Navigating legislative changes like the SECURE Act and SECURE Act 2.0 can be bewildering, especially with their impact on inherited IRA Required Minimum Distributions (RMDs). But fear not! This article provides clarity with dos and don’ts, along with definitions, to simplify the process of managing an inherited IRA.

Key Considerations for Inherited IRA Beneficiaries

Do’s:

- Determine the type of beneficiary you are – different beneficiaries have different rules on drawing down the IRA.

- Withdraw funds within the required timeframe under the new laws.

- Maintain at least the same withdrawal rate as the original owner if they had reached the Required Beginning Date (RBD) before their passing.

- Avoid the 25% under-withdrawal penalty by following the correct withdrawal schedule.

- If you have reached your own RBD, consider using inherited IRA RMDs for qualified charitable distributions.

- Understand that a “death distribution” exempts you from the 10% early withdrawal penalty but remains subject to ordinary income tax.

Don’ts:

- Ignore the account and fail to withdraw funds.

- Overlook tax reporting requirements—each withdrawal generates a 1099-R.

- Assume only traditional IRAs are affected—these rules apply to Roth, SEP, and other IRAs.

- Neglect to consult your tax advisor for the most tax-efficient withdrawal strategy.

- Miss the opportunity to reinvest distributed IRA assets—speak with your financial advisor for reinvestment options.

Understanding Your Beneficiary Type

Inheriting an IRA comes with responsibilities, and understanding the rules can help you avoid costly mistakes. Whether you’re required to withdraw funds over a set period or have the flexibility to stretch distributions, the key is knowing where you stand. Failing to follow the guidelines can result in unnecessary penalties, but with careful planning, you can make the most of your inheritance while staying compliant with tax laws.

Types of Beneficiaries+ –

- Eligible Designated Beneficiaries (EDBs) – are spouses*, a minor child of original owner, someone who is disabled**, someone who is chronically ill** or someone who is less than 10 years younger than the original IRA owner.

- Non-Person – an entity (i.e. Charity, or Estate)

- Non-Eligible Designated Beneficiary (Non EDBs) – everyone else

Now that we understand the classifications of IRA beneficiaries, let’s look at the rules on how they must distribute the funds. By adhering to these guidelines, beneficiaries can navigate the complexities effectively.

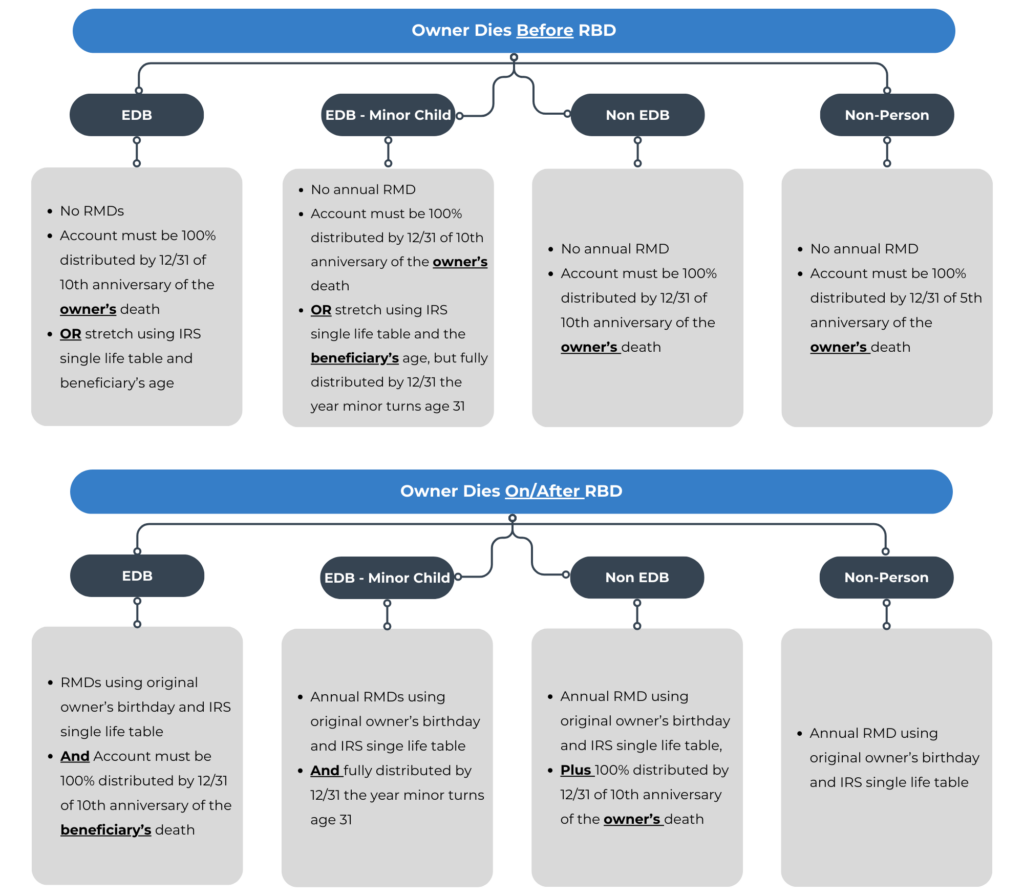

Withdrawal Requirements by Beneficiary Type

*Spouse beneficiaries – spouses are the only beneficiaries who can choose if they want to keep the inherited IRA as an inherited IRA or combine it with their own IRA. There are reasons for both options, but this decision must be made no later than the year after the IRA owner’s death. This decision cannot longer be reversed.

**Disabled and chronically ill beneficiaries must provide qualifying documentation to Custodian no later than 10/31 of the year following the IRA owner’s death.

***RBD – Required Beginning Date. This pertains to the age of the original account owner and if they had already began taking annual Required Minimum Distributions (RMDs) prior to their death. In 2024, that is April 1st of the year after turning 73.

+Trust Beneficiaries are not mentioned in this article, as depending the type of trust and how it was established will determine if that trust is an EDB, Non EDB or Non-Person beneficiary.

By adhering to these guidelines, beneficiaries can navigate the complexities effectively. Remember to determine your beneficiary type, adhere to withdrawal schedules, report withdrawals accurately, and seek professional advice for tax-efficient strategies and reinvestment options. Whether you’re an Eligible Designated Beneficiary (EDB), a Non-Eligible Designated Beneficiary (Non-EDB), or a non-person entity, staying informed and proactive is key to managing inherited IRAs with confidence and compliance.

For more insights on wealth management and financial planning, check out our resource library or connect with one of our advisors at BentOak Capital.

IMPORTANT DISCLOSURE INFORMATION: Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by BentOak Capital [“BentOak”]), or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BentOak is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for personalized investment advice from BentOak. Please remember that it remains your responsibility to advise BentOak, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request at www.bentoakcapital.com/disclosure. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your accounts; and, (3) a description of each comparative benchmark/index is available upon request. Please Note: Limitations: Neither rankings and/or recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any designation, certification, or license should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if BentOak is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation criteria/methodology, to the extent applicable). Unless expressly indicated to the contrary, BentOak did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of BentOak by any of its clients. ANY QUESTIONS: BentOak’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.