In a recent study, Vanguard revealed that American retirement savings have reached record heights, with the average 401(k) savings rate hitting an all-time high of 11.7% in 2023. This is a significant milestone, indicating a positive shift in how individuals approach retirement planning. At BentOak Capital, we’ve observed similar trends among our pre-retiree clients, underscoring the importance of maxing out retirement contributions. But what’s driving this upward trend in savings, and what can you do to make the most of it?

The Drivers Behind Record Savings Rates

Several key factors are contributing to this increase in retirement savings. Understanding these can help you leverage current trends to boost your own retirement nest egg.

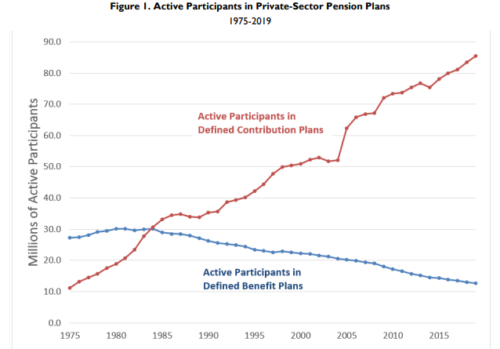

1. The Phasing Out of Private Sector Defined Benefit Pension Plans

We believe that the gradual phasing out of traditional defined benefit pension plans is a significant factor. As these plans become less common, individuals are increasingly responsible for their own retirement savings. This shift places greater importance on contributing to 401(k)s and other retirement accounts. Without the guaranteed income from pension plans, many people are taking a more proactive approach to their retirement planning, ensuring they save enough to maintain their desired lifestyle in retirement.

Source: Congressional Research Service

2. Auto-Enrollment and Escalations

We also believe that the rise of auto-enrollment and automatic escalation features in retirement plans has significantly contributed to increased savings rates. Auto-enrollment ensures that employees are automatically enrolled in their company’s 401(k) plan, often starting with a default contribution rate. Additionally, automatic escalation features gradually increase employee contribution rates over time, typically annually. These features make saving easier and more consistent, helping employees build their retirement savings with minimal effort. The simplicity and automation of these features have been effective in increasing overall participation and contribution rates.

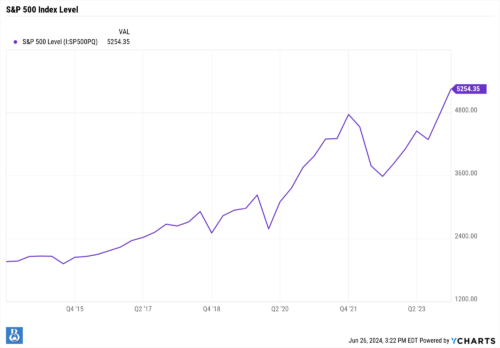

3. Rewarding Financial Markets Post-2008

We believe that the financial markets’ performance post-2008 has been another major driver. The financial crisis of 2008 was a wake-up call for many investors. However, those who continued to invest and save through the subsequent market recovery have seen substantial growth in their retirement accounts. The rewarding financial markets over the past decade have demonstrated the power of compounding returns, encouraging individuals to increase their savings rates. At BentOak Capital, we’ve seen firsthand how consistent saving and investing can grow a nest egg significantly over time, providing greater financial security and peace of mind.

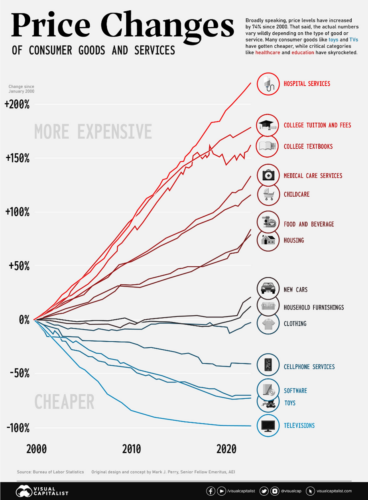

4. The Current Inflationary Environment

We believe that the current inflationary environment also plays a crucial role. Inflation is a growing concern for many pre-retirees. While rising costs might seem like a reason to cut back on savings, it actually underscores the importance of saving more. Inflation erodes purchasing power, meaning that the money you save today will be worth less in the future. By increasing retirement contributions now, you can help ensure that your savings will be sufficient to cover future expenses, even as prices rise. This proactive approach to combating inflation can provide a buffer against the uncertain economic landscape.

Maximizing Your Retirement Savings

Given these trends, it’s crucial to take a strategic approach to your retirement savings. Here are some practical steps to help you make the most of your retirement contributions:

1. Max Out Your 401(k) Contributions

If you’re not already maxing out your 401(k) contributions, now is the time to start. For 2024, the contribution limit for 401(k) plans is $23,000, with an additional $7,500 catch-up contribution for those aged 50 and over. Taking full advantage of these limits can significantly boost your retirement savings, especially with the added benefit of tax-deferred growth. Consider escalating your contributions over time to work towards the maximum contribution if it is currently out of reach.

2. Diversify Your Investments

Diversification is key to managing risk and maximizing returns. Ensure your retirement portfolio includes a mix of asset classes, such as stocks, bonds, and real estate. This can help protect your savings from market volatility and provide more stable returns over time. Consider working with a financial advisor to develop a diversified investment strategy tailored to your risk tolerance and retirement goals.

3. Take Advantage of Employer Matches

Many employers offer matching contributions to their employees’ 401(k) plans. This is essentially free money that can significantly enhance your retirement savings. Make sure you’re contributing enough to take full advantage of your employer’s match, and if possible, aim to exceed that amount.

4. Regularly Review and Adjust Your Plan

Retirement planning is not a set-it-and-forget-it task. Regularly review your retirement plan to ensure it aligns with your changing goals and circumstances. Adjust your contributions and investment strategy as needed to stay on track. At BentOak Capital, we work closely with our clients to provide ongoing support and guidance, helping them navigate the complexities of retirement planning.

5. Consider the Impact of Inflation

As mentioned earlier, inflation can erode the value of your savings. To combat this, consider allocating a portion of your retirement portfolio to investments that have historically outpaced inflation, such as stocks and real estate. Additionally, keep an eye on your spending and adjust your budget as needed to account for rising costs.

Looking Back and Moving Forward

Those who have consistently saved through market cycles can now look back and see how far they’ve come. This perspective not only boosts confidence but also reinforces the importance of continued, disciplined saving. By understanding the factors driving the rise in retirement savings and implementing these strategies, you can take control of your financial future and work towards a confident retirement.

Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapital.com.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial.