What Does It Mean To Truly Be Diversified

BLOGS|16 Jun 2022

We are almost halfway through the year, and we have seen increased movement […]

Diversification is a word that gets thrown around a lot in our industry but doesn’t always get the respect it deserves. Many folks might think they are well diversified simply because they own a lot of “stuff” - dozens of ticker symbols perhaps. In good times, diversification may even get ignored, and there is wisdom in the words of Warren Buffett when he said, “only when the tide goes out do you discover who’s been swimming naked.” This is why understanding – or working with an advisor that truly understands – what your portfolio is constructed of is critical. It’s in volatile times that a lack of diversification may come to light.

We should note that diversification doesn’t necessarily protect investors from broad-based market downturns like we are experiencing now, but it does help ensure that investors can avoid being the embarrassed and vulnerable swimmer that Mr. Buffett referenced. Below are two examples of common diversification missteps – 1) not knowing what you own and 2) being overconfident in a particular company or sector.

Diversification is a word that gets thrown around a lot in our industry but doesn’t always get the respect it deserves. Many folks might think they are well diversified simply because they own a lot of “stuff” - dozens of ticker symbols perhaps. In good times, diversification may even get ignored, and there is wisdom in the words of Warren Buffett when he said, “only when the tide goes out do you discover who’s been swimming naked.” This is why understanding – or working with an advisor that truly understands – what your portfolio is constructed of is critical. It’s in volatile times that a lack of diversification may come to light.

We should note that diversification doesn’t necessarily protect investors from broad-based market downturns like we are experiencing now, but it does help ensure that investors can avoid being the embarrassed and vulnerable swimmer that Mr. Buffett referenced. Below are two examples of common diversification missteps – 1) not knowing what you own and 2) being overconfident in a particular company or sector.

Diversification Example #1: Not knowing what you own

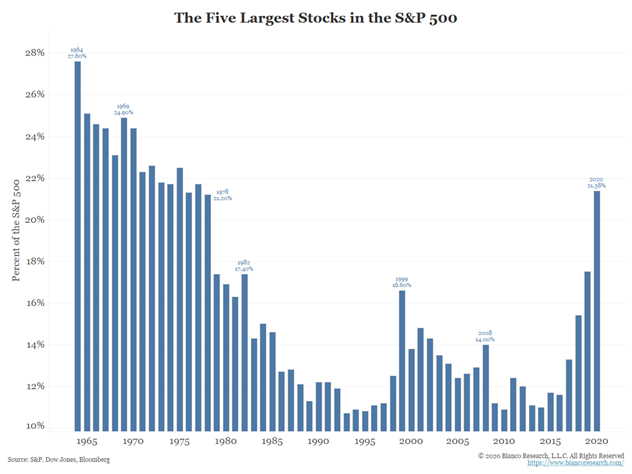

Our first example is somewhat of an often-overlooked issue: traditional indices, such as the S&P 500, may not provide enough diversification. Many individuals have exposure to an S&P 500 fund in some fashion, which is a great way to seek broad domestic large cap diversification. One item to note on the S&P 500 index is that it is market cap weighted. This means that as the market cap, or value of a company, grows then its weighting in the S&P 500 (or similar market cap weighted funds) does as well. That’s not necessarily a bad thing, but in recent years some companies have grown substantially. As of the end of last year, approximately 23% of the S&P 500 holdings were Apple, Microsoft, Amazon, Alphabet (Google), and Tesla. It is important to realize the weight these companies represent in an S&P 500 fund, and the respective account/portfolio.

Our first example is somewhat of an often-overlooked issue: traditional indices, such as the S&P 500, may not provide enough diversification. Many individuals have exposure to an S&P 500 fund in some fashion, which is a great way to seek broad domestic large cap diversification. One item to note on the S&P 500 index is that it is market cap weighted. This means that as the market cap, or value of a company, grows then its weighting in the S&P 500 (or similar market cap weighted funds) does as well. That’s not necessarily a bad thing, but in recent years some companies have grown substantially. As of the end of last year, approximately 23% of the S&P 500 holdings were Apple, Microsoft, Amazon, Alphabet (Google), and Tesla. It is important to realize the weight these companies represent in an S&P 500 fund, and the respective account/portfolio.

In a case like this, you would want to make sure that there is not an overallocation to one of these positions in another account you have, or that there is not hidden overlap in other mutual funds you own. You can ensure strong diversification by not only owning a swath of large cap companies such as those the S&P 500 represents but by also owning additional asset classes such as mid and small cap US stocks, international stocks, real estate, and fixed income (bonds).

Diversification Example #2: being overconfident in a particular company or sector

Another common diversification issue is concentration in a single holding or sector. Often this stems from 401k plans that match employee contributions with company stock. The company match you receive is the most efficient growth you will have as you accumulate assets. With your employer matching, you are essentially doubling the amount you have contributed, which is something that is difficult to obtain elsewhere in investing – an immediate 100% return. While this is a nice retirement perk, there are also a few items to be aware of. Many companies make this match with company stock. Contributions in this form provide a great incentive to employees for the company to do well, but a concentrated stock position needs to be regularly reviewed and revisited. If your company stock does well and appreciates in addition to the contributions, it can become an even larger weighting – potentially driving the majority of your returns, both positive and negative. But it is important to remember that it is just as possible to receive flat or negative returns as it is to receive extremely positive returns. To further illustrate the need for rebalancing a concentrated position, there have been a number of companies in the recent past that have gone through the bankruptcy process or some form of restructuring. Below is a table of some of the larger companies that have declared bankruptcy in the past 20 years. There are varying reasons behind each ranging from fraudulent activity (Enron, WorldCom), effects of the Great Recession/Financial Crisis (Lehman Brothers, Washington Mutual, General Motors), or a company that did not adapt to changing conditions (Eastman Kodak, Toys R Us Inc.). Many of these companies were established household names but provide an excellent example of having concentration risk in your portfolio. This concentration risk could be from an affinity bias, perhaps a position was inherited, or it could be the company you work for or worked in the past. Whatever the case, history has shown that mismanagement at the highest level of these companies can occur, and it can be devastating for individual investors.|

Selected US Companies Declaring Bankruptcy: 2000-Present Source: BankruptcyData.com |

||

| Bethlehem Steel (2001) | General Growth Properties (2009) | Coldwater Creek (2014) |

| Enron (2001) | General Motors (2009) | Gymboree (2017) |

| WorldCom(2002) | Nortel Networks (2009) | Payless (2017) |

| Circuit City Stores (2008) | Borders Group (2011) | Toys R Us Inc. (2017) |

| Delta Air Lines (2008) | Patriot Coal (2012) | Sears (2018) |

| Lehman Brothers Holdings (2008) | Eastman Kodak (2012) | PG&E (2019) |

| Washington Mutual (2008) | Excel Maritime Carriers (2013) | |

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly

Please remember to contact BentOak Capital (“BentOak”), in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, to modify any reasonable restrictions to our investment advisory services, or if you wish to direct that BentOak to effect any specific transactions for your account. A copy of our current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bentoakcapital.com. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Securities offered through LPL Financial, Member: FINRA/SIPC. Investment advice offered through BentOak Capital, a registered investment advisor and separate entity from LPL Financial.