In a recent study, Vanguard revealed that American retirement savings have reached record heights, with the average 401(k) savings rate hitting an all-time high of 11.7% in 2023. This is a significant milestone, indicating a positive shift in how individuals approach retirement planning. At BentOak Capital, we’ve observed similar trends among our pre-retiree clients, underscoring the importance of maxing out retirement contributions. But what’s driving this upward trend in savings, and what can you do to make the most of it?

The Drivers Behind Record Savings Rates

Several key factors are contributing to this increase in retirement savings. Understanding these can help you leverage current trends to boost your own retirement nest egg.

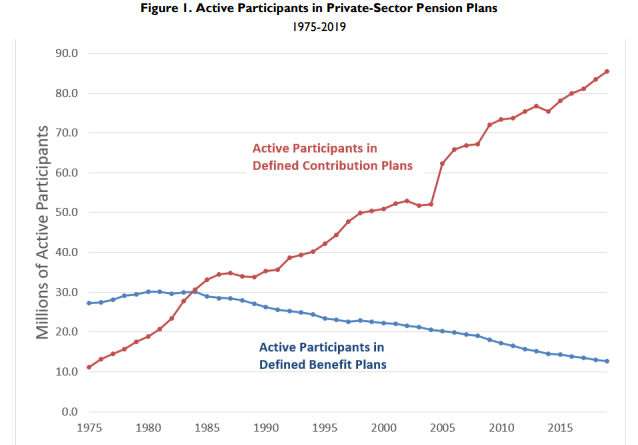

1. The Phasing Out of Private Sector Defined Benefit Pension Plans

We believe that the gradual phasing out of traditional defined benefit pension plans is a significant factor. As these plans become less common, individuals are increasingly responsible for their own retirement savings. This shift places greater importance on contributing to 401(k)s and other retirement accounts. Without the guaranteed income from pension plans, many people are taking a more proactive approach to their retirement planning, ensuring they save enough to maintain their desired lifestyle in retirement.

Source: Congressional Research Service

2. Auto-Enrollment and Escalations

We also believe that the rise of auto-enrollment and automatic escalation features in retirement plans has significantly contributed to increased savings rates. Auto-enrollment ensures that employees are automatically enrolled in their company’s 401(k) plan, often starting with a default contribution rate. Additionally, automatic escalation features gradually increase employee contribution rates over time, typically annually. These features make saving easier and more consistent, helping employees build their retirement savings with minimal effort. The simplicity and automation of these features have been effective in increasing overall participation and contribution rates.

