Retirement planning can be a complex and often daunting task, with numerous strategies and options to consider. One powerful tool that often goes underutilized is the Roth conversion. This financial maneuver allows you to optimize your retirement savings, reduce your tax burden, and gain financial flexibility. In this blog post, we will explore the concept of Roth conversions and the significant advantages of leveraging them before reaching the required minimum distribution (RMD) age.

What is a Roth Conversion?

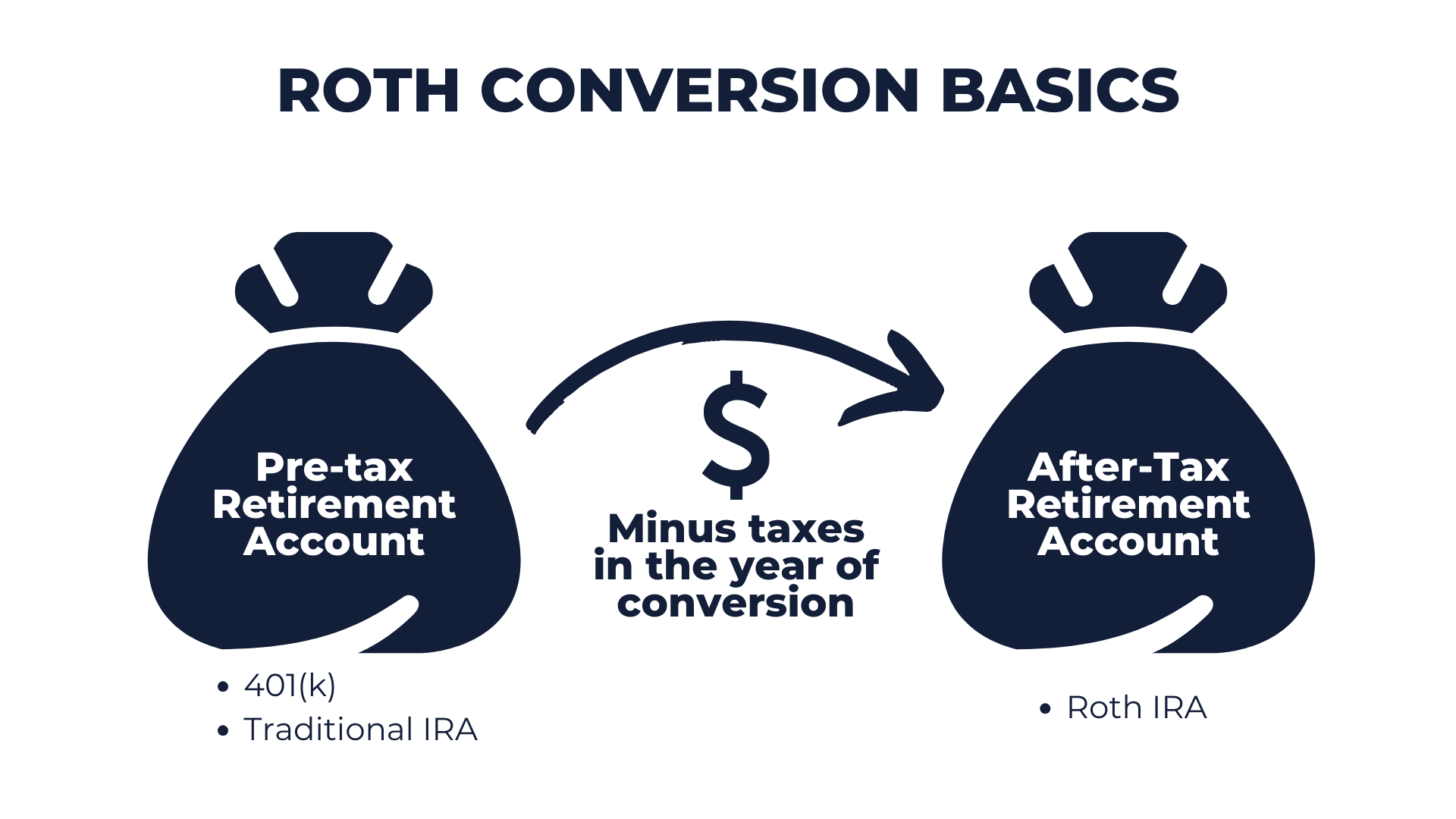

Before delving into the benefits of Roth conversions, let’s clarify what they are. A Roth conversion is a process in which you transfer funds from a traditional retirement account, such as a 401(k) or a traditional IRA, to a Roth IRA. Unlike traditional accounts, Roth IRAs offer tax-free withdrawals during retirement. When you convert funds to a Roth IRA, you’ll owe taxes on the converted amount in the year of the conversion. However, once the funds are in the Roth IRA, they can grow tax-free, and you won’t owe taxes on qualified withdrawals in retirement.

Before delving into the benefits of Roth conversions, let’s clarify what they are. A Roth conversion is a process in which you transfer funds from a traditional retirement account, such as a 401(k) or a traditional IRA, to a Roth IRA. Unlike traditional accounts, Roth IRAs offer tax-free withdrawals during retirement. When you convert funds to a Roth IRA, you’ll owe taxes on the converted amount in the year of the conversion. However, once the funds are in the Roth IRA, they can grow tax-free, and you won’t owe taxes on qualified withdrawals in retirement.

The Roth Conversions Window

The Roth conversions window refers to the period before you reach the required minimum distribution (RMD) age. RMD age currently stands at 73. Before reaching this age, you are not required to take distributions from your traditional retirement accounts, giving you the freedom to convert as much or as little as you choose.

Benefits of Roth Conversions Before RMD Age

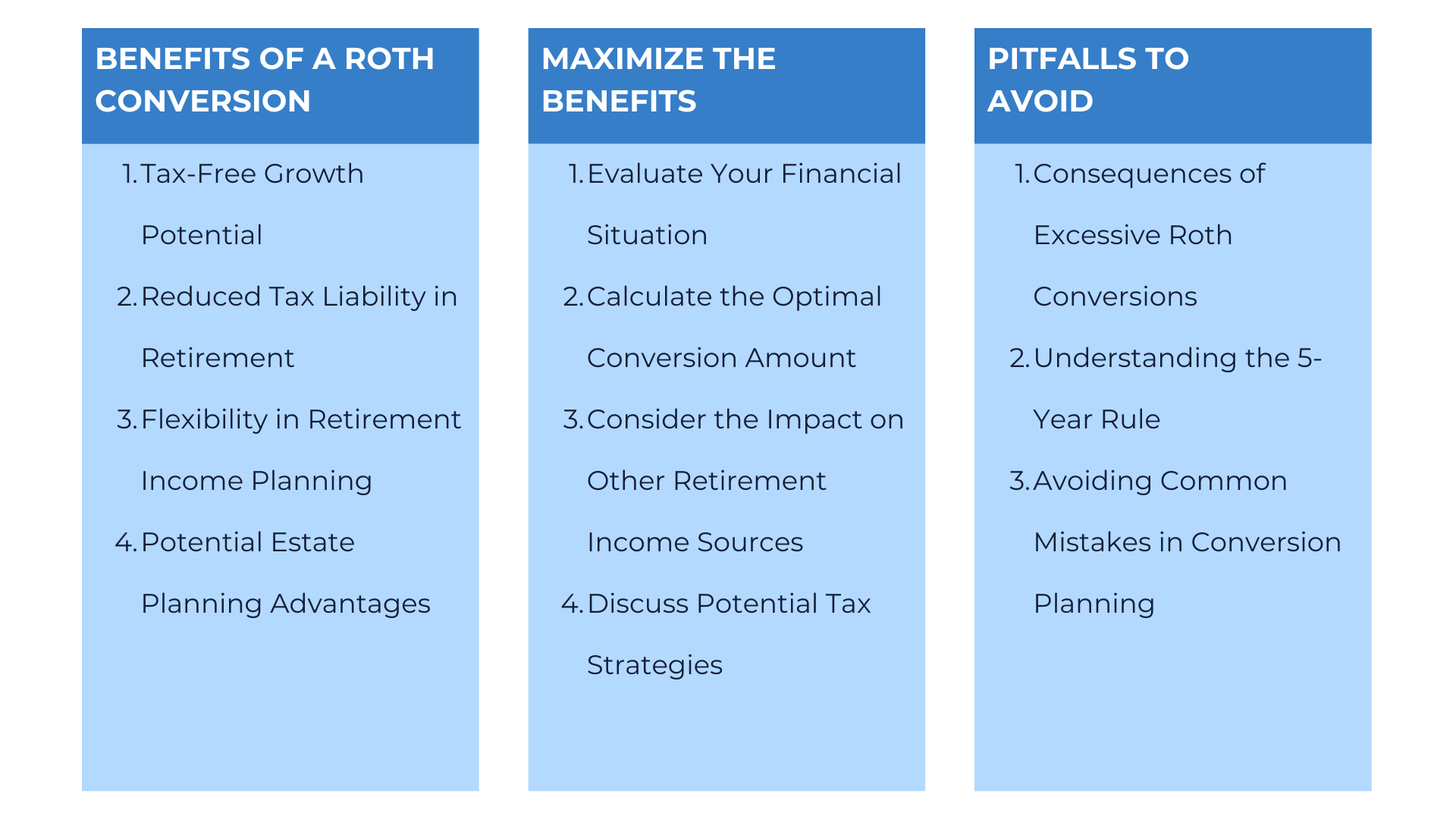

Taking advantage of Roth conversions before the RMD age offers several key advantages:

- Tax-Free Growth Potential: Funds in a Roth IRA can grow tax-free, which can significantly boost your retirement savings. This is especially beneficial if you anticipate needing access to these funds during retirement.

- Reduced Tax Liability in Retirement: By gradually converting your traditional retirement savings into a Roth IRA, you can manage your tax liability in retirement more effectively. This can be crucial in maintaining your desired lifestyle.

- Flexibility in Retirement Income Planning: Roth conversions provide you with a diverse array of income sources in retirement. This flexibility can be invaluable when adapting to changing financial circumstances.

- Potential Estate Planning Advantages: Roth IRAs can be passed on to heirs, who can enjoy tax-free distributions, making them a valuable estate planning tool.

How to Make the Most of Roth Conversions

To maximize the benefits of Roth conversions, follow these steps:

- Evaluate Your Financial Situation: Assess your current financial status and retirement goals. This will help determine how much you can convert each year.

- Calculate the Optimal Conversion Amount: Be strategic about the amount you convert each year to minimize your tax liability and ensure you have access to the funds you need in retirement.

- Consider the Impact on Other Retirement Income Sources: Roth conversions should align with your overall retirement income plan, including Social Security, pensions, and other sources of income.

- Discuss Potential Tax Strategies: Consult with a financial advisor or tax professional to explore strategies that can mitigate the immediate tax impact of conversions.

Pitfalls to Avoid

While Roth conversions offer substantial benefits, it’s essential to be aware of potential pitfalls:

- Consequences of Excessive Roth Conversions: Converting too much too quickly can lead to a significant tax bill. Careful planning is essential.

- Understanding the 5-Year Rule: To enjoy tax-free withdrawals, the converted funds must stay in the Roth IRA for at least five years. Make sure you’re aware of this rule.

- Avoiding Common Mistakes in Conversion Planning: Seek professional guidance to avoid costly mistakes, like missing deadlines or miscalculating conversion amounts.

