Bernie Madoff, Jordan Belfort, Charles Ponzi. Names that you have likely heard of, for all the wrong reasons. They all defrauded investors for one reason or another, and in the end, they not only immensely hurt their clients, but they also tarnished the reputation of the financial services industry.

There are many more names that are on the list from over the years, but would it surprise you to know that these kinds of things are still going on? Even in 2025 there are still “investment professionals” who are taking advantage of investors. In 3 of the areas that we have locations in, there are recent instances of this sort of behavior – Fort Worth, Houston, Lubbock; and there are many more just like them. It is a harsh and unfortunate reality that we, and many we care about, find ourselves in.

Where do you turn to find a Wealth Advisor you can trust? How do you find someone that you can sit across the table from and know that you are being treated and cared for with the upmost dignity and respect? How can you be confident that your money is being managed in such a way that you know it is being done so in your best interest?

One term that you may have heard before is “fiduciary.” This is something that many investors overlook when selecting a Wealth Advisor, and something that would have gone a long way in protecting against those previously mentioned and held them more accountable in the moment. Let’s dive into the details of fiduciary duty and discuss its significance in how your wealth is managed.

What is a Fiduciary

By definition, a fiduciary is an individual or entity entrusted with the responsibility of acting in the best interests of another party. This relationship is characterized by a high level of trust, good faith, and a commitment to prioritize the well-being of the beneficiary (aka: you, the client). In the financial world, a fiduciary takes on the role of a trusted advisor, legally obligated to put their client’s interests ahead of their own. This duty ensures that financial decisions and recommendations are made with utmost transparency, integrity, and a singular focus on achieving the client’s financial objectives.

Wealth Management and the Fiduciary vs Suitable Standard

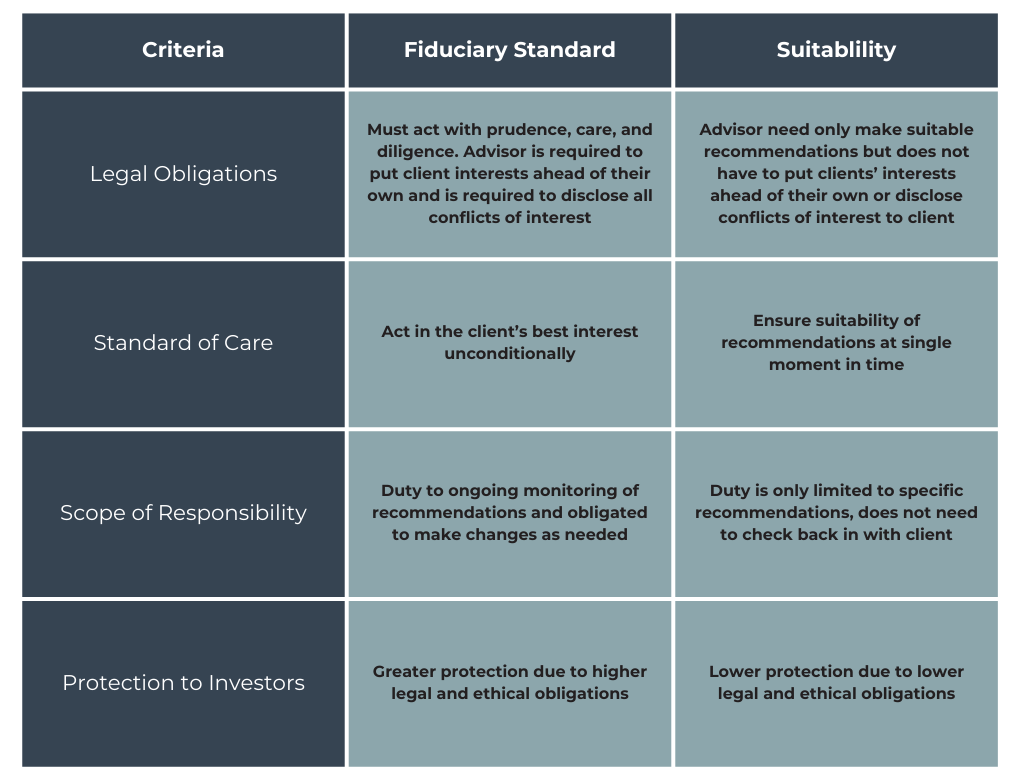

When it comes to managing your wealth, the distinction between a fiduciary advisor and an advisor that operates under the suitable standard is crucial. A fiduciary is bound to act in your best interest, period. On the flip side, there are other advisors out there that are only bound by the suitable standard. This suitable standard is exactly how it sounds, it merely requires recommendations that are suitable based on your financial situation, which can be appropriate depending on individual circumstances. However, we believe that a fiduciary approach, which prioritizes your best interests, is often more comprehensive.

It is incredibly important to discern the motivations behind someone’s financial recommendations to you. Choosing professionals who prioritize your financial well-being rather than their own bottom line will help you avoid dealing with those who adhere to the suitable standard without the fiduciary commitment.

The Importance of Choosing a Fiduciary

A fiduciary operates under a legal and ethical obligation to prioritize your best interests, navigating the complex landscape of wealth management with transparency and unwavering integrity. This commitment ensures that every financial decision, recommendation, and strategy is crafted with your unique goals in mind. Opting for a fiduciary is more than a simply a choice; it’s a proactive step towards securing not just monetary gains but a partnership built on trust, safeguarding your financial well-being over the long haul. In a world where financial decisions carry significant consequences, the importance of a fiduciary cannot be overstated — it’s the key to a resilient and tailored approach to wealth management. The fiduciary duty establishes a relationship built on trust, transparency, and an unwavering commitment to your best interests.

But how can you tell if you’re working with a fiduciary? Here are a few questions to consider when interviewing Wealth Management firms:

- Do they explicitly state their fiduciary duty in writing?

- Transparency is paramount and a Certified Financial Professional™, like all of BentOak Capital’s Wealth Advisors are, is obligated to inform you, in writing, of their duty to you.

- How do they disclose fees and potential conflicts of interest? What do they do when a conflict of interest arises?

- A Fiduciary will disclose these items to you without you even having to ask. Someone operating under the suitable standard may try and hide it in the fine print and consider that “good enough.

- Are they transparent about their investment strategy and decision-making process?

- A Fiduciary will work in a collaborative process with you, building your plan and investment strategy around you and your needs and keep you in the loop every step of the way. Someone who only must make their recommendations under the “suitable” standard may try to mash and force fit you into a product that you may not actually need.

- Do they prioritize your financial well-being over potential commissions or bonuses?

- A Fiduciary is legally obligated to place your financial well-being over their own. They may still benefit from making a recommendation, but they will make this known to you and you can trust that this recommendation is truly in your best interest because of their fiduciary duty. Someone who operates under the suitable standard may leave you wondering if a recommendation is better for you or for them.

Carl Richards, former New York Times behavioral finance columnist, illustrates this concept beautifully in his Fiduciary Standard Sketch. You will see that the fiduciary standard client-advisor relationship revolves solely around the client. Conversely, the suitability standard does not. This type of relationship often centers around financial products and commissions and can lead to priorities being flipped.

The Added Layer of Security: Third-Party Custodians

When working with an investment adviser, it is crucial for you as the client to ensure your assets are held with a reputable third-party custodian. The SEC’s Custody Rule under the Investment Advisers Act of 1940 requires any financial professional managing funds on behalf of others to maintain those assets with a qualified custodian (ex: LPL Financial, Charles Schwab, Fidelity). This regulation is vitally important and provides an additional layer of security by maintaining your funds and securities in your name and delivering regular account statements directly to you. If this had been in place for those that were wronged, it would have not only helped enhance security and transparency, but it would also have certainly prevented misappropriation of assets. If an “investment professional” ever asks you to write a check directly to them and not a 3rd party custodian (and it does not matter how well you know them or you think you know them) major lights and sirens should be going off in your head, and you need to disengage immediately. This could indicate suspicious activity, a violation of SEC regulations, and a potential risk to your funds. Always verify that your assets are kept with a trusted, independent custodian to avoid potential fraud or misuse of your investments.

Financial decisions today can have profound implications for your future, and the distinction between a fiduciary and a non-fiduciary advisor is paramount. Selecting a Wealth Advisor who operates under fiduciary duty is not merely a prudent choice; it’s a proactive step towards safeguarding your financial interests. By explicitly prioritizing your well-being over their own, fiduciary advisors uphold a standard of trust, transparency, and integrity that forms the bedrock of a resilient client-advisor relationship. As you navigate the landscape of wealth management, remember to scrutinize the fiduciary commitment of your advisor through probing questions and discerning observations. Upholding the fiduciary standard isn’t just a legal obligation; it’s a testament to the advisor’s unwavering dedication to your financial prosperity. In a time where trust is currency and transparency is king, embracing the fiduciary principle is the cornerstone of a partnership built on mutual respect, transparency, and a shared commitment to your financial well-being.

IMPORTANT DISCLOSURE INFORMATION: Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request at www.bentoakcapital.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your accounts; and, (3) a description of each comparative benchmark/index is available upon request. Please Note: Limitations: Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any designation, certification, or license should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if BentOak is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation criteria/methodology, to the extent applicable). Unless expressly indicated to the contrary, BentOak did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of BentOak by any of its clients. ANY QUESTIONS: BentOak’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.