In challenging years in the markets, such as this one, it can be difficult to find positives. One potential silver lining for times like this is that we are presented with an opportunity to possibly reduce future taxes for clients. The technical and obscure name for this is “tax loss harvesting”, which many times leaves folks asking more questions and inquiring about it because it seems complex. With this post, we wanted to quickly break it down because it is something we look to do year round for clients when possible. Quite simply, tax loss harvesting is selling an investment that has an unrealized loss. To quickly dispel questions that have come up in the past, yes our ultimate goal is to invest in securities that appreciate over the long-term. Our overall investment strategy is based on a large number of studies and research that have shown that staying invested in a diversified portfolio over time is critical to achieving optimum outcomes. Tax loss harvesting as an ongoing process does not replace prudent investment management, it enhances it over time.

As mentioned above, tax loss harvesting requires selling an asset at a loss. With that loss, managers are then able to offset gains from other transactions. This systematic process of “neutralizing” gains for clients will then help their tax bill and improve their overall tax efficiency. As we have mentioned in a previous blog post, tax season is every season. By completing a comprehensive financial plan, and staying in communication with our clients throughout the year, we strive to be aware of the many different aspects of a client’s life and plan. This is brought up because tax loss harvesting can apply to other investments as well. In addition to investable assets (e.g. mutual funds, individual stocks, exchange traded funds, bonds, etc.), losses generated in a portfolio can also be utilized to offset gains from other investments. This can include gains from the sale of a property, business, or private investment, to name a few. Other scenarios where this has proven useful in the past include working to reduce a concentrated position in the portfolio with sizeable gains, or when vested stock options are sold with a gain. To take advantage of losses in a position and avoid wash sale rules (selling a position for a loss and then repurchasing the same or very similar position), we will find a position that has broad exposure to the respective sub-asset class but still falls within those wash sale parameters. In short, we want something that is similar, but not too similar. In the example above, one fund that has exposure to the domestic large-cap market is sold for a loss and the proceeds are reinvested into another domestic large-cap fund to maintain the overall allocation target that best meets the client’s needs. This is allowed since the new fund is not considered a “substantially identical” security.

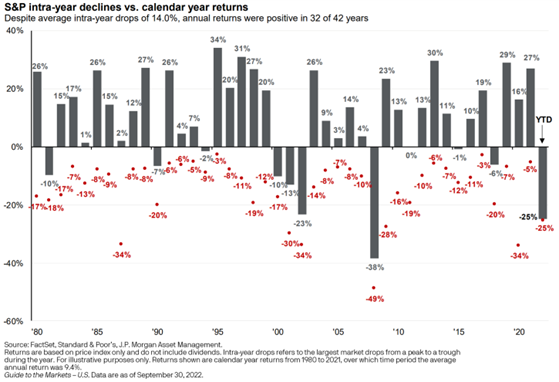

These conversations seem to arise typically near year-end when there is a better picture of a client’s tax situation. While that is definitely appropriate, why not look for these opportunities throughout the year? With advancements in technology and reduced trading costs, here at BentOak Capital, we are cognizant of tax sensitivity in non-retirement accounts year-round. I bring this up because it is extremely common for the broad stock market to have significant losses during the year only to rebound before year-end.

These conversations seem to arise typically near year-end when there is a better picture of a client’s tax situation. While that is definitely appropriate, why not look for these opportunities throughout the year? With advancements in technology and reduced trading costs, here at BentOak Capital, we are cognizant of tax sensitivity in non-retirement accounts year-round. I bring this up because it is extremely common for the broad stock market to have significant losses during the year only to rebound before year-end.

Another factor to keep in mind is that tax loss harvesting becomes even more attractive as both your ordinary income tax rate and long-term capital gains tax rates increase. Ordinary income taxes rates come into the picture when one is dealing with short-term capital gains (realized gains on investments held less than 1 year). If an investment is sold at a gain that has been held less than the 1 year window, capturing losses (from either long-term or short-term positions) can be used to offset the gain. Tax law says long-term gains are offset by long-term losses, and short-term gains are offset by short-term losses first. Then whatever losses remain in those respective categories offset each other (e.g. a long-term loss can offset a short-term gain). This strategy is more lucrative for those that fall into the 20% long-term capital gains tax rate (roughly $500,000 in annual income) but is very likely beneficial to most taxpayers who might pay capital gains tax. Additionally, if there are capital losses remaining at the end of the year that cannot be offset with realized gains, $3,000 of those losses can be applied to ordinary income, and the remaining amount can then be carried forward.

As mentioned above, we work with clients to pursue opportunities year-round in taxable (non-retirement) accounts to be opportunistic in harvesting losses. Having a good comprehensive financial plan in place, and updates on any transactions outside of our management (e.g. sale of property, investment, stock options, etc.) is always welcome so we can proactively work to mitigate and reduce one’s tax liability. Interestingly enough, these extra steps to being tax sensitive are not reflected in the account’s performance. Rather, the benefit is seen in your annual tax return through tax savings. Several studies have shown that this savings, or “additional return”, can fall within a range of 0.57% to 2.29%1, depending on a number of factors such as tax rate and income.

Tax loss harvesting is an area that leaves many with additional questions. For any of our clients that have had a taxable event outside of their managed accounts here, please give your advisor a call so we can update your financial plan and discuss options that might be available. For any prospective clients (or friends of current clients), if you have not discussed this with your advisor, please contact us so we can set up a meeting to share more about our services and outline how we can add value to your comprehensive financial picture.

- Chaudhuri, S. E., Burnham, T. C., & Lo, A. W. (2020). An empirical evaluation of tax-loss-harvesting alpha. Financial Analysts Journal, 76(3), 99–108. https://doi.org/10.1080/0015198x.2020.1760064

IMPORTANT DISCLOSURE INFORMATION: Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request at www.bentoakcapital.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your accounts; and, (3) a description of each comparative benchmark/index is available upon request. Please Note: Limitations: Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any designation, certification, or license should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if BentOak is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation criteria/methodology, to the extent applicable). Unless expressly indicated to the contrary, BentOak did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of BentOak by any of its clients. ANY QUESTIONS: BentOak’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.