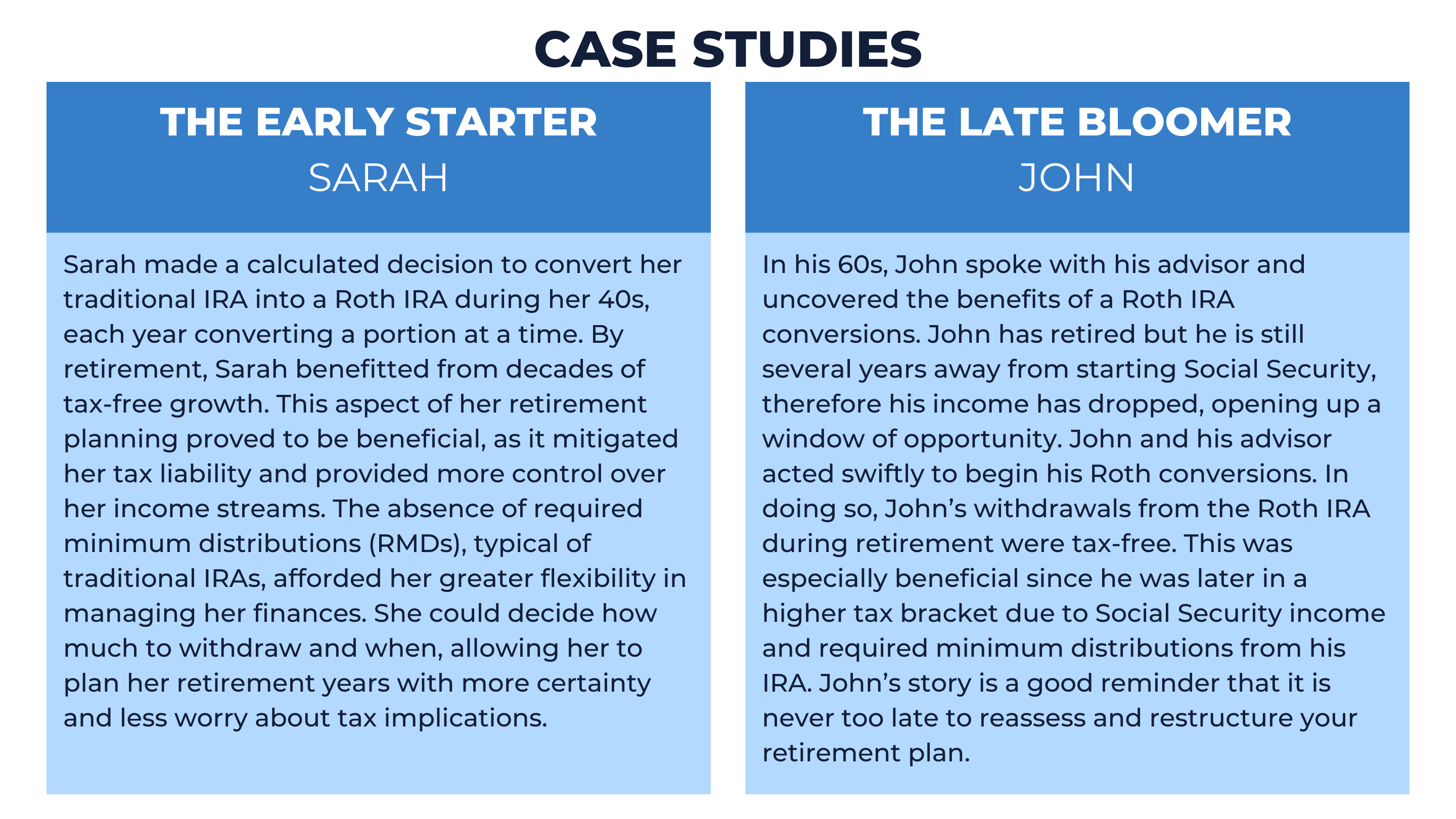

Strategies for Late Starters

If you’re approaching the RMD age and haven’t yet explored Roth conversions, it’s not too late. Late starters should work with your financial advisor to develop a strategic plan that aligns with their retirement goals.

Leveraging Roth conversions before the RMD age can be a game-changer in your retirement planning. The tax benefits, flexibility, and estate planning advantages are too valuable to ignore. Start early if you can or develop a thoughtful plan if you’re a late starter. Your future self will thank you for the effort and foresight. Remember, consulting a financial advisor is always a wise choice when making significant financial decisions. If you’re considering the strategic benefits of a Roth conversion, BentOak Capital is here to guide you through the complexities. Our team is dedicated to providing personalized strategies that align with your financial aspirations.

Don’t miss the opportunity to potentially lower your tax burden and enhance your retirement outlook. Connect with BentOak Capital today to evaluate if a Roth conversion is right for you.

IMPORTANT DISCLOSURE INFORMATION: Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request at www.bentoakcapital.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your accounts; and, (3) a description of each comparative benchmark/index is available upon request. Please Note: Limitations: Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any designation, certification, or license should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if BentOak is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation criteria/methodology, to the extent applicable). Unless expressly indicated to the contrary, BentOak did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of BentOak by any of its clients. ANY QUESTIONS: BentOak’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.