“If you fail to plan, you are planning to fail” – Benjamin Franklin

The Tax Cuts and Jobs Act of 2017 (TCJA) will expire on December 31, 2025, unless Congress intervenes. Now, there’s a reason the phrase “it will take an act of congress” was colloquially created to describe getting a difficult situation taken care of. While it is possible that Congress could extend the TCJA Sunset, getting the two sides to come together on taxes in today’s political climate is not promising. We feel that it’s crucial to review your estate plan and tax situation now to be sure you are well prepared before January 1, 2026.

Estate and Gift Tax Exemption

The implementation of the Tax Cuts and Jobs Act doubled the lifetime federal estate and gift tax exemption, which is currently $13.61 million per person in 2024, or $27.22 for a married couple. This amount will drop to around $7 million per person on January 1, 2026. To maximize these current benefits, consider utilizing the increased exemptions before they expire.

Possible Estate Planning Strategies to Consider:

- Outright Gifts: Direct gifts to non-spousal and non-charitable recipients utilize your gift tax exemption ($18k in 2024) and can be an effective way to transfer wealth, especially to grandchildren by also applying your GSTT exemption.

- Insurance Trusts: Use your gift tax exemption to fund an irrevocable life insurance trust (ILIT), either by creating a new trust to purchase a policy or transferring an existing policy into an ILIT.

- Other Complex Strategies: Some UHNW clients may benefit from a mix of some other relatively complex but highly effective strategies. Please be sure to sit down with your wealth advisor and your estate planning attorney to determine what risks your estate may be exposed to starting in January 2026 and the best ways to plan around them.

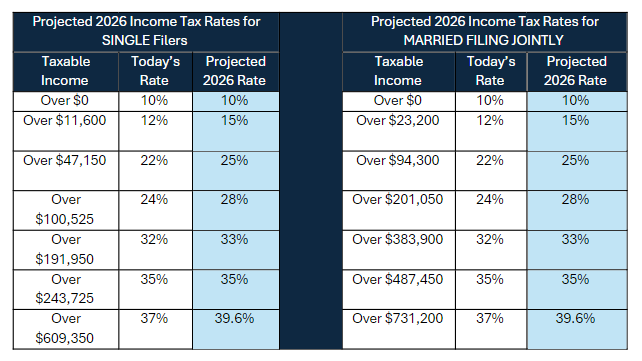

Income Tax Planning

Federal income tax rates will increase after 2025, with the top rate rising from 37% to 39.6%. To mitigate this, consider strategies such as accelerating ordinary income or transferring income-producing assets to lower-earning family members. Note that capital gains tax rates will remain unchanged. If you would like a detailed look at the changes that are coming, take a look at this helpful Comparison Guide.

Consider These Possible Tax Planning Opportunities:

- Accelerate Ordinary Income: If you believe your tax rate will be higher starting in 2026 and you have control over all or part of your annual income, consider accelerating income into 2024 or 2025. This may help you take advantage of the current lower rates before they potentially increase. W-2 income cannot be accelerated but you could, for example, choose to exercise vested stock options.

- Roth IRA Conversions: Converting traditional IRA assets to a Roth IRA now might be beneficial for your situation with rates being lower currently. A Roth IRA grows tax-free and is not subject to required minimum distributions (RMDs). Note that Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.

- Traditional IRA Withdrawals: Consider accelerating withdrawals to take advantage of lower tax rates before 2026. This could be especially useful for individuals over age 59½ who do not want to convert to a Roth IRA but still want to benefit from current rates.

- Inherited IRA Distributions: If you inherited an IRA from someone other than your spouse anytime since January 1, 2020, that account is subject to the 10-year withdrawal window via the SECURE ACT. That means everything must be distributed from the account within 10 years. As such, you may consider taking some larger distributions before 2026 to take advantage of a lower tax rate right now.

Itemized Tax Deductions

The standard deduction will decrease in 2026, making itemized deductions more beneficial for many taxpayers. This change will affect state and local income tax (SALT) deductions, mortgage interest deductions, and charitable deductions. Additionally, the itemized deduction limitation (PEASE limitation) will return, affecting high-income taxpayers.

Key Points:

- State and Local Income Tax (SALT): The current $10,000 limit on SALT deductions will expire, allowing more individuals to itemize deductions. One thing that taxpayers may consider is taking advantage of is delaying the payment of the 4th quarter estimated SALT in 2025 to January 2026 to have the deduction for the 2026 tax year.

- Mortgage Interest Deduction: The deduction for mortgage interest will revert to interest on the first $1,000,000 of mortgage debt plus up to $100,000 of home equity debt. The current limit under TCJA is $750k.

- Charitable Deductions: Should the sunset occur, the amount of charitable contributions you can deduct may be reduced as well. The IRS doesn’t necessarily give you a full deduction towards your income taxes in the year you make a charitable gift – the type of charity you give to, the type of asset you give, and your taxable income for that year all play a part in determining how much of your charitable giving can actually be written off. Discuss this with your wealth advisor and tax professional to better understand the impact on your plan.

Business Income

The Tax Cuts and Jobs Act’s Qualified Business Income (QBI) Deduction, which allows a 20% deduction on passthrough business income, will expire at the end of 2025. This will significantly increase the tax burden on passthrough entities (Sole Proprietors, LLCs, S-Corporations, Partnerships) compared to C corporations, whose tax rate remains at 21%. Business owners should consider the impact this will have on their tax planning and current entity structure.

Alternative Minimum Tax (AMT)

The Alternative Minimum Tax (AMT) is a parallel tax system designed to ensure that high-income individuals and corporations pay at least a minimum amount of tax, regardless of deductions or credits they might otherwise qualify for. It recalculates income tax by adding back certain tax preference items to taxable income, potentially resulting in a higher tax bill. If the Tax Cuts and Jobs Act sunsets, the AMT exemption and phaseout thresholds will revert to pre-TCJA levels. What this means is that many taxpayers who have never had to worry about AMT may all of a sudden have an AMT problem. This change, along with the re-expansion of AMT tax preference items like SALT deductions, presents opportunities for strategic income and deduction timing to manage tax liabilities.

Don’t Sit Back and Watch the Tax Cuts and Jobs Act Sunset, Take Action Now

The anticipated sunset of the Tax Cuts and Jobs Act provisions necessitates proactive planning. If you are feeling overwhelmed right now, it’s okay. Know that these changes aren’t happening overnight, but be mindful that they are on the horizon and we do need to be prepared and plan for them. Don’t wait until the end of 2025. Download our TCJA Preparedness Checklist today about how your plan may or may not be affected by the TCJA Sunset and share it with us to discuss what strategies we can preemptively have ready for you as we go through the rest of 2024 and into 2025.

IMPORTANT DISCLOSURE INFORMATION: Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request at www.bentoakcapital.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your accounts; and, (3) a description of each comparative benchmark/index is available upon request. Please Note: Limitations: Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any designation, certification, or license should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if BentOak is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation criteria/methodology, to the extent applicable). Unless expressly indicated to the contrary, BentOak did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of BentOak by any of its clients. ANY QUESTIONS: BentOak’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.