The closing weeks of 2025 present a critical window for investors to evaluate decisions that may influence their tax obligations and overall financial health. Though sound financial planning extends throughout the entire year, numerous tax-related deadlines converge on December 31. This makes the year’s final stretch an opportune moment for investors to assess their tax approaches and complete actions that could affect their 2025 tax returns.

This article examines three important considerations for investors, covering the management of retirement account withdrawals, conversions to Roth accounts, and optimizing portfolio structures for tax benefits. Given the complexity of these subjects and the varied regulations that apply differently to each person, consulting with qualified professionals is essential.

Completing required minimum distributions by year-end is essential

While much of an investor’s attention centers on building wealth and expanding portfolios, the method of withdrawing from these accumulated assets carries equal weight. This becomes particularly crucial for those who have reached the age threshold for Required Minimum Distributions (RMDs). The December 31 deadline stands as one of the most critical dates on the calendar, as failing to meet it can trigger substantial IRS penalties—currently set at 25% of the amount that should have been withdrawn.

RMDs represent the minimum yearly withdrawals mandated from traditional IRAs, 401(k)s, and similar tax-deferred retirement vehicles once individuals attain a specified age. Through the SECURE 2.0 Act enacted by Congress in 2022, the RMD age rose to 73 for individuals who reached 72 after December 31, 2022. This threshold will advance to 75 starting in 2033.

The accompanying chart displays current distribution periods in years along with corresponding required withdrawal percentages applicable to most account holders. Withdrawal amounts depend on the account value at the close of the previous year, modified by an IRS-published life expectancy factor. Though these calculations follow relatively simple formulas, the planning implications can prove far more intricate:

- Account selection: Thoughtful coordination is essential when determining which accounts to tap first, the timing of withdrawals during the year, and how to align RMDs with additional income streams. The sequence of account withdrawals can impact total tax liability, particularly since Social Security benefits become subject to taxation at specific income levels and may result in elevated taxes.

- First-year delay: An exception exists for individuals in their initial RMD year, permitting them to postpone distributions until April 1 of the subsequent year. However, this approach may necessitate taking two RMDs in year two, potentially elevating them into a higher tax bracket.

- Other distribution strategies: Additional approaches include Qualified Charitable Distributions (QCDs), which enable investors to contribute directly from their IRA to approved charitable organizations. This satisfies the RMD obligation while keeping the amount outside taxable income. Nevertheless, timing considerations surrounding these choices demand thoughtful planning.

A significant choice in the years preceding age 73 involves whether to initiate distributions before RMDs become mandatory. Certain investors may gain advantages by withdrawing sufficient amounts to “fill a tax bracket” (extracting income up to the threshold of the next bracket). This approach proves valuable when anticipating a higher tax bracket once RMDs commence.

These considerations underscore why retirement planning demands a multi-year outlook instead of concentrating exclusively on individual tax years.

Converting to Roth accounts presents strategic advantages in the current climate

Roth conversions represent another valuable year-end planning mechanism subject to the December 31 deadline. Similar to RMDs, they necessitate thorough analysis and preparation. A Roth conversion entails moving assets from a traditional IRA into a Roth IRA, triggering immediate taxation in return for subsequent tax-free appreciation and withdrawals.

In contrast to Roth contributions that impose income restrictions, conversions remain accessible to all investors without regard to earnings. For those whose income exceeds the thresholds for direct Roth IRA contributions, these transactions are frequently termed “backdoor” Roth conversions.

