoid short-term market movements.

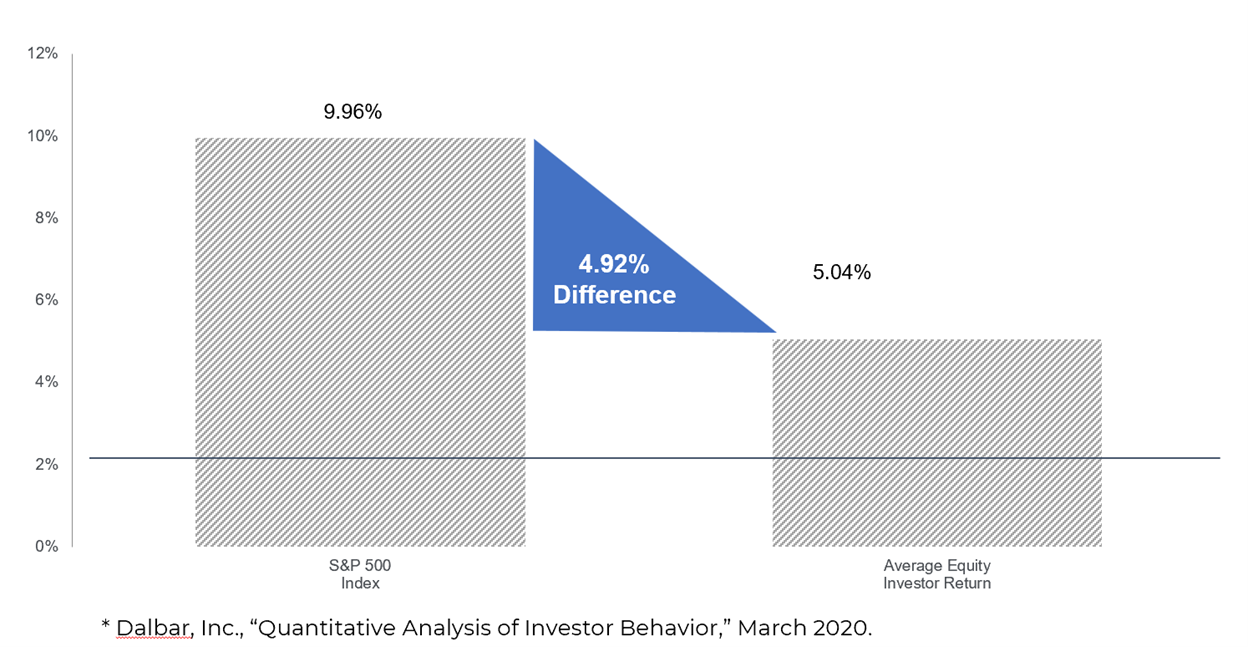

Below is a study from Dalbar that we have shared before on our webinars. This is a quick look at what market timing can do to your long-term returns. For the average investor that was actively buying and selling mutual funds over the last few decades, it effectively cut their returns in half. This doesn’t account for fees and taxes either.

While you could get lucky and time the market successfully for a short period, the next decision to make is when to get back in. The downside effects of market timing can be devastating – creating permanent losses.

Warren Buffett is often misrepresented about market fluctuations due to his quote about investment losses: “The first rule of an investment is don’t lose [money]. And the second rule of an investment is don’t forget the first rule.” What people don’t consider is what that actually means. Losing money means selling at a loss. He doesn’t mean to not allow your investments to fluctuate during volatility, he is encouraging investors to not sell low. Spoiler alert: Buffett is buying stocks at these levels – not selling. Let’s all assume we will not outsmart the Oracle of Omaha.

Stock Market Correction Conclusions

Short of a time-traveling machine, there is no amount of information that will answer the question of “what happens over the next days, weeks, or months?” For this reason alone, we encourage you to resist the allure of talking heads with sensationalized headlines, so-called experts with cracked crystal balls, and mythical market timing theories that simply do not exist. Now is not the time for bold moves and predictions as the biggest investment mistakes historically happen during market volatility.

So what should you do now? For most people, the answer might be very little. Being diversified, having a sound financial plan, and maintaining adequate cash & equivalents for near-term spending needs is likely the best way to navigate the current environment. For our clients, we are happy to revisit your financial plan, objectives, and risk tolerance. For prospective clients, if you are unclear about your investment strategy and are lacking a financial plan, we encourage you to give us a call!

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

DALBAR’S year Quantitative Analysis of Investor Behavior (QAIB) study examines real, investor returns from equity, fixed income, and money markets mutual funds. The study was originally conducted by DALBAR, Inc. in 1994 and was the first to investigate how mutual fund investors’ behavior affects the returns they actually earn.