The evolution of computing technology mirrors many of the changes we’re seeing today in artificial intelligence. In the 1940s and early 1950s, computers were large power-hungry machines that relied on vacuum tubes that took up entire floors of a building or basement. One IBM executive even predicted that the global market would only need “about five computers.” However, the semiconductor revolution of the mid-1950s broke through these constraints, leading to the development of smaller, more efficient computers—a shift that continues to influence the technology we use today.

A similar paradigm shift may be underway in artificial intelligence with recent developments from DeepSeek, a Chinese AI firm. Currently, developing sophisticated AI models like those behind ChatGPT requires enormous resources available to only a select few organizations. DeepSeek’s reported breakthrough indicates a significant reduction in the resources needed for AI development, but there may be more to the story than initially published.

DeepSeek’s technical publications suggest a remarkable 95-97% reduction in the cost of model development, which could represent a breakthrough as significant as the shift from vacuum tubes to semiconductors. This development has generated both excitement and concern within the technology and investment sectors. However, after reviewing their late 2024 technical paper, it’s clear that important factors were left out, such as “prior research and ablation experiments on architectures, algorithms, or data.” This omission raises questions about whether we are comparing two fundamentally different cost estimates. Additionally, if DeepSeek can create this technology for only around $6 million1, why did China (the Bank of China) announce a $137 billion1 investment in AI development on January 23, 2025, to be allocated over the next five years? While DeepSeek is indeed a powerful model, further details are likely to emerge regarding the financial, software, and hardware investments that went into its creation.

1. Technology Stocks and Market Dynamics

The technology sector, particularly the Magnificent 7 companies, has been a primary driver of market performance. This concentration has raised questions about market sustainability and diversification risks. The market’s reaction to the DeepSeek news was swift – Nvidia experienced a 16.9% decline on January 27, 2025 while the Nasdaq and S&P 500 fell 3.1% and 1.5% respectively.

This market response underscores the importance of portfolio diversification. When major indices become heavily concentrated in specific sectors or companies, investors may be exposed to unexpected risks. A well-diversified investment strategy is essential for achieving long-term success.

2. Long-term Impact of Technological Advancement

Historical patterns suggest that truly transformative technologies often take years or decades to realize their full potential. As Roy Amara (American scientist, researcher and futurist) observed, we tend to overestimate short-term technological impacts while underestimating long-term implications.

In response to the DeepSeek news, Microsoft’s CEO shared a comment online offering insights and referencing the Jevons Paradox. This concept suggests that greater efficiency often leads to increased usage rather than reduced consumption. Just as improved semiconductor efficiency spurred widespread computing applications, more efficient AI models may drive higher overall computing demands through the development of new applications.

While the current market focus centers on AI infrastructure providers, the demand-side potential for AI applications remains largely unexplored.

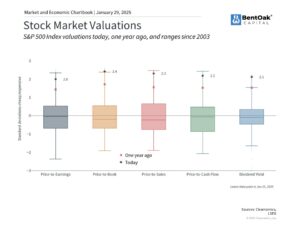

3. Current Market Valuations

Market valuations, particularly in AI-related sectors, have reached levels reminiscent of the dot-com era. This “priced to perfection” scenario means current stock prices reflect highly optimistic future projections, making them sensitive to new developments.

While elevated valuations can persist during bull markets, they should inform portfolio allocation decisions. A diversified approach across various sectors and asset classes helps manage short-term volatility while capturing long-term growth opportunities.

Technological advancements, such as DeepSeek’s development and other AI innovations, have the potential to transform industries. However, successful investing requires maintaining a long-term perspective through market fluctuations, sticking to solid investment principles, and following a well-rounded comprehensive financial plan.

1Kim, Tae. “DeepSeek Sparked a Market Panic. We Separate Fact From Fiction.” Barron’s, 27 Jan. 2025, https://www.barrons.com/articles/deepseek-nvidia-stock-price-4abca87d

IMPORTANT DISCLOSURE INFORMATION: Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request at www.bentoakcapital.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your accounts; and, (3) a description of each comparative benchmark/index is available upon request. Please Note: Limitations: Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any designation, certification, or license should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if BentOak is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation criteria/methodology, to the extent applicable). Unless expressly indicated to the contrary, BentOak did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of BentOak by any of its clients. ANY QUESTIONS: BentOak’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.