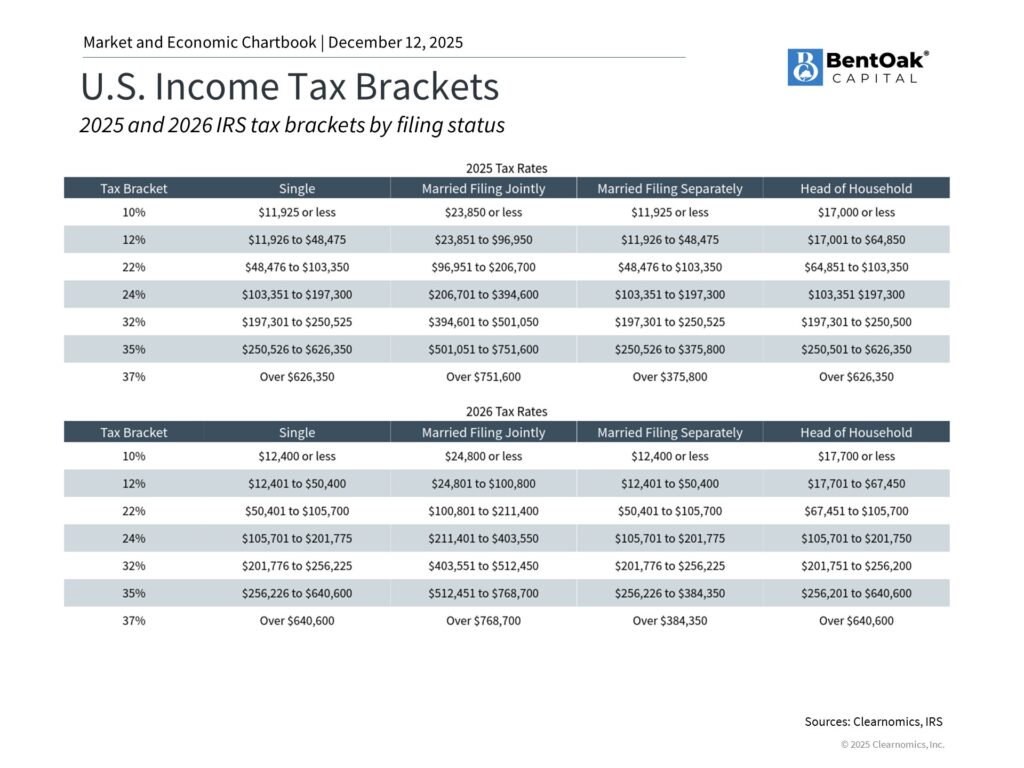

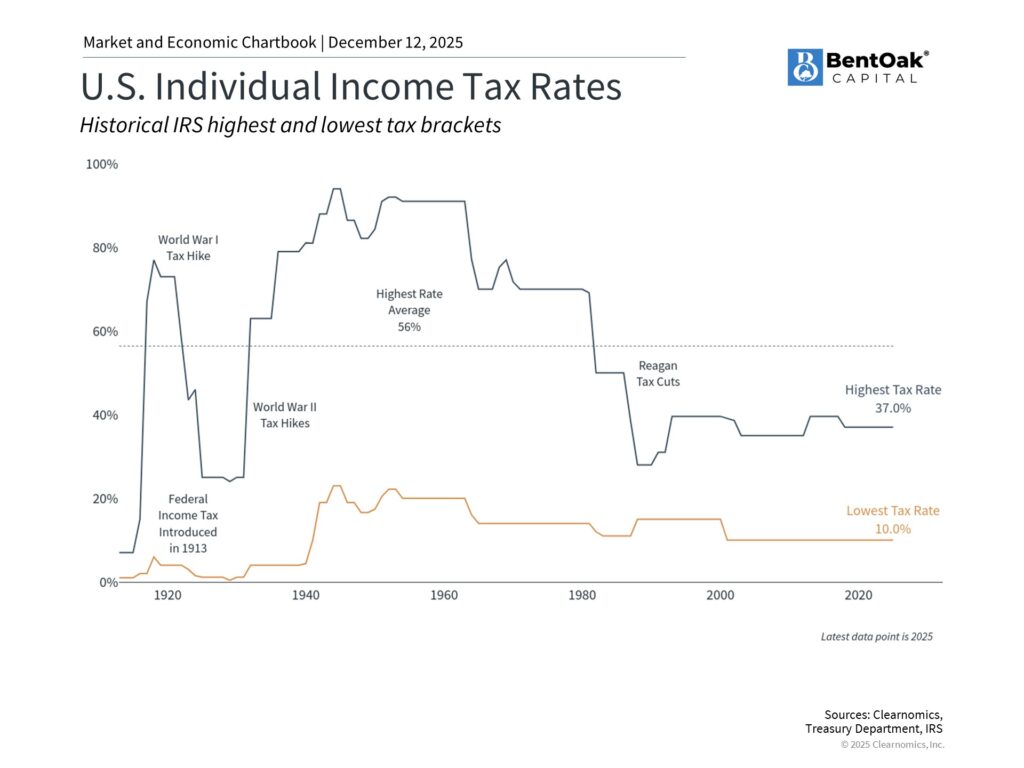

The “One Big Beautiful Bill” enacted by Congress this year has made permanent the reduced tax rates established under the Tax Cuts and Jobs Act. For numerous investors, present tax rates may prove more advantageous than potential future rates. Given the expanding national debt and fiscal shortfall, some investors express concern that tax rates could increase down the road.

Important factors to inform Roth conversion choices include:

- Tax bracket comparison: Investors should evaluate their current tax bracket against their projected retirement bracket. When a higher bracket appears likely in retirement—perhaps due to RMDs, pension payments, or Social Security income—paying taxes now through Roth conversions at today’s lower rate can prove advantageous.

- Time horizon for tax-free growth: Extended periods for tax-free accumulation in the Roth account enhance conversion value. Therefore, converting sooner typically yields better results.

- Medicare premiums: Elevated income from Roth conversions may activate Income-Related Monthly Adjustment Amounts (IRMAA), raising Medicare Part B and Part D premium costs. While this doesn’t automatically eliminate conversions as an option, it represents another element to weigh in comprehensive planning.

Harvesting investment losses can offset gains and lower tax obligations

Whereas RMDs and Roth conversions pertain to retirement accounts, tax-loss harvesting applies to taxable investment portfolios and can enhance current-year tax outcomes. This technique involves selling depreciated investments to recognize capital losses, which then counterbalance capital gains captured earlier in the year. This must occur before December 31 to apply to the current tax year, making it a vital component of comprehensive investment and financial planning.

How does this function in reality? When an investor disposed of investments during 2025 and recognized capital gains, they can harvest losses from other holdings to neutralize those gains on a one-to-one basis. Tax loss harvesting provides value even during years without substantial realized gains. Should losses surpass gains, investors can apply up to $3,000 of net capital losses against ordinary income each year, with remaining losses carried into subsequent years. https://www.irs.gov/taxtopics/tc409

Multiple elements influence tax-loss harvesting effectiveness:

- Capital gains rates: Long-term capital gains (from holdings exceeding one year) receive preferential taxation at 0%, 15%, or 20% based on income level, whereas short-term gains face taxation at ordinary income rates. Harvesting losses to counterbalance short-term gains proves especially beneficial since those gains would otherwise incur higher taxation. This advantage may be amplified for residents of high-tax states.

- Wash sale rule: A critical consideration involves the “wash sale” rule, which bars repurchasing identical or “substantially identical” securities within 30 days before or after the sale. This prevents claiming tax losses while preserving identical investment positions. Investors may, however, substitute similar investments like an ETF, enabling them to retain market participation and their target asset allocation while capturing the tax loss.

- Account considerations: Tax-loss harvesting exclusively applies to taxable brokerage accounts, not IRAs or 401(k)s where gains and losses don’t constitute taxable events. Retirement accounts accumulate tax-deferred irrespective of internal trading activity.

Integrating these approaches demands thoughtful coordination

Effective year-end planning is not just about checking off individual tactics. It is about coordinating the right strategies to create the greatest overall impact. Keeping sight of your bigger goals is important. Reducing taxes this year can be valuable, but not if it comes at the expense of long-term financial progress. The best planning balances today’s tax opportunities with a smart approach to building wealth over time.

With several meaningful opportunities available before year-end, now is a great time to review your tax situation and financial strategy to ensure you are positioned for success in the year ahead.

IMPORTANT DISCLOSURE INFORMATION: Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request at www.bentoakcapital.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your accounts; and, (3) a description of each comparative benchmark/index is available upon request. Please Note: Limitations: Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any designation, certification, or license should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if BentOak is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation criteria/methodology, to the extent applicable). Unless expressly indicated to the contrary, BentOak did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of BentOak by any of its clients. ANY QUESTIONS: BentOak’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.