Tax-loss harvesting is a valuable strategy for optimizing your investment portfolio and reducing taxes. While it may seem straightforward, even seasoned investors can stumble into costly pitfalls. Whether you’re a novice or an experienced investor, avoiding these common tax-loss harvesting mistakes is crucial to maximizing its benefits and aligning the strategy with your long-term goals.

Understanding Tax-Loss Harvesting

At its core, tax-loss harvesting involves selling investments that have declined in value to realize a loss, which can then offset capital gains or reduce taxable income. Contrary to popular belief, this strategy isn’t limited to end-of-year portfolio reviews—opportunities can arise anytime market fluctuations impact your investments.

However, the process requires precision. Missteps can lead to missed opportunities or, worse, unwanted tax consequences. Let’s explore some common tax-loss harvesting mistakes and how to avoid them.

#1: Falling Into the Wash Sale Trap

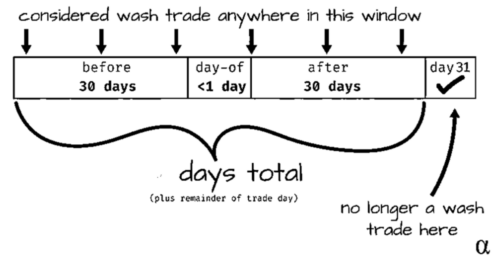

The wash sale rule is one of the most common stumbling blocks. If you sell an investment at a loss and purchase the same—or a “substantially identical”—investment within 30 days before or after the sale, the IRS disallows the loss for tax purposes. Think of it as running in circles: you’re right back where you started without any tax benefit.

How to Avoid It:

Carefully plan your transactions. If you sell a specific stock, wait at least 31 days to repurchase it. Alternatively, consider reinvesting in a similar but not identical asset. For instance, selling a large-cap tech stock like Apple could mean purchasing a technology-focused ETF instead of the same stock. This way, you preserve your portfolio’s exposure while complying with IRS regulations.

#2: Ignoring Asset Allocation

Tax-loss harvesting isn’t just about reducing taxes; it’s also about maintaining a balanced portfolio. Selling assets to realize losses can unintentionally skew your portfolio, leaving you overexposed or underexposed to specific sectors or asset classes.

How to Avoid It:

Before executing trades, revisit your investment strategy. Ensure replacement investments align with your goals, risk tolerance, and desired asset allocation. Think of it as replacing a flat tire: the new one should keep your car running smoothly without throwing it off balance.

#3: Neglecting Tax Implications

Not all losses are created equal. Tax-loss harvesting only applies to taxable accounts, so selling assets in tax-advantaged accounts like IRAs won’t impact your tax bill. Additionally, short-term losses (from assets held less than a year) offset short-term gains, which are taxed at higher rates than long-term gains.

How to Avoid It:

Focus on taxable accounts and understand how different types of gains are taxed. Strategically pairing losses with the appropriate gains can maximize your tax savings while keeping your portfolio goals intact.

#4: Overlooking Portfolio Gains

While tax-loss harvesting focuses on minimizing losses, failing to address gains in your portfolio can lead to missed opportunities. For instance, if you have appreciated assets or concentrated positions, pairing gains with losses can rebalance your portfolio while minimizing tax impact.

How to Avoid It:

Take a holistic approach. Look at both gains and losses across your portfolio to ensure tax efficiency. By integrating tax-loss harvesting with broader portfolio management, you can optimize your overall strategy.

Why Avoiding These Mistakes Matters

Tax-loss harvesting is like tuning your financial engine—it helps reduce your tax burden while keeping your financial plan on track. However, common missteps like violating the wash sale rule or neglecting asset allocation can derail your strategy, leading to avoidable tax consequences and financial setbacks.

How to Avoid Common Tax-Loss Harvesting Mistakes

Tax-loss harvesting isn’t just about minimizing taxes; it’s about doing so while staying aligned with your long-term financial goals. A thoughtful, strategic approach ensures you reap the benefits without compromising your portfolio’s balance.

If you’re unsure where to start, BentOak Capital is here to guide you. Our team can help you navigate the intricacies of tax-loss harvesting, ensuring your investment strategy stays on course.

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.

Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapital.com.Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial.