Invest with your prefrontal cortex, not your amygdala.

Markets are messy. Emotions are high. And the financial media is pouring gasoline on the fire with headlines engineered to spike your blood pressure, not your portfolio returns. Declarative statements like “it’s different this time because _______” are the norm. (Spoiler alert: the reasons might be different, but market uncertainty isn’t all that different. I’ve written about this before).

Let’s be clear – we’re not out of the woods yet. Volatility is real, and uncertainty is still in the driver’s seat. But when fear dominates the conversation, perspective can become your competitive advantage.

So no, we’re not saying the clouds will lift immediately. But we are saying that if you zoom out and think 6 to 12 months ahead, the outlook may not be as bleak as the headlines suggest, which means opportunities for long-term investors abound.

Here are five things most investors are missing right now because fear is louder than facts.

1. Inflation Is Cooling… Even If the Fed Won’t Say It Yet

Real-time inflation data from Truflation, based on actual daily prices across housing, fuel, groceries, and more, is pointing to a clear downtrend. This isn’t cherry-picked optimism. It’s just better data than what the official reports show, which tend to be backward-looking and slow to reflect what’s really happening.

We’re not saying inflation is solved – we need a couple more months of lower inflation data to signal a more sustainable path. But the direction of travel is promising and happening faster than many think. With a target of 2% inflation and Truflation currently tracking at less than 1.25%, the Fed’s rate decisions could potentially positively surprise market participants later in the year.

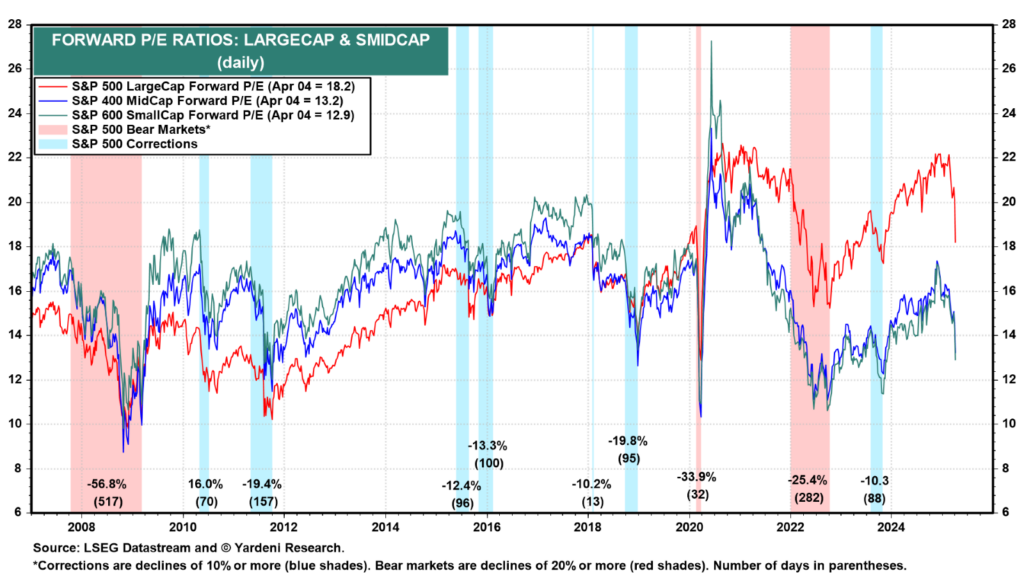

2. Stocks Are Cheaper Than They Look

Yes, earnings estimates have pulled back. But so have valuations. Price-to-earnings ratios are down across the board, which means investors are paying less for every dollar of profit.

Said another way, great companies are on sale. That doesn’t mean we anticipate the beginning of a new long-term bull market rally next week. But historically, periods like this, when fear is high and prices are compressed, often lead to stronger returns down the road. Pessimism can be expensive. So can sitting in cash for too long.

Your best move now? Long-term investors should be looking for rebalancing opportunities to reposition into attractive positions. Further, for long-term investors with surplus cash to invest, consider consulting a financial advisor to explore your options. At BentOak Capital, we offer personalized advice tailored to your financial goals. Please note that investment decisions should be made based on individual circumstances, so your mileage may vary.

Buy low, sell high: it’s always easier to say than do, but more likely than not, this will eventually become one of those blips on a long-term chart. Do you want to say “I am glad I stayed invested” or “I am glad I put cash to work back then,” or would you rather say “that is where I capitulated, sold my stocks, and derailed my long-term investment plan.” I think I know the answer! Make decisions you will one day be proud of during times like these.

