“Everything you want is on the other side of fear” – Jack Canfield

When it comes to financial markets, there’s no shortage of things to be afraid of – geopolitical tensions, economic health, world events, inflation, the U.S. dollar, recessions, etc.

You may have immediately thought of today’s investment environment when you read that short list of worrying issues. Or, you may have thought of the early 2000s, or the 1990s, or 80s, or 70s, or even the 60s! Whatever images your anecdotal evidence of market turmoil conjures, those images are likely seared into your memory like a hot branding iron. Painful financial memories that are now behind you but not forgotten. The funny thing about scary, uncertain times is whenever we come out on the other side, there’s often a sense of pride that we made it through – an accomplishment of sorts. That doesn’t mean we eagerly go looking for the next overwhelmingly difficult experience, but whatever trials we just conquered become part of our unique story.

I believe we are in the midst of one of those stories right now – one of life’s many trials, and you will come out on the other side triumphant if you avoid common mistakes that investors make.

For the past 15 months, markets have been fairly range-bound (meaning the S&P 500 has traded up and down in a choppy, sidewise pattern). The market is currently closer to the high end of that range now though it is still trading below all-time highs. We are not currently in a free fall, but periods like this can still cause investors angst and consequently increase the likelihood to overthink things.

Here are 3 investment pitfalls to avoid when you are feeling fearful in uncertain, range-bound markets.

1) “I’m Waiting for Markets to Improve”

As financial advisors, this is one of the most common statements we hear when markets are volatile, and it is quite possibly the most ironic investing statement one could make. When someone says this, they are literally saying “I want to buy higher.” I probably do not need to explain why this is a bad idea since the adage “buy low, sell high” is universally known.

Good investing means buying stocks and/or staying invested in stocks with resolve during bouts of volatility. If we only invested when things felt “good,” we would only buy stocks at the top of the market. When things feel better, the market has likely already rebounded.

This notion that an investor should wait until things are better typically happens when folks have extra cash to invest, panic sell out of the market, or are trying to outsmart their retirement plan contribution timing. If you are struggling with this, here’s a blog post on using dollar cost averaging to overcome investment fears and short-term buyer’s remorse.

2) “I Just Need ‘X’ to Happen”

It’s easy to get anchored on certain variables, and often these variables are irrelevant to the bigger picture. Here’s how this might manifest during uncertain times:

“We just need to get through this election, then I’ll invest this cash”

“Once interest rates come down, I will make a decision”

“I’ll increase my contributions after we get a feel for earnings season”

You get the picture. Statements that when said seem intelligible and prudent on the surface, but in reality have little impact on your own personal finances and goals. Or, at the very least, even if these things do affect you in some way, they are entirely out of your control.

This type of thinking is a form of deflection – rather than facing our investing fears head on, we project them into another issue that may be trivial to the overall picture.

3) “It’s Different This Time”

It really isn’t. We’re all probably just a little different ourselves. A different stage of life, evolving worldviews, and a myriad of other changes of perspective can cause us to believe we are always in uncharted territory. Of course, history doesn’t repeat itself, but it often does rhyme.

Here are a handful of major events that took place each decade over the past 60 years that probably worried the majority of folks at the time.

1960’s

• Bay of Pigs & Cuban Missile Crisis

• Assassination of Pres. John F. Kennedy

• Assassination of Martin Luther King, Jr.

