As another Texas winter approaches, ranchers are looking ahead to 2026 with a mix of optimism and caution. Rainfall has been unpredictable, costs are up, and cattle prices remain strong. With so many moving parts, now is the time to tighten up your risk plan. There are sevearl beneficial tools, but two to keep in mind are Pasture, Rangeland, and Forage (PRF) insurance and Livestock Risk Protection (LRP) insurance.

The PRF sales deadline is December 1, and it is one date every rancher should have circled on the calendar.

Why PRF Insurance Is Worth Considering

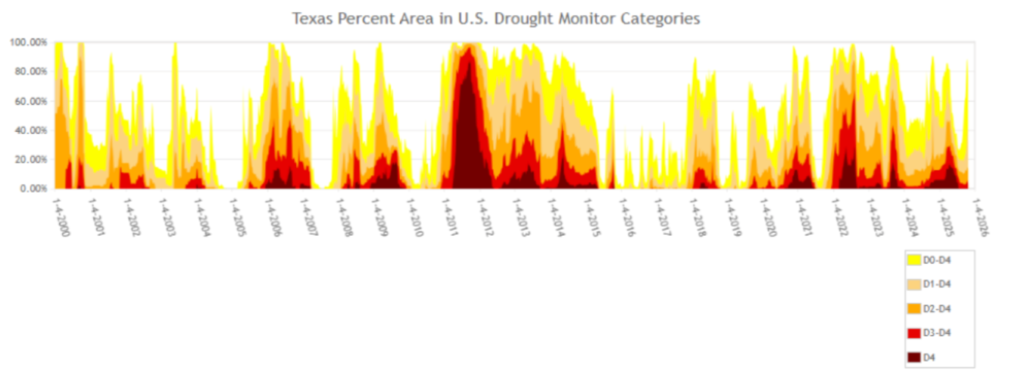

In Texas, rainfall is rarely consistent. Some years pastures stay green all season; other years they dry out far too soon. PRF insurance helps smooth out those ups and downs by paying when rainfall in your area falls below normal.

https://agrilife.org/agecon/pasture-rangeland-and-forage-insurance-deadline-is-coming-soon/

PRF uses rainfall data from the National Weather Service for a 17-mile grid that covers your ranch. You choose which two-month periods are most important, such as March-April or May-June. If rainfall during that time is below the long-term average, you receive a payment.

The Benefits

- Helps with cash flow. If you need to buy hay or feed because of dry weather, PRF can help offset the cost.

- Protects land and herd. Payments can reduce pressure to overgraze or sell in drier periods.

- Customizable to fit your needs. You select the coverage level (usually between 70 and 90 percent) and the months that fit your grazing plan. Depending on coverage selections, subsidies from USDA vary to assist in offsetting the premium cost.

Important Dates

- Sign-up deadline: December 1

- Premium due: typically by late fall of the following year

- Payouts: usually within two to three months after the insured rainfall period ends

For many ranches, PRF has become as standard as fertilizing or vaccinating for most ranchers as part of risk management. It is a typical part of operating in a state where the weather does not always cooperate.

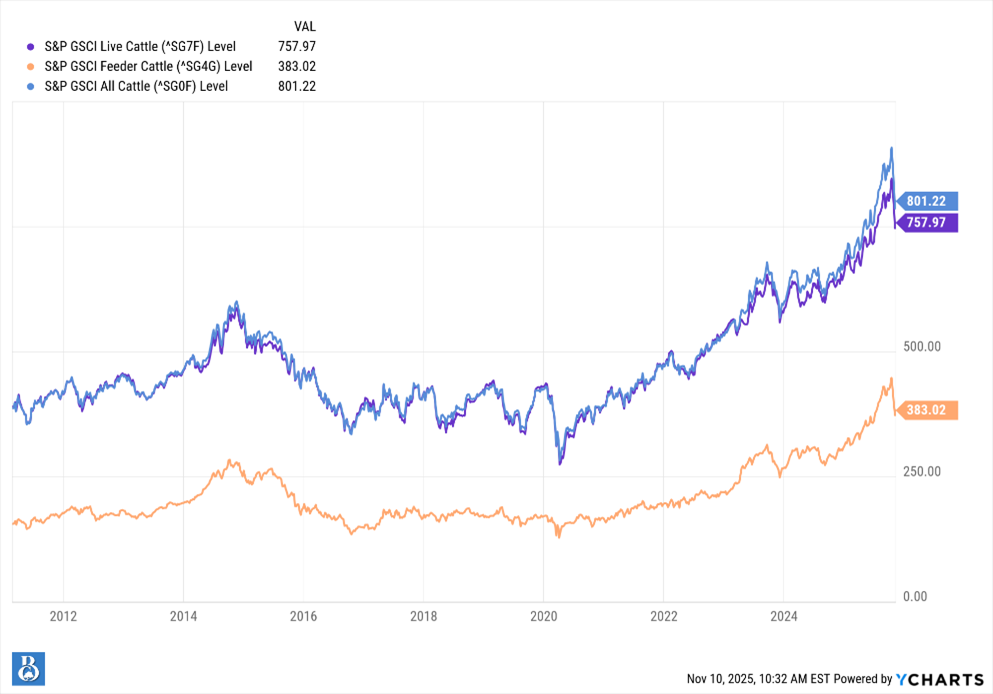

Why It’s Time to Look at LRP Too

If PRF helps protect your grass, LRP helps protect your cattle prices. It is a price-insurance program that provides a “floor” for your livestock while allowing you to benefit if prices rise.

You decide how many head to cover, what weight you expect to sell, and your target sale date. If prices drop before that date, LRP pays the difference between your insured price and the actual market price.

Why LRP Makes Sense

- Cattle prices are high. That creates more profit potential but also more risk if prices fall.

- Flexible coverage. You can match coverage to your marketing date, from a few months up to a year.

- Simple and affordable. Premiums are subsidized up to 55 percent, and there are no margin calls or futures accounts required.

LRP is especially helpful for cow-calf and backgrounding operations that want price protection without the complexity of market hedging.

A Smarter Way to Manage Risk

PRF and LRP work well together. PRF helps when dry weather drives up your feed costs. LRP helps when cattle prices drop before you sell. Combined, they protect both sides of your operation: your pasture and your paycheck.

At BentOak Capital, we take a comprehensive approach to wealth management that brings together the many disciplines influencing your financial well-being. Our advisors understand that true asset management extends beyond traditional portfolios to livestock, crops, equipment, real estate interests, and ownership in a business. Our mission is not to predict the weather or the markets, but to help you build a well-structured financial plan supported by trusted professionals and strategies designed to protect what you have built.

IMPORTANT DISCLOSURE INFORMATION: Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request at www.bentoakcapital.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your accounts; and, (3) a description of each comparative benchmark/index is available upon request. Please Note: Limitations: Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any designation, certification, or license should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if BentOak is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation criteria/methodology, to the extent applicable). Unless expressly indicated to the contrary, BentOak did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of BentOak by any of its clients. ANY QUESTIONS: BentOak’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.