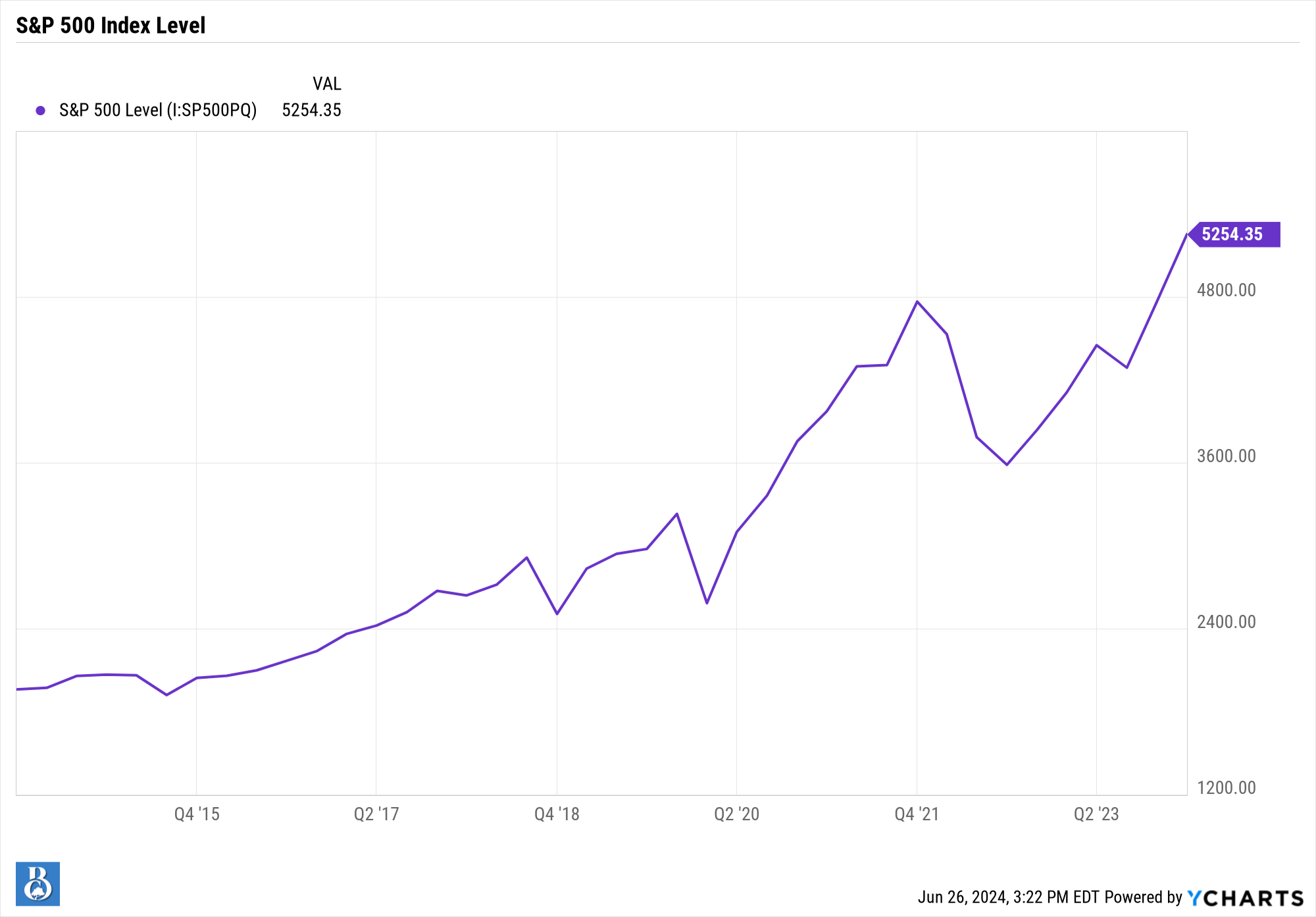

3. Rewarding Financial Markets Post-2008

We believe that the financial markets’ performance post-2008 has been another major driver. The financial crisis of 2008 was a wake-up call for many investors. However, those who continued to invest and save through the subsequent market recovery have seen substantial growth in their retirement accounts. The rewarding financial markets over the past decade have demonstrated the power of compounding returns, encouraging individuals to increase their savings rates. At BentOak Capital, we’ve seen firsthand how consistent saving and investing can grow a nest egg significantly over time, providing greater financial security and peace of mind.