3. Tariff Talk Is Loud, But Reality Is Quieter

About 25% of global GDP has responded to recent tariffs with retaliation, namely China, Germany, France, and Canada. However, within the EU, countries are divided, and many are pushing for negotiation over escalation. EU representatives, though actively pursuing retaliatory tariffs, have indicated they are still open to negotiation. With countries like Italy and the UK looking to negotiate, there is a chance the stauncher European countries may compromise to some degree to create a unified front. And while China is always a wildcard when it comes to geopolitics and the global economy, with a slowing economy and a high demand from US consumers, there’s still a chance they may be more willing to negotiate than most realize.

As of Sunday evening April 6th, approximately 50 countries have reached out to the US administration to make a deal. About half the world’s economy is playing it cool – either calling to end tariffs with the US or signaling they are willing to negotiate. Additionally, there are a good number of smaller countries that likely aren’t in a position to retaliate.

This isn’t a full-blown trade war as of now. It’s more like a geopolitical staring contest dressed up for power positioning and optics – a negotiation phase to reset the global trade narrative.

And no, we’re not minimizing the risks. But the market is already adjusting to price in some worst-case scenarios that may not materialize. I am not saying “it’s all priced in” but current market moves seem to reflect a more gloomy outlook already. This take isn’t about politics. It’s about probabilities, and there could be room for upside surprises.

Now, the long-term effects of tariffs? We will be covering that in the coming days and weeks, but for now, we believe the current level of panic will probably be viewed as overreaction in hindsight.

4. The Permabears Are Back, Which Should Raise Eyebrows, Not Alarms

Every pullback drags out the same crew. The self-proclaimed market prophets who’ve confidently predicted ten of the last three recessions.

They sound smart. They wear suits. They get airtime.

But they usually don’t get returns. You do. Staying invested, thoughtfully and strategically with a long-term lens, is what builds wealth. Not fear. Not forecasts. Not falling for every hyperbolic take on CNBC.

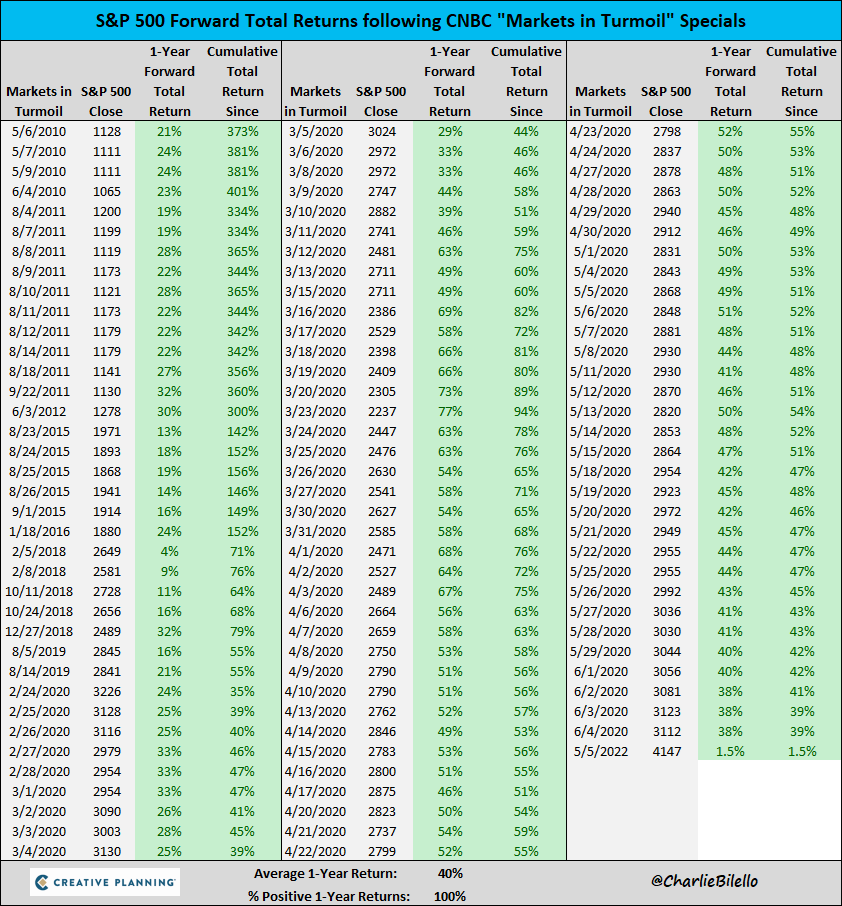

Investment strategist Charlie Bilello has observed that historically, after CNBC airs their news special “Markets in Turmoil” segment, the S&P 500 often rebounded positively over the following year. That’s not a guarantee, but it is a compelling pattern. And it’s worth paying attention to. In fact, for the past several years, we have viewed the “Markets in Turmoil” segment as a contrarian indicator of sorts and have mentioned it in past blog posts. When the mainstream media raises concerns about market volatility, take it with a grain of salt because they are often late to the party.