• Civil Rights Movement

• Vietnam War

1970’s

• Kent State Shootings

• The Watergate Scandal

• OPEC Oil Embargo

• Jonestown Massacre

• Hyperinflation

1980’s

• Assassination attempt of Ronald Reagan

• Chernobyl Nuclear Accident

• Savings & Loan Crisis

• Exxon Valdez

• Black Monday

1990’s

• Persian Gulf War

• USSR break-up

• European Union formed

• Oklahoma City bombing

• Clinton impeached

2000’s

• 9/11 Terrorist Attacks

• Dotcom bear market

• Global War on Terror

• Hurricane Katrina

• The Great Recession

2010’s

• Occupy Wall Street

• Debt Ceiling – Treasury downgrade

• Boston Marathon bombing

• Death of Bin Laden and Saddam Hussein

• BREXIT

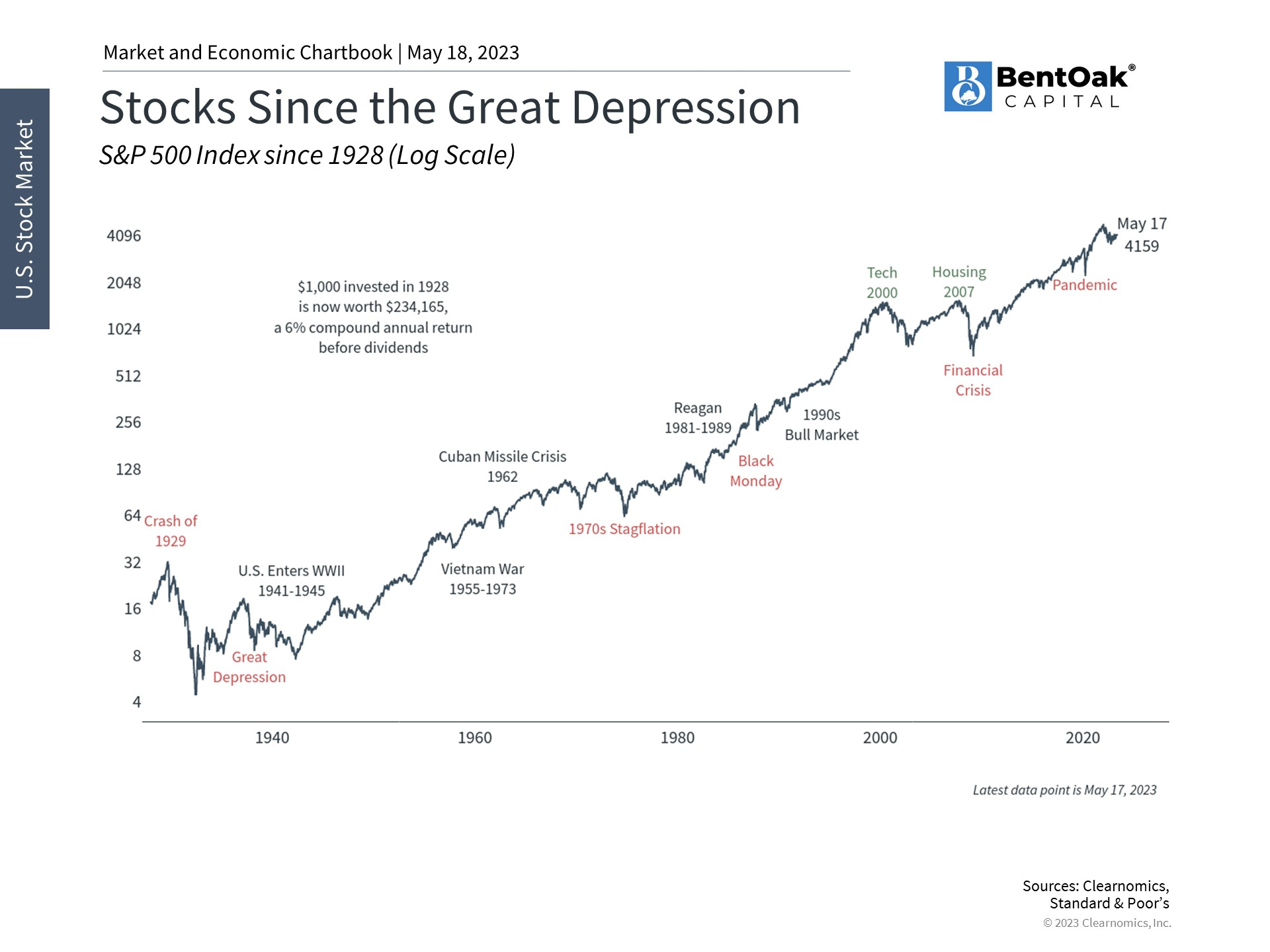

Each of these major world events, geopolitical issues, recessions, natural disasters, etc. all had something in common: they eventually ended, the world carried on, and the markets made new highs.

(Check out this blog post for reasons why things may feel different in this current environment).

Closing: Be Not Afraid

Markets have historically increased over time – often seemingly despite the crazy world around us. At the end of the day, stock markets have gone up over the long-term because of one thing: corporate profits. Stocks represent capitalism in one of its purest forms; owning a piece of a company and profiting from its cash flow over time. No amount of fearmongering from the television should rob you of the opportunity to participate in American corporations’ collective ability to make money over the long-term (more on that here).

When you find yourself wondering if you should do something different in this current market environment, just remind yourself of the old Persian proverb:

This too, shall pass.

When things are bad, remember: it won’t always be this way. Take one day at a time.

When things are good, remember: it won’t always be this way. Enjoy every great moment.

There’s something that can be learned from the last year and a half of lackluster markets. Hopefully investors are reminded to temper their expectations when things are great. And when times are tough, remember that a cool head prevails. Good things await us on the other side.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.