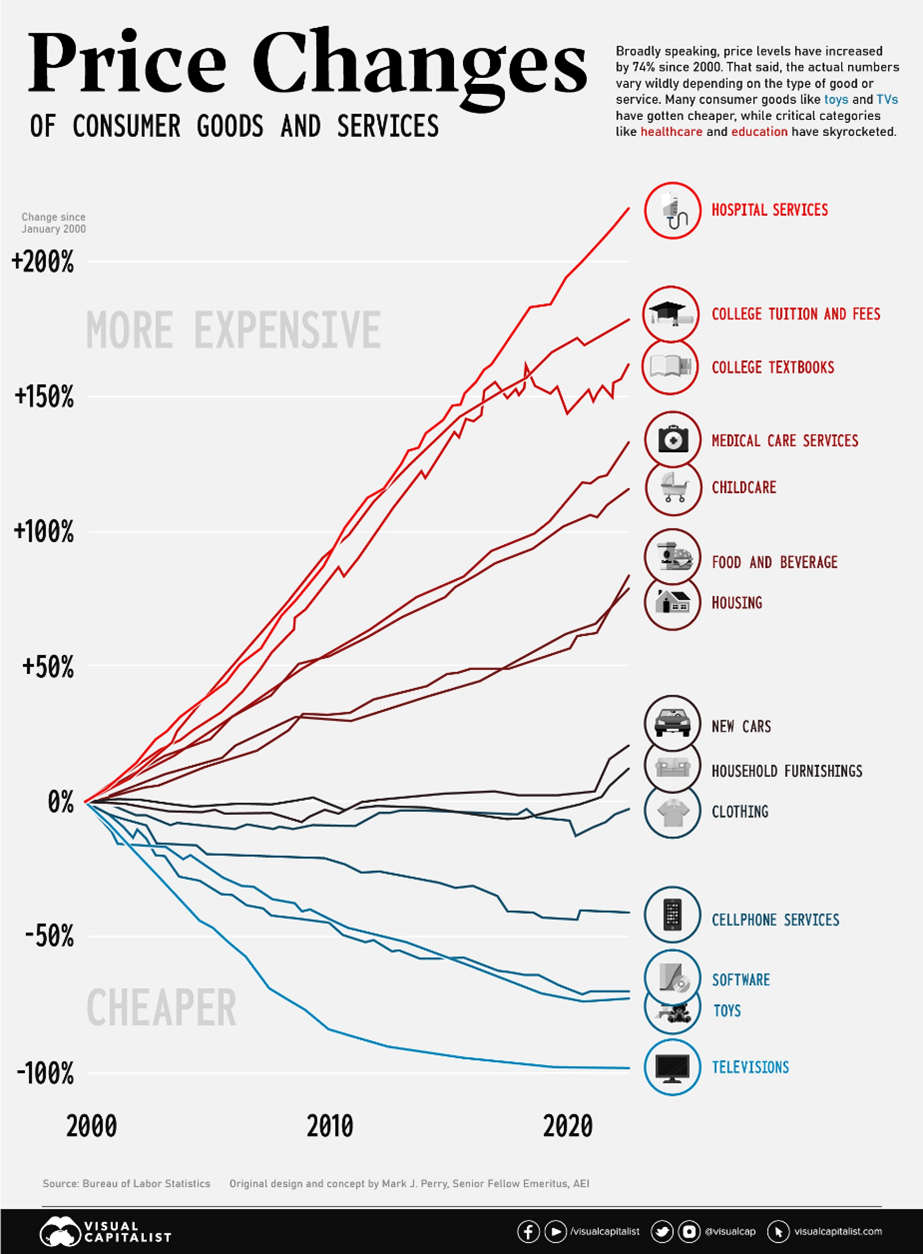

4. The Current Inflationary Environment

We believe that the current inflationary environment also plays a crucial role. Inflation is a growing concern for many pre-retirees. While rising costs might seem like a reason to cut back on savings, it actually underscores the importance of saving more. Inflation erodes purchasing power, meaning that the money you save today will be worth less in the future. By increasing retirement contributions now, you can help ensure that your savings will be sufficient to cover future expenses, even as prices rise. This proactive approach to combating inflation can provide a buffer against the uncertain economic landscape.

Maximizing Your Retirement Savings

Given these trends, it’s crucial to take a strategic approach to your retirement savings. Here are some practical steps to help you make the most of your retirement contributions:

1. Max Out Your 401(k) Contributions

If you’re not already maxing out your 401(k) contributions, now is the time to start. For 2024, the contribution limit for 401(k) plans is $23,000, with an additional $7,500 catch-up contribution for those aged 50 and over. Taking full advantage of these limits can significantly boost your retirement savings, especially with the added benefit of tax-deferred growth. Consider escalating your contributions over time to work towards the maximum contribution if it is currently out of reach.

2. Diversify Your Investments

Diversification is key to managing risk and maximizing returns. Ensure your retirement portfolio includes a mix of asset classes, such as stocks, bonds, and real estate. This can help protect your savings from market volatility and provide more stable returns over time. Consider working with a financial advisor to develop a diversified investment strategy tailored to your risk tolerance and retirement goals.

3. Take Advantage of Employer Matches

Many employers offer matching contributions to their employees’ 401(k) plans. This is essentially free money that can significantly enhance your retirement savings. Make sure you’re contributing enough to take full advantage of your employer’s match, and if possible, aim to exceed that amount.

4. Regularly Review and Adjust Your Plan

Retirement planning is not a set-it-and-forget-it task. Regularly review your retirement plan to ensure it aligns with your changing goals and circumstances. Adjust your contributions and investment strategy as needed to stay on track. At BentOak Capital, we work closely with our clients to provide ongoing support and guidance, helping them navigate the complexities of retirement planning.

5. Consider the Impact of Inflation

As mentioned earlier, inflation can erode the value of your savings. To combat this, consider allocating a portion of your retirement portfolio to investments that have historically outpaced inflation, such as stocks and real estate. Additionally, keep an eye on your spending and adjust your budget as needed to account for rising costs.

Looking Back and Moving Forward

Those who have consistently saved through market cycles can now look back and see how far they’ve come. This perspective not only boosts confidence but also reinforces the importance of continued, disciplined saving. By understanding the factors driving the rise in retirement savings and implementing these strategies, you can take control of your financial future and work towards a confident retirement.

IMPORTANT DISCLOSURE INFORMATION: Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request at www.bentoakcapital.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your accounts; and, (3) a description of each comparative benchmark/index is available upon request. Please Note: Limitations: Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any designation, certification, or license should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if BentOak is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation criteria/methodology, to the extent applicable). Unless expressly indicated to the contrary, BentOak did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of BentOak by any of its clients. ANY QUESTIONS: BentOak’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.