Source: Charlie Bilello*

*BentOak Capital has no affiliation with nor endorses Charlie Bilello. This information is believed to be reliable but is not guaranteed for accuracy or completeness.

Past performance does not guarantee future results, and individual circumstances may vary. This chart reflects data as of Q4 2023. The cumulative total return has increased since then, meaning the current figures are likely even more favorable.

The bottom line? The bears may own the microphone during moments like this, but you, the disciplined investor, have the upper hand.

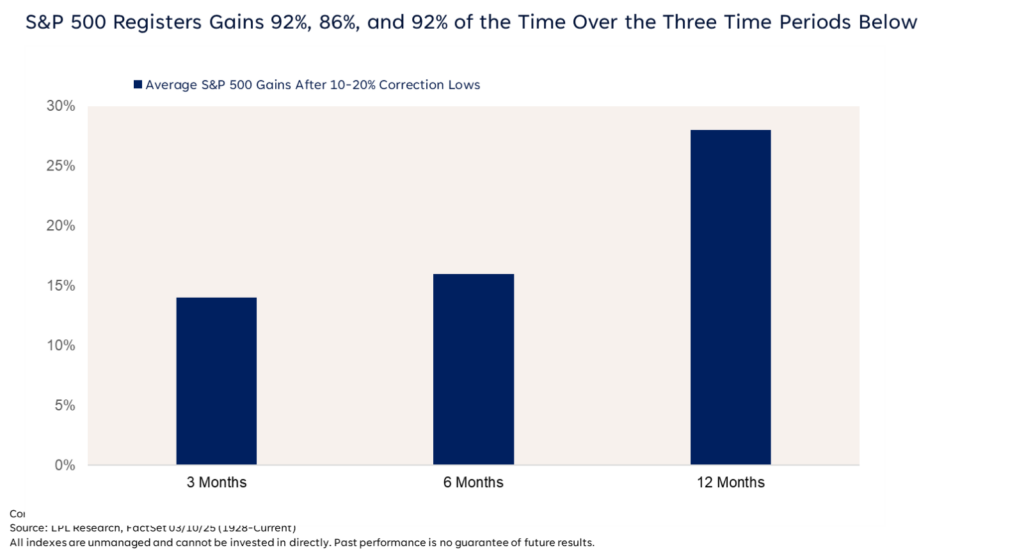

5. Big Drops Often Set the Stage for Bigger Bounces

The recent two-day drop was sharp, fast, and uncomfortable. But not unprecedented. Historically, when markets fall this hard and this fast, and we’re not in a deep recession, they tend to recover within months not years. And more often than not, they rebound strong.

Are we guaranteed a rally? Of course not. But the odds shift when panic spikes and positioning gets extreme. The market bottoming process rarely feels like opportunity in the moment, but that’s usually when opportunities arise.

Final Word: Your Brain Is Wired to Panic. But You Don’t Have to Fall For It.

Here’s the problem with volatility. It doesn’t just move the markets. It moves us. And the financial media is built to capitalize on that.

“Markets in Turmoil” banners. Flashing red. Talking heads predicting the end of the world, yet again.

Let’s be honest. It’s not news. It’s financial theater. Brain rot, dressed up as insight. It’s engineered to trigger your amygdala, the part of your brain designed for survival, not strategy.

But long-term wealth isn’t built in the amygdala. It’s built in the prefrontal cortex, where reason lives. Where patience lives. Where smart decisions are made when things don’t feel easy.

And here’s something worth considering. We all anticipate the future in other areas of life. We look forward to summer vacations, the start of football season, or Christmas with the family. So why does investing make us feel like we have to live in the anxiety of the present moment? Why can’t we look forward to better returns the same way we look forward to the next chapter in life? Because we can chose to do so. And historically, doing so has paid off more often than not.

So here’s your move: Turn it off. Zoom out. Think further down the road than the next market headline.

At BentOak Capital, we’re not chasing noise. We’re sticking to the plan. If the noise is getting to you, let’s talk. Not to predict the future, but to keep making wise decisions in the present.

We don’t panic.

We plan.

And we keep moving forward – on purpose.

IMPORTANT DISCLOSURE INFORMATION: Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request at www.bentoakcapital.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your accounts; and, (3) a description of each comparative benchmark/index is available upon request. Please Note: Limitations: Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any designation, certification, or license should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if BentOak is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation criteria/methodology, to the extent applicable). Unless expressly indicated to the contrary, BentOak did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of BentOak by any of its clients. ANY QUESTIONS: BentOak’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.